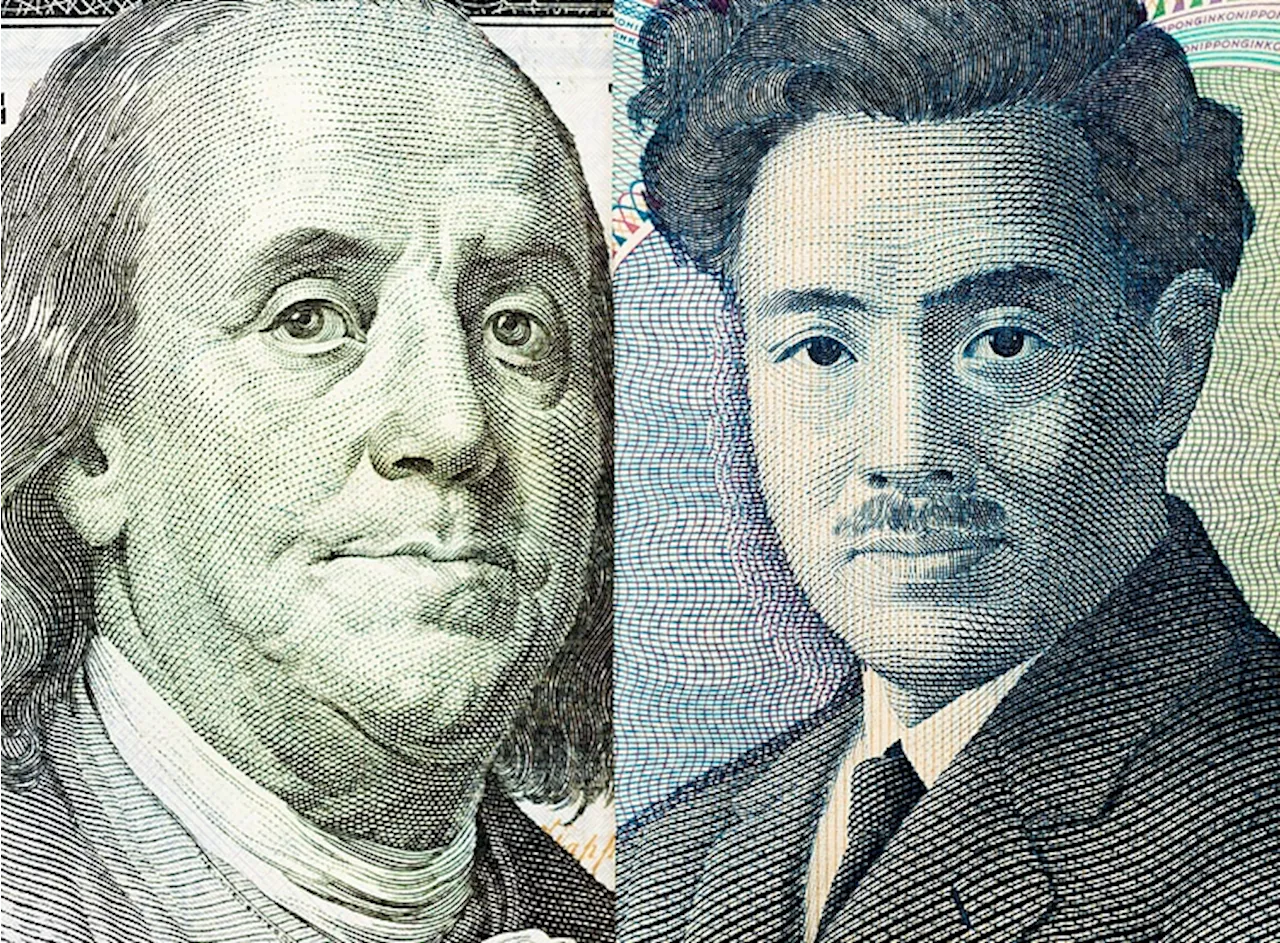

Yen furthers gains as bets firm on an aggressive Fed rate cut

SINGAPORE -The yen hit its highest levels in more than a year on Monday in trading thinned by a holiday in Japan, as market participants increasingly expected an oversized rate cut by the Federal Reserve later this week.The dollar was down 0.47% at 140.15 yen, falling further from the 140.285 end-December low it struck on Friday to levels last seen in July 2023. It fell 1.3% on the yen last week.

Benchmark 10-year yields are down 30 basis points in about two weeks. Cash Treasuries were not traded in Asia due to the Japan holiday. Two-year yields, more closely linked to monetary policy expectations were around 3.57% and down from roughly 3.94% two weeks ago. Fed speakers and data releases over the past month have had markets shifting the odds around the size of this week's rate cut, debating whether the Fed will head off weakness in the labor market with aggressive cuts or take a slower wait-and-see approach.

Investors are also looking to the Bank of Japan's interest rate decision on Friday, when it is expected to keep its short-term policy rate target steady at 0.25%. Sanae Takaichi, one of the leading contenders to replace Kishida, said on Friday the Bank of Japan should hold off on further interest rate hikes, to keep the country's economic recovery intact.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Strong Yen Weighed on Japan’s Trade Balance in July, Fed Speakers up NextThe significant strengthening of the yen added to Japan’s trading deficit in July but economists and the market as a whole still expect another rate hike in December

Strong Yen Weighed on Japan’s Trade Balance in July, Fed Speakers up NextThe significant strengthening of the yen added to Japan’s trading deficit in July but economists and the market as a whole still expect another rate hike in December

Read more »

Dollar tentative, yen dips on muddled Fed rate-cut outlookDollar tentative, yen dips on muddled Fed rate-cut outlook

Dollar tentative, yen dips on muddled Fed rate-cut outlookDollar tentative, yen dips on muddled Fed rate-cut outlook

Read more »

Fed's Goolsbee: There is an overwhelming Fed consensus for multiple rate cutsFederal Reserve (Fed) Bank of Chicago President Austan Goolsbee noted on Friday that Fed officials are finally beginning to catch up with the broader market's view that the time has come for movement from the US central bank on policy rates, but downplayed discussion of a larger opening cut in September.

Fed's Goolsbee: There is an overwhelming Fed consensus for multiple rate cutsFederal Reserve (Fed) Bank of Chicago President Austan Goolsbee noted on Friday that Fed officials are finally beginning to catch up with the broader market's view that the time has come for movement from the US central bank on policy rates, but downplayed discussion of a larger opening cut in September.

Read more »

Fed’s Daly: Fed needs to cut policy rate because inflation is falling, economy is slowingOn Thursday, San Francisco Federal Reserve President Mary Daly said that the “Fed needs to cut policy rate because inflation is falling and the economy is slowing.” Additional comments On size of Sept Fed rate cut, 'we don't know yet'.

Fed’s Daly: Fed needs to cut policy rate because inflation is falling, economy is slowingOn Thursday, San Francisco Federal Reserve President Mary Daly said that the “Fed needs to cut policy rate because inflation is falling and the economy is slowing.” Additional comments On size of Sept Fed rate cut, 'we don't know yet'.

Read more »

Japanese Yen gains ground as the government funds energy subsidiesThe Japanese Yen (JPY) ended its four-day losing streak, edging higher against the US Dollar (USD) on Tuesday.

Japanese Yen gains ground as the government funds energy subsidiesThe Japanese Yen (JPY) ended its four-day losing streak, edging higher against the US Dollar (USD) on Tuesday.

Read more »

Japanese Yen gains ground after inflation data, BoJ Governor Ueda’s speechThe Japanese Yen (JPY) strengthens against the US Dollar (USD) following the release of the National Consumer Price Index (CPI) inflation data and a speech by Bank of Japan (BoJ) Governor Kazuo Ueda in Parliament on Friday.

Japanese Yen gains ground after inflation data, BoJ Governor Ueda’s speechThe Japanese Yen (JPY) strengthens against the US Dollar (USD) following the release of the National Consumer Price Index (CPI) inflation data and a speech by Bank of Japan (BoJ) Governor Kazuo Ueda in Parliament on Friday.

Read more »