New data shows that a growing number of Americans are having difficulty making their monthly credit card payments due to high inflation and interest rates. Credit card delinquency rates have reached their highest level since 2012.

Americans are drowning in credit card debt . New data published by the Federal Reserve Bank of Philadelphia shows that a growing number of Americans are struggling to make their monthly credit card payments as they continue to battle high inflation and interest rates. All stages of credit card delinquency – 30, 60 and 90 days past due – rose during the fourth quarter of 2023 to the highest level since 2012.

Stress among cardholders was "further underscored in payment behavior," the report said. The share of accounts making minimum payments jumped 34 basis points from the third quarter. Although the share of Americans paying off their credit card balance in full rose eight basis points, a 3.1% increase in revolving balances – which carry over from month to month – "implies higher card balances among a smaller group of revolvers.

Americans Credit Card Debt Federal Reserve Bank Philadelphia Inflation Interest Rates Delinquency Holiday Spending

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Average Credit Scores Decrease as Consumers Struggle with DebtFor the first time in a decade, average credit scores have decreased slightly to 717, according to data released by FICO. This decline is likely due to high interest rates and inflation that are causing consumers to miss more payments and take on higher levels of debt.

Average Credit Scores Decrease as Consumers Struggle with DebtFor the first time in a decade, average credit scores have decreased slightly to 717, according to data released by FICO. This decline is likely due to high interest rates and inflation that are causing consumers to miss more payments and take on higher levels of debt.

Read more »

Americans see inflation rising again in the long term, key NY Fed survey showsA New York Federal Reserve survey published on Monday found that many American consumers expect inflation to remain abnormally high in the coming years.

Americans see inflation rising again in the long term, key NY Fed survey showsA New York Federal Reserve survey published on Monday found that many American consumers expect inflation to remain abnormally high in the coming years.

Read more »

Retirement crisis looms as Americans struggle to saveEric Payne, a 37 year-old single father to two boys, works hard to stretch his paycheck each week. It’s a task he refers to as “clicking.”

Retirement crisis looms as Americans struggle to saveEric Payne, a 37 year-old single father to two boys, works hard to stretch his paycheck each week. It’s a task he refers to as “clicking.”

Read more »

Americans' credit card fees have surged 50% since Joe Biden became presidentIn a significant financial shift, U.S. credit-card users experienced a 50% hike in fees and other expenses last year, signaling a deepening concern over the cost-of-living crisis as the nation approaches the November elections.

Americans' credit card fees have surged 50% since Joe Biden became presidentIn a significant financial shift, U.S. credit-card users experienced a 50% hike in fees and other expenses last year, signaling a deepening concern over the cost-of-living crisis as the nation approaches the November elections.

Read more »

Financial coach warns Americans' credit score drop points to 'uncertain economic times'Finance coach Jeannie Dougherty warns the decline in the average credit score of Americans is evidence of these 'uncertain economic times,' and explains what is happening.

Financial coach warns Americans' credit score drop points to 'uncertain economic times'Finance coach Jeannie Dougherty warns the decline in the average credit score of Americans is evidence of these 'uncertain economic times,' and explains what is happening.

Read more »

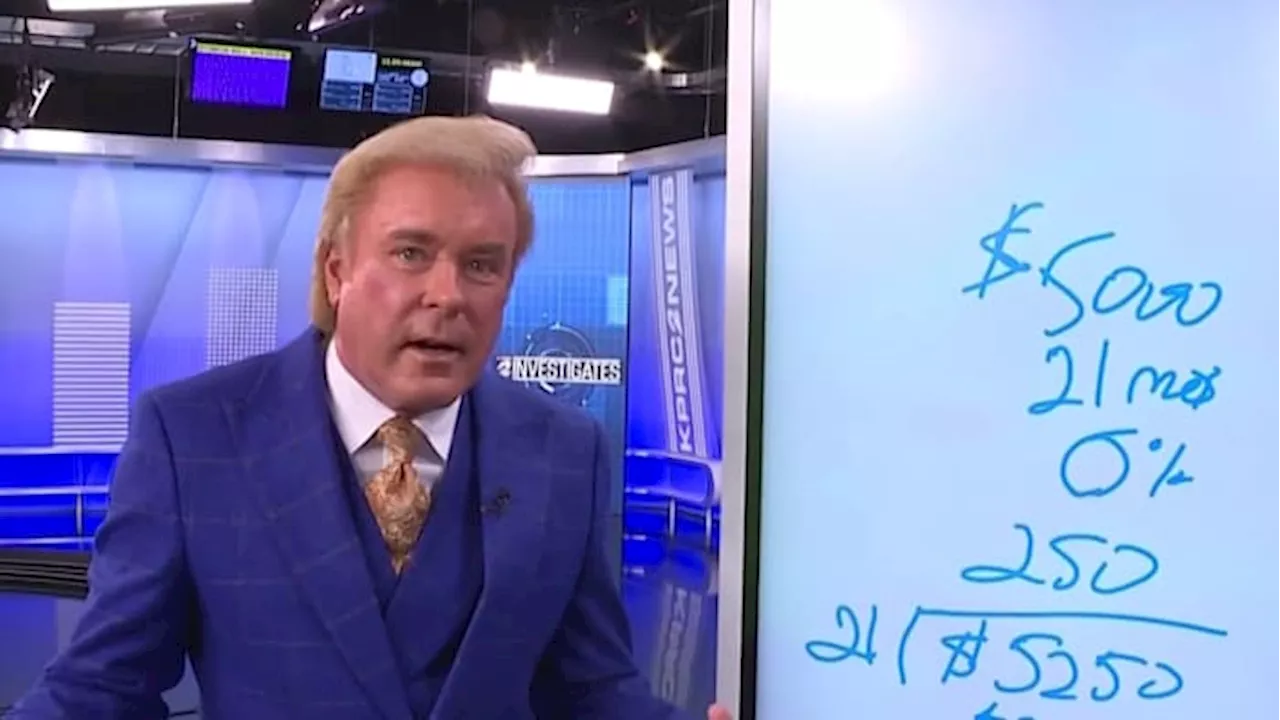

WATCH LIVE: Total Solar Eclipse and Rising Credit Card DebtWatch the sunrise ahead of today's Total Solar Eclipse and learn about the soaring credit card debt. Find out two ways to eliminate credit card debt without paying high interest rates.

WATCH LIVE: Total Solar Eclipse and Rising Credit Card DebtWatch the sunrise ahead of today's Total Solar Eclipse and learn about the soaring credit card debt. Find out two ways to eliminate credit card debt without paying high interest rates.

Read more »