Readers ask about taking CPP at 60 and investing it - and what returns are needed to do better than waiting until 65

. Get exclusive investment industry news and insights, the week’s top headlines, and what you and your clients need to know. For more from Globe Advisor, visit our, in which Globe Advisor explores the decisions behind when to take CPP benefits and reviews different aspects of the beloved and often-debated government-sponsored pension plan.

Let’s assume your CPP at 65 would be $1,000 a month and your CPP at 60 would be $640 a month, which is 36 per cent lower for starting five years early. If you take the CPP starting at 60, there would be $38,400 in CPP payments made between 60 and 65. However, if you take the CPP starting at 65, these monthly payments are $360 more.

That the zero-earning years being added between 60 and 65 will not be a drag on your CPP benefit; this only applies to someone who has made a maximum contribution over 39 years.It doesn’t consider Guaranteed Income Supplement clawbacks after the age of 65 for lower- and moderate-income retirees. GIS clawbacks are triggered by CPP benefits and other taxable income, so a higher CPP benefit after 65 may not be as attractive.

Assuming higher real investment returns of 4 per cent , the break-even point happens later, at 77 and five months.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

CPP to invest up to US$2.2 billion in Telecom Italia’s networkCanada Pension Plan Investment Board has agreed to acquire a minority stake in Telecom Italia SpA’s landline network.

CPP to invest up to US$2.2 billion in Telecom Italia’s networkCanada Pension Plan Investment Board has agreed to acquire a minority stake in Telecom Italia SpA’s landline network.

Read more »

Four years later, Canadians with long COVID are still strugglingThe Globe followed up with readers who shared their experience with post-COVID-19 condition last year.

Four years later, Canadians with long COVID are still strugglingThe Globe followed up with readers who shared their experience with post-COVID-19 condition last year.

Read more »

Four years later, Canadians with long COVID are still strugglingThe Globe followed up with readers who shared their experience with post-COVID-19 condition last year.

Four years later, Canadians with long COVID are still strugglingThe Globe followed up with readers who shared their experience with post-COVID-19 condition last year.

Read more »

Four years later, Canadians with long COVID are still strugglingThe Globe followed up with readers who shared their experience with post-COVID-19 condition last year.

Four years later, Canadians with long COVID are still strugglingThe Globe followed up with readers who shared their experience with post-COVID-19 condition last year.

Read more »

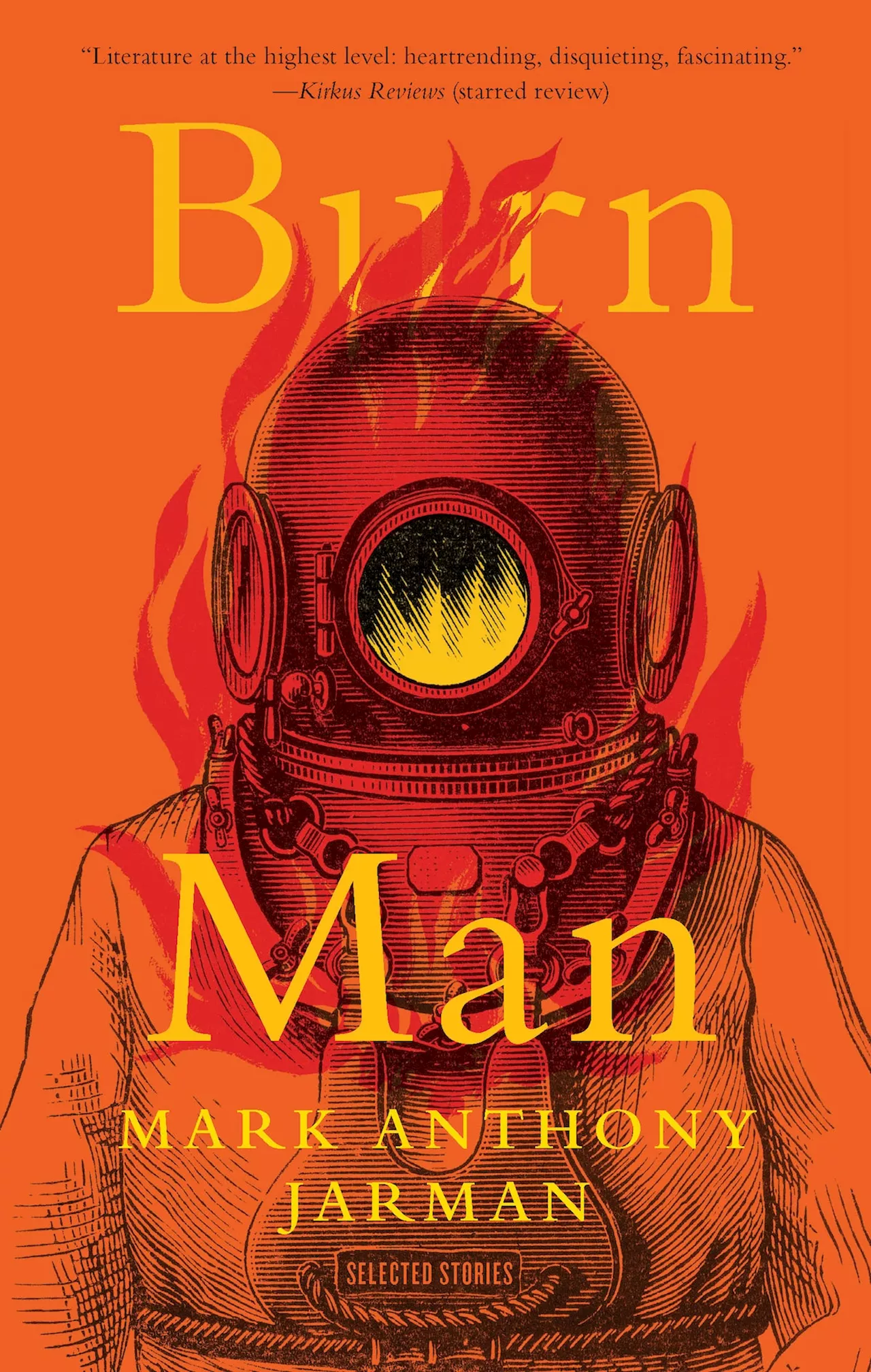

Burn Man weaves the macabre with the magical in searing story collectionBurn Man offers pleasures beyond expanding one’s vocabulary, though readers invested primarily in plot, character development or an easy-to-follow chronology might disagree

Burn Man weaves the macabre with the magical in searing story collectionBurn Man offers pleasures beyond expanding one’s vocabulary, though readers invested primarily in plot, character development or an easy-to-follow chronology might disagree

Read more »

Can Sally, 44, afford to retire early to travel the world?Since both Elliot and Sally are healthy, the planners recommend they delay their CPP and OAS benefits until age 70. This will give them a boost in benefits

Can Sally, 44, afford to retire early to travel the world?Since both Elliot and Sally are healthy, the planners recommend they delay their CPP and OAS benefits until age 70. This will give them a boost in benefits

Read more »