President of the U.S. Mortgage Insurers writes about the misconception among many would-be homeowners that they won’t qualify for a mortgage without a 20%...

In addition to helping first-time buyers become homeowners, private mortgage insurance, or PMI, can be a vital resource for helping underserved communities affordably and sustainably access the mortgage market, writes Seth Appleton.that many first-time buyers feel they have been priced out due to low inventory and inflation, even in an area that is a national leader in housing starts.

Rising rents in Dallas — and across Texas — have increased the burden on low- to moderate-income and minority families waiting to enter homeownership. However, new 2022provides good news and hope for first-time homebuyers in Dallas: low down payment mortgages backed by private mortgage insurance are thriving in the state. Texas leads the nation for the highest number of homebuyers who purchased a home with a low down payment-insured mortgage.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Watch your windshield: Insurers crack down on auto glass claims in ArizonaJoe concentrates on consumer investigative stories by exposing scams, rip-offs and deals that are just too good to be true.

Watch your windshield: Insurers crack down on auto glass claims in ArizonaJoe concentrates on consumer investigative stories by exposing scams, rip-offs and deals that are just too good to be true.

Read more »

Army veteran gifted mortgage-free homeRetired Army Sergeant Michael Burroughs and his family got the keys to their new home thanks to the organization 'Building Homes for Heroes'.

Army veteran gifted mortgage-free homeRetired Army Sergeant Michael Burroughs and his family got the keys to their new home thanks to the organization 'Building Homes for Heroes'.

Read more »

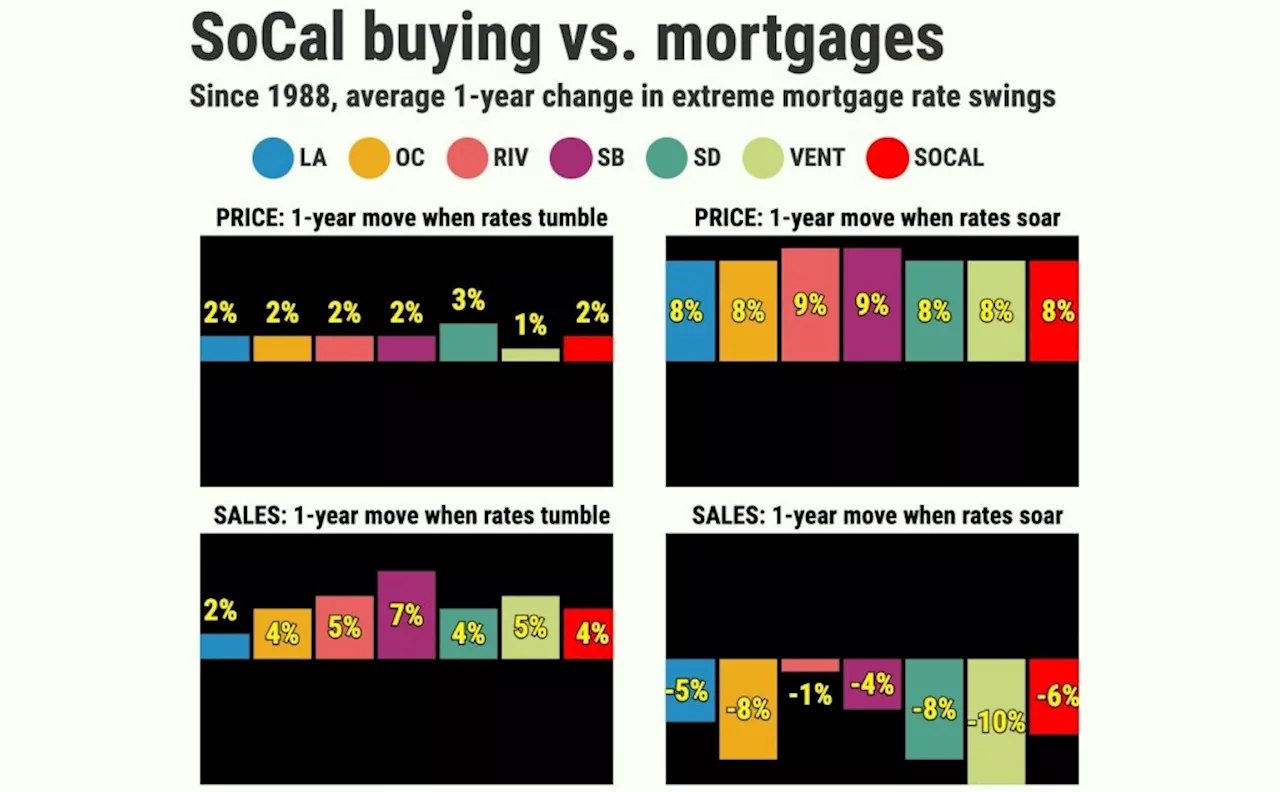

Will lower mortgage rates revive Los Angeles County’s housing market?The largest rate drops since 1988 came with 2.1% one-year gains in the number of closed transactions.

Will lower mortgage rates revive Los Angeles County’s housing market?The largest rate drops since 1988 came with 2.1% one-year gains in the number of closed transactions.

Read more »

How much does it cost to refinance a mortgage?People usually refinance a mortgage to save money. But refinancing itself can be expensive. Here’s what it costs — and the factors that can impact that price tag.

Read more »

Today’s mortgage rates for edge down for 15- and 30-year termsMortgage rates fluctuate almost daily based on economic conditions. Here are today’s mortgage rates and what you need to know about getting the best rate.

Today’s mortgage rates for edge down for 15- and 30-year termsMortgage rates fluctuate almost daily based on economic conditions. Here are today’s mortgage rates and what you need to know about getting the best rate.

Read more »

High mortgage rates driving one of most unaffordable markets ever to buy a homeHigh interest rates and asking prices have cooled sales in the housing market for months, dragging home sales to the lowest levels since the financial crisis.

High mortgage rates driving one of most unaffordable markets ever to buy a homeHigh interest rates and asking prices have cooled sales in the housing market for months, dragging home sales to the lowest levels since the financial crisis.

Read more »