Breaking: The IRS gave a one-year tax-reporting reprieve to millions of Americans who make money through e-commerce platforms

The Internal Revenue Service on Friday gave millions of Americans a one-year reprieve on new tax-reporting requirements, delaying implementation of a law that requires e-commerce platforms such as eBay , Etsy and Airbnb to

give the tax agencyThe delay means the platforms won’t have to send sellers and the IRS a blizzard of 1099-K tax forms early in 2023, and it gives opponents of the $600 threshold more time to push for a change in the law next year.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

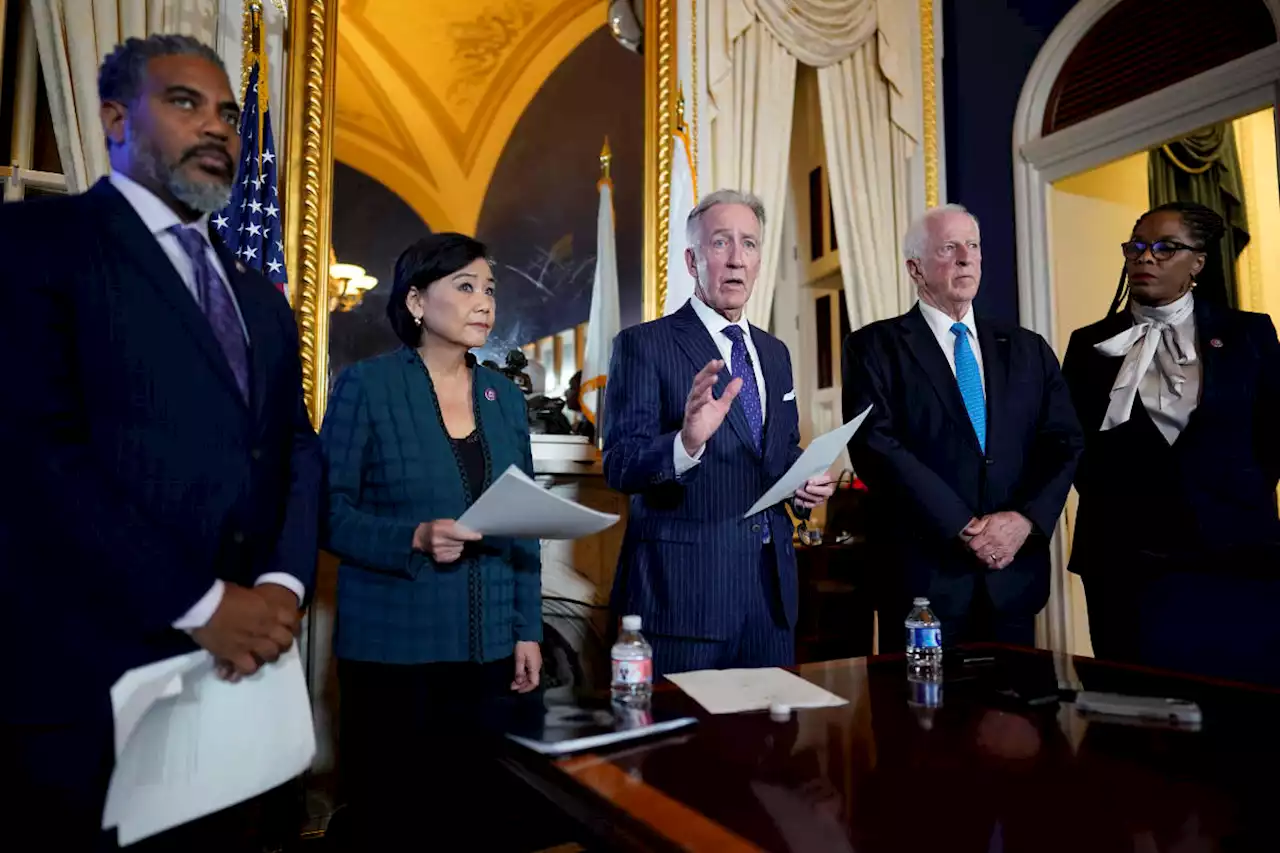

Trump tax audits required by IRS were delayed, panel saysThe IRS failed to pursue mandatory audits of Donald Trump on a timely basis during his presidency, a congressional panel found on Tuesday, raising questions about statements by the former president and leading members of his administration who claimed he could not release his tax filings because of the ongoing reviews. A report released by the Democratic majority on the House Ways and Means Committee indicated the Trump administration may have disregarded an IRS requirement dating back to 1977 that mandates audits of a president's tax filings. The IRS only began to audit Trump's 2016 tax filings on April 3, 2019, more than two years into Trump's presidency and just months after Democrats took control of the House.

Trump tax audits required by IRS were delayed, panel saysThe IRS failed to pursue mandatory audits of Donald Trump on a timely basis during his presidency, a congressional panel found on Tuesday, raising questions about statements by the former president and leading members of his administration who claimed he could not release his tax filings because of the ongoing reviews. A report released by the Democratic majority on the House Ways and Means Committee indicated the Trump administration may have disregarded an IRS requirement dating back to 1977 that mandates audits of a president's tax filings. The IRS only began to audit Trump's 2016 tax filings on April 3, 2019, more than two years into Trump's presidency and just months after Democrats took control of the House.

Read more »

Donald Trump Somehow Avoided a Mandatory IRS Tax Audit For Two Years as PresidentCongress has finally got its hands on Trump's taxes and it's already raising a lot of questions.

Donald Trump Somehow Avoided a Mandatory IRS Tax Audit For Two Years as PresidentCongress has finally got its hands on Trump's taxes and it's already raising a lot of questions.

Read more »

Trump tax returns: House committee report shows IRS failed to conduct 'mandatory' auditsHouse report says IRS failed to conduct mandatory reviews of Trump tax returns, recommends new federal law mandating the audits.

Trump tax returns: House committee report shows IRS failed to conduct 'mandatory' auditsHouse report says IRS failed to conduct mandatory reviews of Trump tax returns, recommends new federal law mandating the audits.

Read more »