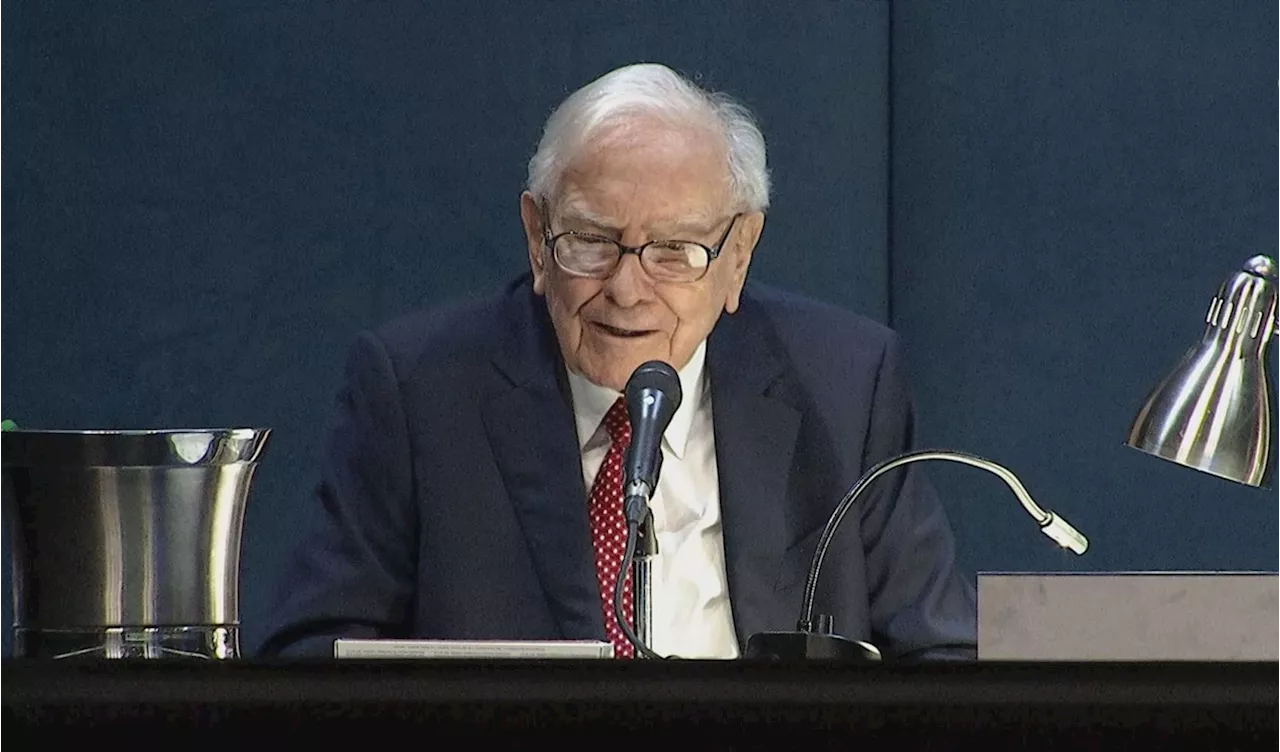

Berkshire Hathaway disclosed a $84.2 billion bet in Apple at the end of the second quarter, indicating that Warren Buffett offloaded 49.4% of the tech bet.

The Omaha-based conglomerate disclosed that its holding in the iPhone maker was valued at $84.2 billion at the end of the second quarter, indicating that the Oracle of Omaha offloaded 49.4% of the tech bet.hinted at the Berkshire annual meeting in May that it was for tax reasons.

Buffett noted that selling 'a little Apple' this year would benefit Berkshire shareholders in the long run if the tax on capital gains is raised down the road by a U.S. government wanting to plug a climbing fiscal deficit.

It won't be clear exactly why the famously long-term focused investor is selling down the holding Berkshire first bought more than eight years ago, whether company reasons, market valuation or because of portfolio management concerns . Berkshire's Apple holding was once so big that it took up half of its equity portfolio.

Berkshire began buying Apple's stock in 2016 under the influence of Buffett's investing lieutenants Ted Weschler and Todd Combs. Over the years, Buffett grew so fond of Apple that he increased the stake drastically to make it Berkshire's biggest and called the tech giant 30-year-old who quit her job and moved to Budapest now works remotely 25 hours a week: ‘It's a beautiful life'Apple is still Berkshire's biggest holding after the sale for the last two quarters. Buffett recently starting downsizing his second biggest stake —Wall Street looks for signs of what's next for the market after a rocky week

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Warren Buffett's Berkshire Hathaway has a new analyst, and he is lukewarm on the conglomerateTD Cowen's Andrew Kligerman initiated his coverage on the Omaha-based giant with a hold rating on Monday.

Warren Buffett's Berkshire Hathaway has a new analyst, and he is lukewarm on the conglomerateTD Cowen's Andrew Kligerman initiated his coverage on the Omaha-based giant with a hold rating on Monday.

Read more »

Warren Buffett's Berkshire Hathaway sells Bank of America for a ninth-straight dayOver the past nine trading sessions, Berkshire has cut its BofA stake by 71.2 million shares with just over $3 billion of sales.

Warren Buffett's Berkshire Hathaway sells Bank of America for a ninth-straight dayOver the past nine trading sessions, Berkshire has cut its BofA stake by 71.2 million shares with just over $3 billion of sales.

Read more »

Berkshire Hathaway dumps $2.3 billion of Bank of America shares in a 6-day saleWarren Buffett's holding company sold more Bank of America shares this week, reducing its holding across six consecutive trading days.

Berkshire Hathaway dumps $2.3 billion of Bank of America shares in a 6-day saleWarren Buffett's holding company sold more Bank of America shares this week, reducing its holding across six consecutive trading days.

Read more »

Berkshire Hathaway dumps $2.3 billion of Bank of America shares in a 6-day saleWarren Buffett’s holding company sold more Bank of America shares this week, reducing its holding across six consecutive trading days.

Berkshire Hathaway dumps $2.3 billion of Bank of America shares in a 6-day saleWarren Buffett’s holding company sold more Bank of America shares this week, reducing its holding across six consecutive trading days.

Read more »

Here are Monday's biggest analyst calls: Apple, Nvidia, Amazon, Burlington, CrowdStrike, Berkshire Hathaway, Coinbase & moreHere are Monday's biggest calls on Wall Street.

Here are Monday's biggest analyst calls: Apple, Nvidia, Amazon, Burlington, CrowdStrike, Berkshire Hathaway, Coinbase & moreHere are Monday's biggest calls on Wall Street.

Read more »

Berkshire has eliminated 10% of outstanding shares as Buffett values the enduring power of buybacksOver the past five and a half years, Berkshire has repurchased nearly $75 billion worth of its stock, eliminating 10% of shares outstanding, one analyst said.

Berkshire has eliminated 10% of outstanding shares as Buffett values the enduring power of buybacksOver the past five and a half years, Berkshire has repurchased nearly $75 billion worth of its stock, eliminating 10% of shares outstanding, one analyst said.

Read more »