Expecting a tax refund? It could be smaller than last year. And with inflation still high, that money won’t go as far as it did. The average refund is $2,910, down from $3,226, a difference of more than $300, according to the most recent IRS data.

“As those provisions expired, that’s had a big impact,” Pickering said.

Zhou has worked as a receptionist, at a grill and an ice cream shop, and in other jobs. For her father, who has shifted more towards self employment in the past few years , she said taxes have also become “more of a hit and less of a refund.”Pickering said that more Americans took on side hustles, gig and freelance work during and since the pandemic, and so they may be experiencing the self-employment tax and the consequences of a lack of withholding.

Alaina, 32, a Florida-based fiber artist who asked to be identified by her first name to protect her privacy, said her refund will go toward house repairs and “clearing up debt.”

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Economists predict big fights between Biden, Republicans over beefed-up IRS, $80B expansionFormer Trump adviser Stephen Moore and Americans for Tax Reform's Grover Norquist argue Biden's IRS is being 'weaponized and politicized' to go after Republican policy.

Economists predict big fights between Biden, Republicans over beefed-up IRS, $80B expansionFormer Trump adviser Stephen Moore and Americans for Tax Reform's Grover Norquist argue Biden's IRS is being 'weaponized and politicized' to go after Republican policy.

Read more »

Taxes 2023: Here's how to get a tax extension from the IRSTax Day is fast approaching, with Americans facing an April 18 deadline to file their 2022 tax returns with the IRS.

Taxes 2023: Here's how to get a tax extension from the IRSTax Day is fast approaching, with Americans facing an April 18 deadline to file their 2022 tax returns with the IRS.

Read more »

IRS: Taxpayers in 21 states should consider amending returnsThe IRS said those who filed their taxes early might be able to amend their returns to get a refund.

IRS: Taxpayers in 21 states should consider amending returnsThe IRS said those who filed their taxes early might be able to amend their returns to get a refund.

Read more »

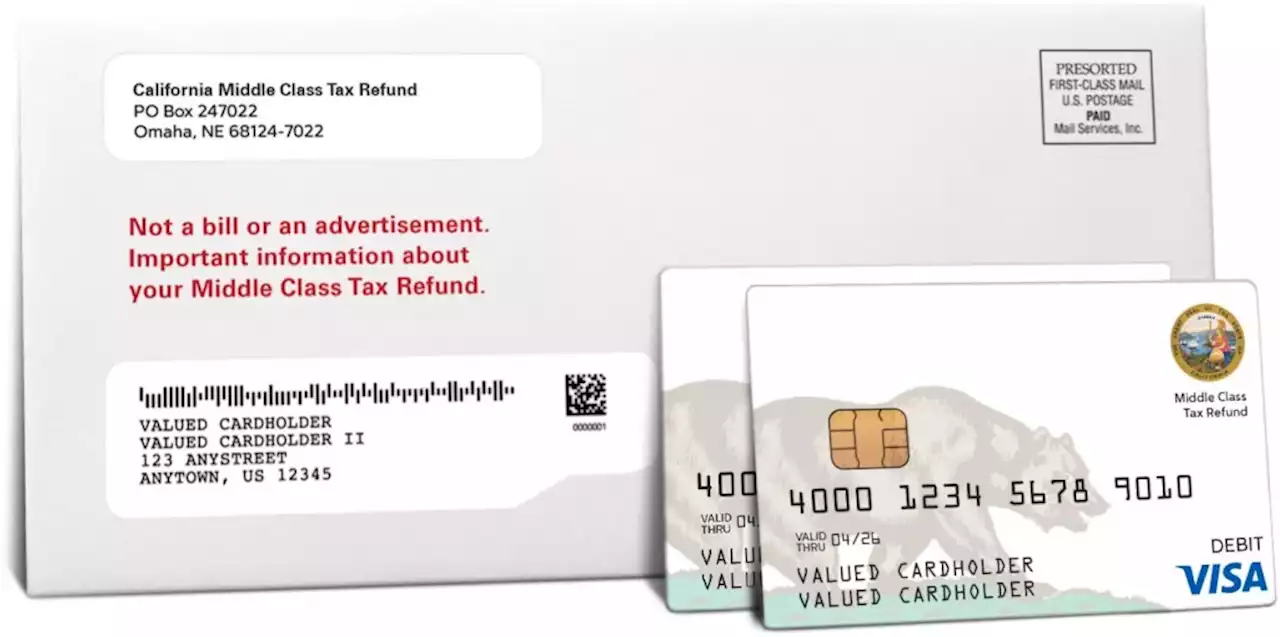

Middle Class Tax Refund: Early filers can amend 2022 returns to recoup taxes, IRS saysAnyone who included the refund as taxable income using a 1099 should consider refiling.

Middle Class Tax Refund: Early filers can amend 2022 returns to recoup taxes, IRS saysAnyone who included the refund as taxable income using a 1099 should consider refiling.

Read more »

Taylor: Why the IRS doesn’t offer its own free online tax software — and why it shouldReviewing the story of why free tax filing hardly exists. Preparing federal income tax returns for most people should be free and easy. This might get better in the future.

Read more »