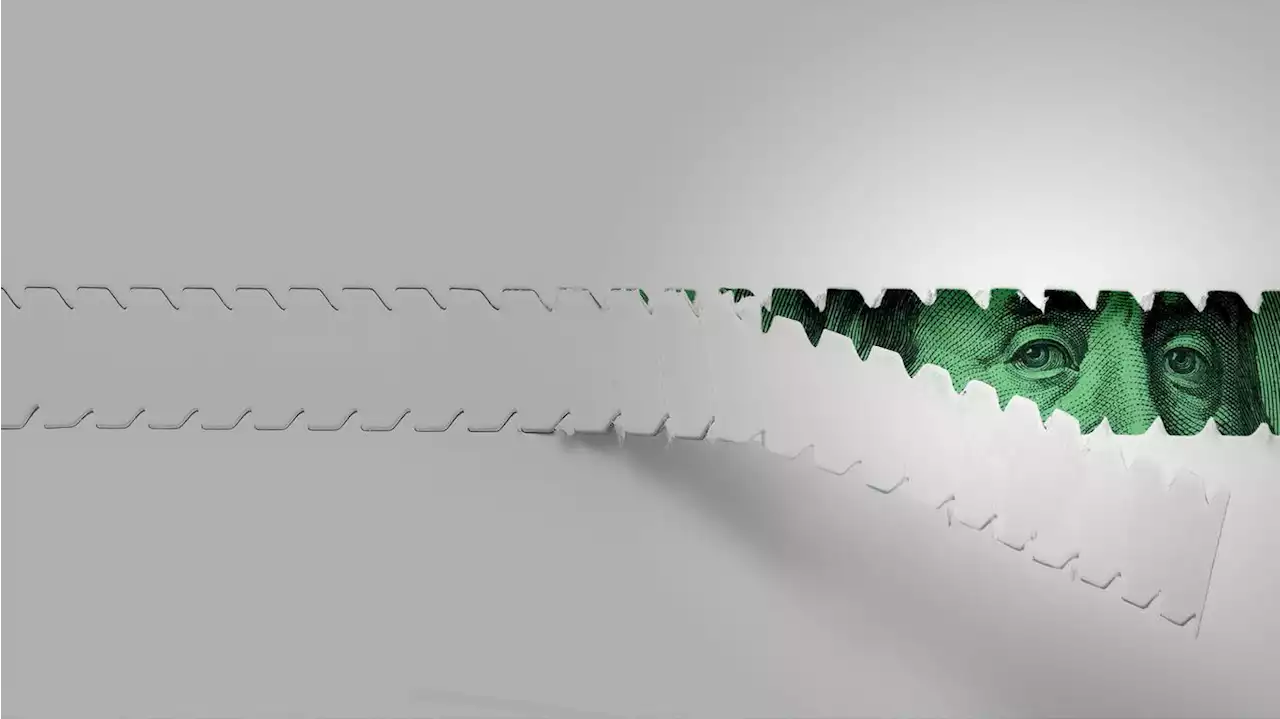

You can keep more money from the IRS next year. The agency is raising income thresholds for all tax brackets because of inflation.

The top tax rate of 37 percent will apply to individuals with income exceeding $578,125 and married couples filing jointly with income more than $693,750. Both of those amounts are up 7 percent from 2022 to track with increases in the consumer price index.

The standard deduction — the baseline amount of income that filers can collect tax free — will increase to $13,850 for individuals and $27,700 for married couples. It is the largest adjustment to deductions since 1985, when the IRS began annual automatic inflationary adjustments. Certain parts of the tax code are tied to inflation to prevent rising prices from causing higher taxes. Taxpayers will see the new figures reflected in withholding statements on paychecks beginning in January, with workers securing more take-home pay.The tax system changes follow a large cost of living adjustment, or COLA, announced by the Social Security Administration last week to compensate for inflation. Social Security benefits are set to jump 8.

The annual gift tax exclusion — the maximum amount one person can give another without incurring a tax penaltywill rise to $17,000 from $16,000. The estate tax threshold, often used by the wealthiest Americans to shield inherited assets from levies, will jump to $12.9 million from $12.1 million. The IRS will also allow parents adopting a child to shield $15,950 per child from taxes, up from $14,890 in 2022.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Paycheck not keeping up with inflation? Here’s what you can doThe survey sponsored by Bank of America found that nearly three in four American workers surveyed said the cost of living is outpacing their salary and wages.

Paycheck not keeping up with inflation? Here’s what you can doThe survey sponsored by Bank of America found that nearly three in four American workers surveyed said the cost of living is outpacing their salary and wages.

Read more »

WH press sec mocked for linking inflation rise to spending bill, saying relief starts ‘early next year’President Biden's spokeswoman Karine Jean-Pierre said Americans won't feel economic relief from the Inflation Reduction Act until next year.

WH press sec mocked for linking inflation rise to spending bill, saying relief starts ‘early next year’President Biden's spokeswoman Karine Jean-Pierre said Americans won't feel economic relief from the Inflation Reduction Act until next year.

Read more »

IRS releases details on how your tax rate could change next yearThe Internal Revenue Service released inflation-adjusted tax brackets for next year on Tuesday. The changes could boost your paycheck in 2023.

IRS releases details on how your tax rate could change next yearThe Internal Revenue Service released inflation-adjusted tax brackets for next year on Tuesday. The changes could boost your paycheck in 2023.

Read more »

Get ready for one major impact of inflation that won't hit until next yearWhen it comes to healthcare spending, 'consumers can only really choose between paying up or walking away,' one analyst told MarketWatch.

Get ready for one major impact of inflation that won't hit until next yearWhen it comes to healthcare spending, 'consumers can only really choose between paying up or walking away,' one analyst told MarketWatch.

Read more »

Today’s Strong U.S. Dollar Can Save Money on Travel to Europe Next YearSome U.S. travelers planning international vacations next year are wondering if they should lock in rates now by prepaying for major costs. Here's where more savings can be found—and the risks.

Today’s Strong U.S. Dollar Can Save Money on Travel to Europe Next YearSome U.S. travelers planning international vacations next year are wondering if they should lock in rates now by prepaying for major costs. Here's where more savings can be found—and the risks.

Read more »

Right-wing group behind ‘2000 Mules’ could face federal scrutinyArizona’s AG thinks the FBI and the IRS should investigate a right-wing group whose 2020 election lies — dismissed by Bill Barr — were used to raise money.

Right-wing group behind ‘2000 Mules’ could face federal scrutinyArizona’s AG thinks the FBI and the IRS should investigate a right-wing group whose 2020 election lies — dismissed by Bill Barr — were used to raise money.

Read more »