Why private flood insurance is a positive for FHA-secured mortgages | Opinion

estimates that nearly 1.4 million Texas homes have a 26% chance of being severely affected by flooding over the next 30 years. Most of these properties are outside of NFIP’s mandatory coverage zones, so homeowners mistakenly believe their risk is low. Recent history belies this confidence. The Dallas-Fort Worth floods of August 2022 caused as much as $6 billion in damage, and the state has suffered more than $200 billion in aggregate losses from natural disasters over the past five years alone.

State capitols are likewise at the forefront of reform. In December, Florida legislators met in a special session to address the health of the property and casualty insurance markets in the wake of Hurricane Ian. Through a broad package of reforms, legislators made it clear that private markets are essential to distribute risk appropriately and protect taxpayers and ratepayers from footing the bill for unexpected losses.

Thanks to these nascent reform efforts, we may be moving closer to a more sustainable relationship between public and private insurance. The private insurance market has shown it can absorb even unexpected losses from catastrophe events through careful underwriting on the front end and the purchase of private reinsurance on the back end. Public insurers, by contrast, have tended to offer “one size fits all” policies that lack the underwriting sophistication of leading private insurers.

Actions by the FHA and Florida suggest the possibility of a new era in American property insurance — one in which public insurers work more closely with their private counterparts, recognizing the inherent limits of publicly funded coverage and encouraging policy migration to private companies. It is incumbent on legislators and regulators to recognize the value of the private market and protect American taxpayers from footing the bill for the next earthquake, wildfire or hurricane.

Mac Armstrong is the chairman and CEO of Palomar Holdings, a specialty insurance company with expertise in catastrophe insurance. He wrote this column for The Dallas Morning News.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Opinion | Why the scary, funny, profane ‘FAFO’ was 2022’s word of the yearA double-edged taunt, 'eff around and find out' is a weapon for you and a weapon for them.

Opinion | Why the scary, funny, profane ‘FAFO’ was 2022’s word of the yearA double-edged taunt, 'eff around and find out' is a weapon for you and a weapon for them.

Read more »

China Surpasses Germany To Become World's Second-Largest Auto Exporter | CarscoopsChina Surpasses Germany To Become World's Second-Largest Auto Exporter | Carscoops carscoops

China Surpasses Germany To Become World's Second-Largest Auto Exporter | CarscoopsChina Surpasses Germany To Become World's Second-Largest Auto Exporter | Carscoops carscoops

Read more »

38 TikTok Products To Make 2023 Easier Than 2022Shoutout to this tiny app-controlled button pusher that will turn on your coffee machine for you while you're still in bed.

38 TikTok Products To Make 2023 Easier Than 2022Shoutout to this tiny app-controlled button pusher that will turn on your coffee machine for you while you're still in bed.

Read more »

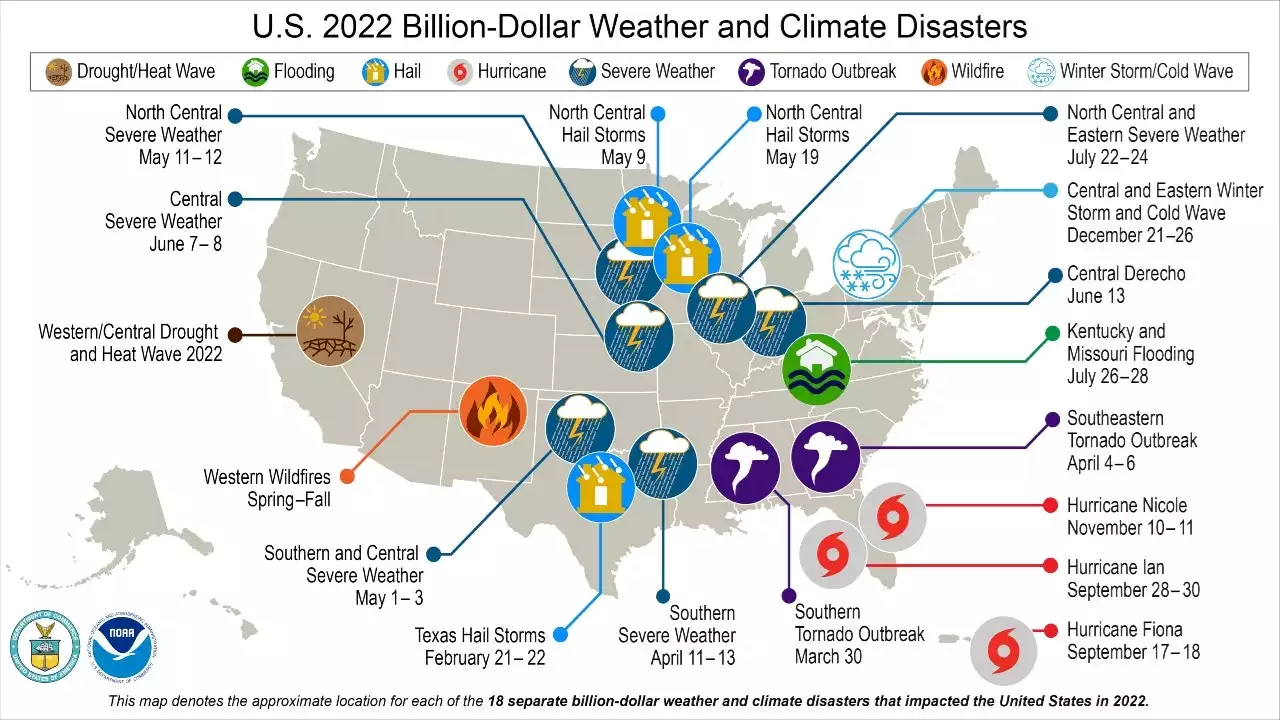

A breakdown of 2022's billion-dollar weather disastersIt was a particularly bad year for billion-dollar weather disasters in our country.

A breakdown of 2022's billion-dollar weather disastersIt was a particularly bad year for billion-dollar weather disasters in our country.

Read more »

Elon Musk's private jet: Here's how much CO2 it released in 2022Musk, a champion of environment-friendly cars is not shy to hop on a private plane and travel halfway across the globe to watch a game of football.

Elon Musk's private jet: Here's how much CO2 it released in 2022Musk, a champion of environment-friendly cars is not shy to hop on a private plane and travel halfway across the globe to watch a game of football.

Read more »

NOAA: Ian, drought supercharged US weather extremes in 2022Costly weather disasters kept raining down on America last year, pounding the nation with 18 climate extremes that caused at least $1 billion in damage each, totaling more than $165 billion, federal climate scientists calculated Tuesday. The amount, cost and death toll of billion-dollar weather disaster s make up a key measurement, adjusted for inflation, that NOAA uses to see how bad human-caused climate change is getting. “People are seeing the impacts of a changing climate system where they live, work and play on a regular basis,” NOAA Administrator Rick Spinrad said at a Tuesday press conference.

NOAA: Ian, drought supercharged US weather extremes in 2022Costly weather disasters kept raining down on America last year, pounding the nation with 18 climate extremes that caused at least $1 billion in damage each, totaling more than $165 billion, federal climate scientists calculated Tuesday. The amount, cost and death toll of billion-dollar weather disaster s make up a key measurement, adjusted for inflation, that NOAA uses to see how bad human-caused climate change is getting. “People are seeing the impacts of a changing climate system where they live, work and play on a regular basis,” NOAA Administrator Rick Spinrad said at a Tuesday press conference.

Read more »