CNBC Pro analyzes Berkshire Hathaway's portfolio and identifies stocks with high potential for growth in 2025, based on Wall Street analyst estimates.

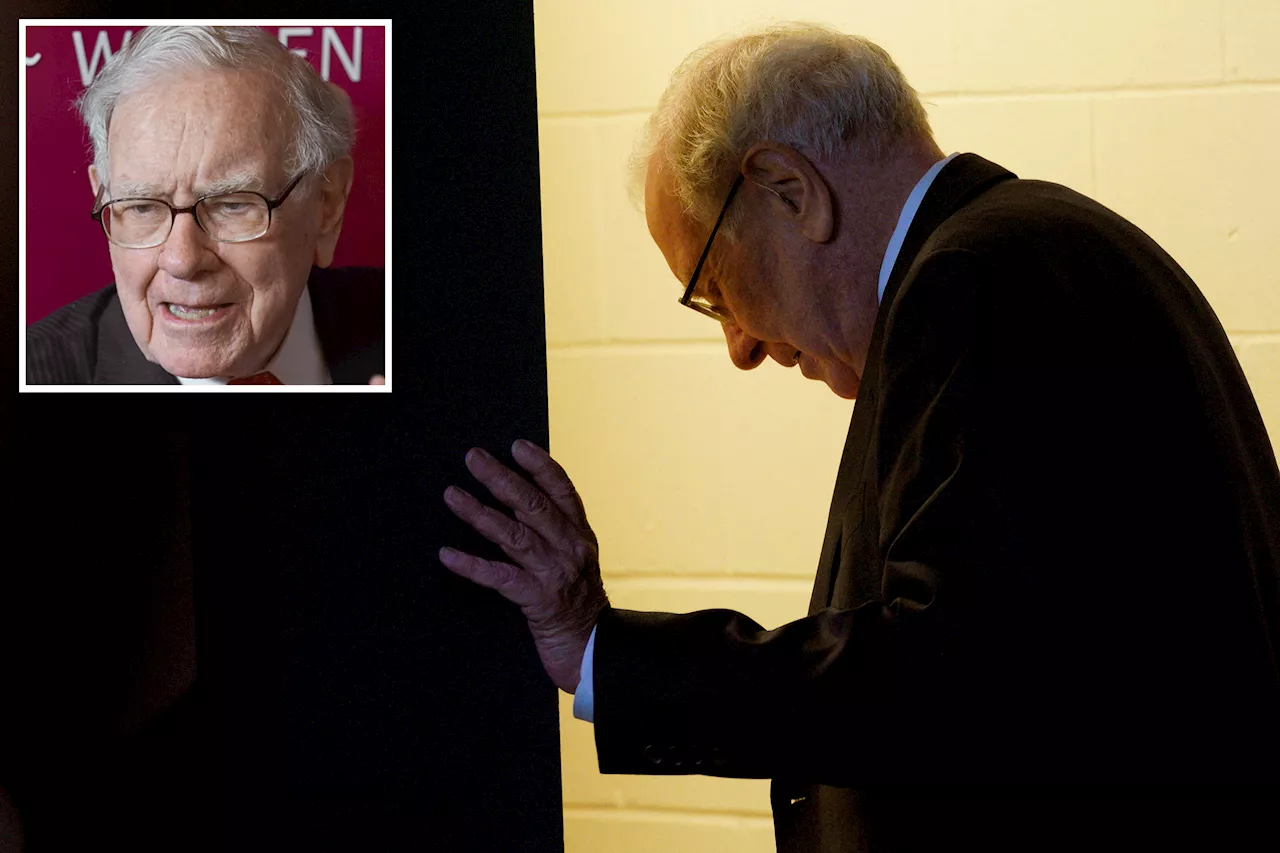

Wall Street analysts predict significant gains in the new year for several stocks held by Warren Buffett . CNBC Pro, using FactSet data, examined Berkshire Hathaway's equity portfolio at the end of the third quarter, focusing on stocks with the highest potential for growth compared to Wall Street analysts' average 12-month price targets. Berkshire Hathaway is seeking to maintain its momentum after a successful 2024, where its Class A shares surged 25.

5%, surpassing the S&P 500's return, marking its best year since 2021. The conglomerate's strong performance was driven by solid operating earnings, boosted by substantial investment income and underwriting earnings at Geico, despite the 'Oracle of Omaha' pausing Berkshire's stock buyback program. Looking ahead, Wall Street analysts are particularly optimistic about Liberty Latin America, a telecommunications company operating in Latin America and the Caribbean, anticipating a nearly 58% stock increase in the next 12 months. Berkshire has held a modest stake in the company for nearly a decade. Given its relatively small size, worth $37 million, the stock might have been acquired by one of Buffett's investment deputies. Analysts also foresee a 42% gain for Atlanta Braves Holdings. The baseball franchise, formerly part of John Malone's Liberty Media group, was spun off last summer, potentially leading to a sale. Speculation abounds that the Braves, who were eliminated by the San Diego Padres in the 2024 National League Wild Card playoffs, could be taken private by a billionaire. Occidental Petroleum is projected to rise more than 20% in the next 12 months, according to the average price target from analysts. The oil and gas producer has experienced a 17% decline in the past year, prompting Buffett to capitalize on lower prices and acquire additional shares. Based in Houston, Occidental is Berkshire's sixth-largest equity holding. Buffett has ruled out a complete takeover

WARREN BUFFETT BERKSHIRE HATHAWAY STOCK MARKET INVESTING ANALYST ESTIMATES

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Left at Wall: A Quirky Indie Comedy Taking on Wall StreetInspired by the GameStop short squeeze, 'Left at Wall' follows the story of two brothers, one a struggling Hollywood writer, the other a Wall Street investor, whose rivalry escalates when the writer discovers his brother's latest scheme.

Left at Wall: A Quirky Indie Comedy Taking on Wall StreetInspired by the GameStop short squeeze, 'Left at Wall' follows the story of two brothers, one a struggling Hollywood writer, the other a Wall Street investor, whose rivalry escalates when the writer discovers his brother's latest scheme.

Read more »

Warren Buffett's Berkshire Hathaway scoops up Occidental and other stocks during sell-offBerkshire Hathaway bought over $560 million worth of stocks over the last three sessions.

Warren Buffett's Berkshire Hathaway scoops up Occidental and other stocks during sell-offBerkshire Hathaway bought over $560 million worth of stocks over the last three sessions.

Read more »

Warren Buffett heads into 2025 with his biggest cash position in more than 30 yearsAt $325 billion, Berkshire's cash level now accounts for about 30% of the conglomerate's total assets, the highest percentage since 1990.

Warren Buffett heads into 2025 with his biggest cash position in more than 30 yearsAt $325 billion, Berkshire's cash level now accounts for about 30% of the conglomerate's total assets, the highest percentage since 1990.

Read more »

Warren Buffett's Cash Hoard and MicroStrategy's Bitcoin BetCNBC Daily Open discusses Warren Buffett's record cash holdings and MicroStrategy's success tied to Bitcoin. The report also touches on the UK's economic growth and the NYSE's early Christmas Eve closure.

Warren Buffett's Cash Hoard and MicroStrategy's Bitcoin BetCNBC Daily Open discusses Warren Buffett's record cash holdings and MicroStrategy's success tied to Bitcoin. The report also touches on the UK's economic growth and the NYSE's early Christmas Eve closure.

Read more »

Warren Buffett Outlines Plan for Wealth Distribution After DeathWarren Buffett, the CEO of Berkshire Hathaway, shared details about his plans for distributing his vast fortune after his death in a letter to shareholders. He announced donations to his family's foundations and outlined a process for his children to gradually distribute the remaining wealth. The letter also reflects on Buffett's mortality and offers advice to other parents on handling wealth transfer.

Warren Buffett Outlines Plan for Wealth Distribution After DeathWarren Buffett, the CEO of Berkshire Hathaway, shared details about his plans for distributing his vast fortune after his death in a letter to shareholders. He announced donations to his family's foundations and outlined a process for his children to gradually distribute the remaining wealth. The letter also reflects on Buffett's mortality and offers advice to other parents on handling wealth transfer.

Read more »

Warren Buffett Outlines Plans for $150 Billion Fortune After DeathBerkshire Hathaway CEO Warren Buffett shares his estate plan, outlining donations to family foundations and instructions for distributing the remainder of his wealth.

Warren Buffett Outlines Plans for $150 Billion Fortune After DeathBerkshire Hathaway CEO Warren Buffett shares his estate plan, outlining donations to family foundations and instructions for distributing the remainder of his wealth.

Read more »