For the first time in a decade, average credit scores have decreased slightly to 717, according to data released by FICO. This decline is likely due to high interest rates and inflation that are causing consumers to miss more payments and take on higher levels of debt.

For the first time in a decade, average credit scores have decreased slightly to 717, according to data released by FICO. In 2023, average scores sat at 718. This decline is likely due to high interest rates and inflation that are causing consumers to miss more payments and take on higher levels of debt. Since October, more than 18% of Americans have had past-due payments on one or more credit accounts. Compared to April 2023, this is up by 4%, FICO reported.

Missed payments on mortgages and auto loans have gone up but are still lower than they were before the pandemic. It’s missed payments on credit cards that have gone up most, and now exceed pre-pandemic levels. "The apparent cumulative impact of higher interest rates, elevated consumer prices and economic uncertainty has put a financial strain especially on those consumers who heavily rely on credit cards to cover everyday expenses," FICO stated in its report. "This can lead to higher credit card utilization and subsequent defaults on credit card payments." One way to get your credit score back up is to consolidate your debt and pay it down quicker. Credible can help you find the loan that’s right for you by showing you several reputable personal loan lenders that offer quick loans. CONSUMER SPENDING AND DEBT ARE UP AS US ECONOMY BEGINS REBOUND State governments are taking action to curb the effect medical debt has on credit score

Credit Scores Debt Interest Rates Inflation Missed Payments Credit Cards Consolidation Loans Consumer Spending US Economy Medical Debt

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

CFPB finalizes rule capping credit card late fees at $8 on averageA new CFPB rule caps credit card late fees to 25% of the required payment and ends the automatic inflation adjustment for these charges.

CFPB finalizes rule capping credit card late fees at $8 on averageA new CFPB rule caps credit card late fees to 25% of the required payment and ends the automatic inflation adjustment for these charges.

Read more »

Credit scores decreased for first time in a decade as borrowers miss paymentsMissed payments and high levels of inflation has led to lower credit scores for consumers.

Credit scores decreased for first time in a decade as borrowers miss paymentsMissed payments and high levels of inflation has led to lower credit scores for consumers.

Read more »

California lawmakers say medical debt shouldn't hurt credit scoresSupporters say debt for medical bills shouldn't prevent a person from obtaining credit or loans.

California lawmakers say medical debt shouldn't hurt credit scoresSupporters say debt for medical bills shouldn't prevent a person from obtaining credit or loans.

Read more »

All In Credit Union named Best Regional Credit Union by NewsweekU.S. President Joe Biden and former President Donald Trump warned of dire consequences for the country if the other wins another term in the White House as the pair held dueling rallies in Georgia.

All In Credit Union named Best Regional Credit Union by NewsweekU.S. President Joe Biden and former President Donald Trump warned of dire consequences for the country if the other wins another term in the White House as the pair held dueling rallies in Georgia.

Read more »

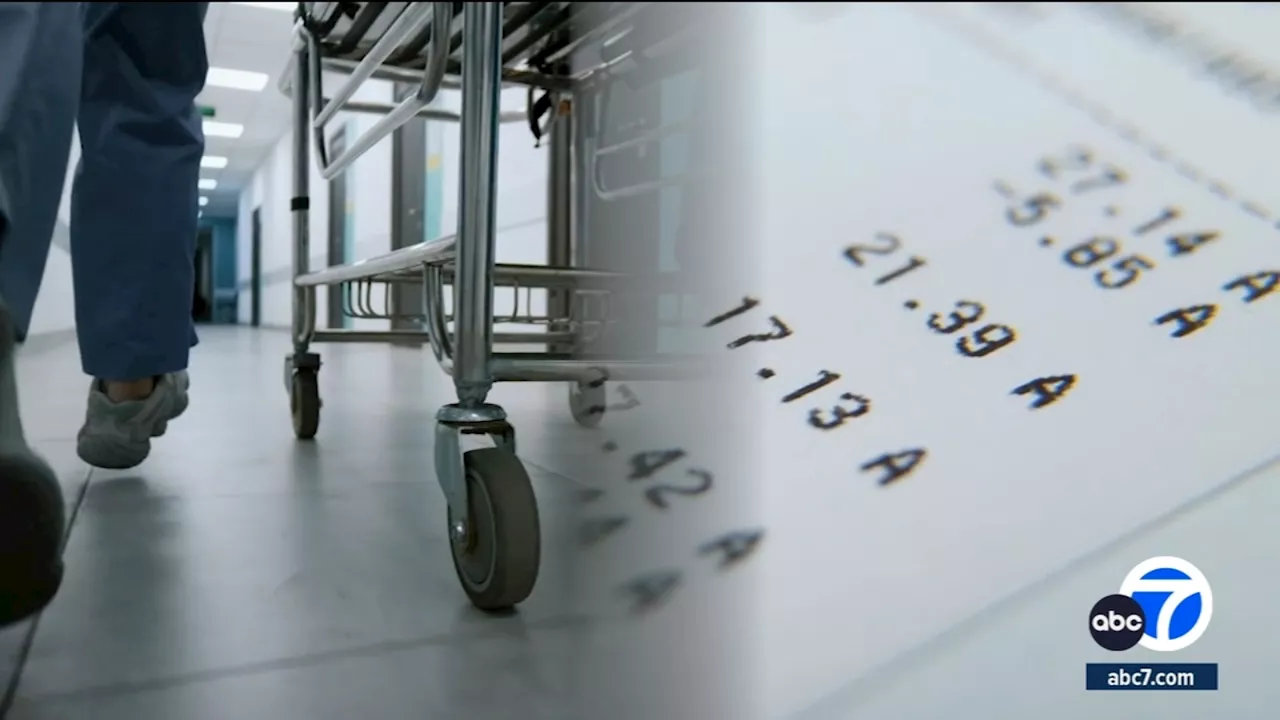

Decrease in Respiratory Illnesses Compared to Last YearFewer colds, coughs, fevers and sick days are interrupting our day-to-day lives now than in late December and early January. Last year was COVID’s least deadly so far, with 6,900 deaths in California, still far outpacing the 400 flu deaths the state saw in the same period.

Decrease in Respiratory Illnesses Compared to Last YearFewer colds, coughs, fevers and sick days are interrupting our day-to-day lives now than in late December and early January. Last year was COVID’s least deadly so far, with 6,900 deaths in California, still far outpacing the 400 flu deaths the state saw in the same period.

Read more »

Phoenix Union High School District working to decrease dropout ratesElenee Dao joined ABC15 in August 2022 as a multimedia journalist.

Phoenix Union High School District working to decrease dropout ratesElenee Dao joined ABC15 in August 2022 as a multimedia journalist.

Read more »