Morgan Stanley's software developers are prioritizing open-source technology, reflecting a broader trend in the financial industry. This shift towards open collaboration and cost-efficiency is driven by a need to respond to increasing technology spending and the rise of AI.

Software developers at Morgan Stanley are accustomed to pushback when pitching to build something new.

'I tell technologists all the time, if you're building something and it is not a source of competitive advantage, you have to wonder: 'Is this already outside? Should I be using it if I'm not using it? Is there something or a gap that I should be improving and contributing back my improvement?'' Dov Katz, a managing director helping oversee the bank's tens of thousands of developers, told Business Insider. 'And only then should you build something net new.'Katz is talking about prioritizing open-source technology, which is non-proprietary software that can allow developers from all over, including rival companies, to view, collaborate on, and modify the code behind it.The open source-first approach and collaborative attitude is a departure from the hyper-competitive and proprietary nature that Wall Street has come to be known for. But Katz's stance is part of a sea change in the industry as banks, hedge funds, and asset-management firms find more reasons to open up.While revealing their secrets is alien to the Wall Street DNA, finance firms have been shedding those conservative notions over the past few years. In that shift, financial institutions are growing to become contributors to open source, not just consumers. As such, the amount of intellectual property flowing to open-source hosting platforms and the number of contributions from financial services professionals continue to rise.In 2024, financial services workers contributed more than 750,000 commits, or changes, to GitHub, one of the main platforms for hosting open-source projects, according to the Fintech Open Source Foundation (FINOS), an open-source nonprofit for financial services. That's a 55% increase from 2021 levels. Around the same time, financial companies from JPMorgan to BlackRock and Man Group also released internal platforms for open source.Wall Street's embrace of open source could come at a good time. Global technology spending in banking ballooned to $650 billion in 2023 — roughly the GDP of Belgium or Sweden, according to an October report from McKinsey. Despite the steady 9% a year increase on average in spending, bank shareholders and analysts are still questioning when they're going to see quantifiable value, the report said. Scrutiny comes as finance firms carve out even more resources for AI, which can be a costly endeavor.One of the main upsides to leveraging open source is cost efficiency: sharing the burden of development while freeing up engineers to work on other tasks. It could allow firms to be more nimble in the long run, cutting down on their yearslong roadmaps because outside contributors can make fixes to codebases and introduce new features. 'Otherwise, you're just building tech debt forever. You're going to have to support something forever if you're building it yourself,' Katz said.Goldman Sachs' chief data officer, Neema Raphael, has witnessed this cultural shift over his more-than two decades at the bank. Attitudes went 'from almost very secretive, we're going to keep everything within,' to accepting the benefits of open source with some caution, he said. 'Then finally, to like, 'OK, we should actually be a player in this space in the sense that we should also contribute to open source'' and get leverage from that, he said There's momentum at senior levels, Katz said, for engineers to work together to solve common industry problems and that more diverse contributor pools can lead to better solutions. The reasons are not all altruistic, of course.Open source can lower the cost of development and ownership, help with scalability, and even provide some regulatory insulation. It's helped banks speed up integrations with technology vendors and made it easier to share data with clients. There are even ripple effects to engineering retention and job satisfaction, Raphael said, adding that, 'contributing to open source and having your name out there in open source is almost like table stakes.'It's hard to talk about Wall Street's adoption of open source without talking about the cloud.Wall Street largely held out on adopting the public cloud, with regulatory uncertainty and security concerns being two big reasons. But that started to change around 2019 and 2020, when the cloud became the place for data and analytics, faster experimentation, and a breeding ground for launching new businesses.To reap the benefits of speed and cost efficiency, companies had to adopt a different toolkit and approach compared with developing software on physical servers. That brought many finance firms face to face with open-source technologies, like Kubernetes and Docker, which are cornerstones of the cloud-native software development

OPEN SOURCE WALL STREET FINANCE CLOUD COMPUTING COST EFFICIENCY COLLABORATION TECHNOLOGY SPENDING

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Asia-Pacific Markets to Open Higher After Mixed Wall Street SessionAsia-Pacific markets are poised for a higher open following a mixed performance on Wall Street, where the Dow Jones Industrial Average surged while the Nasdaq Composite slipped. Investors are shifting away from tech stocks and toward sectors like energy. Key economic indicators from Japan, India, and Thailand will also be watched.

Asia-Pacific Markets to Open Higher After Mixed Wall Street SessionAsia-Pacific markets are poised for a higher open following a mixed performance on Wall Street, where the Dow Jones Industrial Average surged while the Nasdaq Composite slipped. Investors are shifting away from tech stocks and toward sectors like energy. Key economic indicators from Japan, India, and Thailand will also be watched.

Read more »

![]() Asia markets open mixed, tracking Wall Street moves that saw investors rotate out of techAsia-Pacific markets open higher even after a mixed session on Wall Street.

Asia markets open mixed, tracking Wall Street moves that saw investors rotate out of techAsia-Pacific markets open higher even after a mixed session on Wall Street.

Read more »

Katie Holmes Embraces Pastel Green in NYC Street StyleKatie Holmes steps out in a surprising shade of minty green, proving celebrities are breaking seasonal color rules this year.

Katie Holmes Embraces Pastel Green in NYC Street StyleKatie Holmes steps out in a surprising shade of minty green, proving celebrities are breaking seasonal color rules this year.

Read more »

Australian Open Embraces Wii-Style Animation to Attract New FansThe Australian Open is experimenting with a unique approach to engage younger audiences and gamers by streaming real-time animated feeds on its YouTube channel. These cartoonish replays, which mimic the action in the main stadiums with a one-point delay, are capturing the attention of players and viewers alike.

Australian Open Embraces Wii-Style Animation to Attract New FansThe Australian Open is experimenting with a unique approach to engage younger audiences and gamers by streaming real-time animated feeds on its YouTube channel. These cartoonish replays, which mimic the action in the main stadiums with a one-point delay, are capturing the attention of players and viewers alike.

Read more »

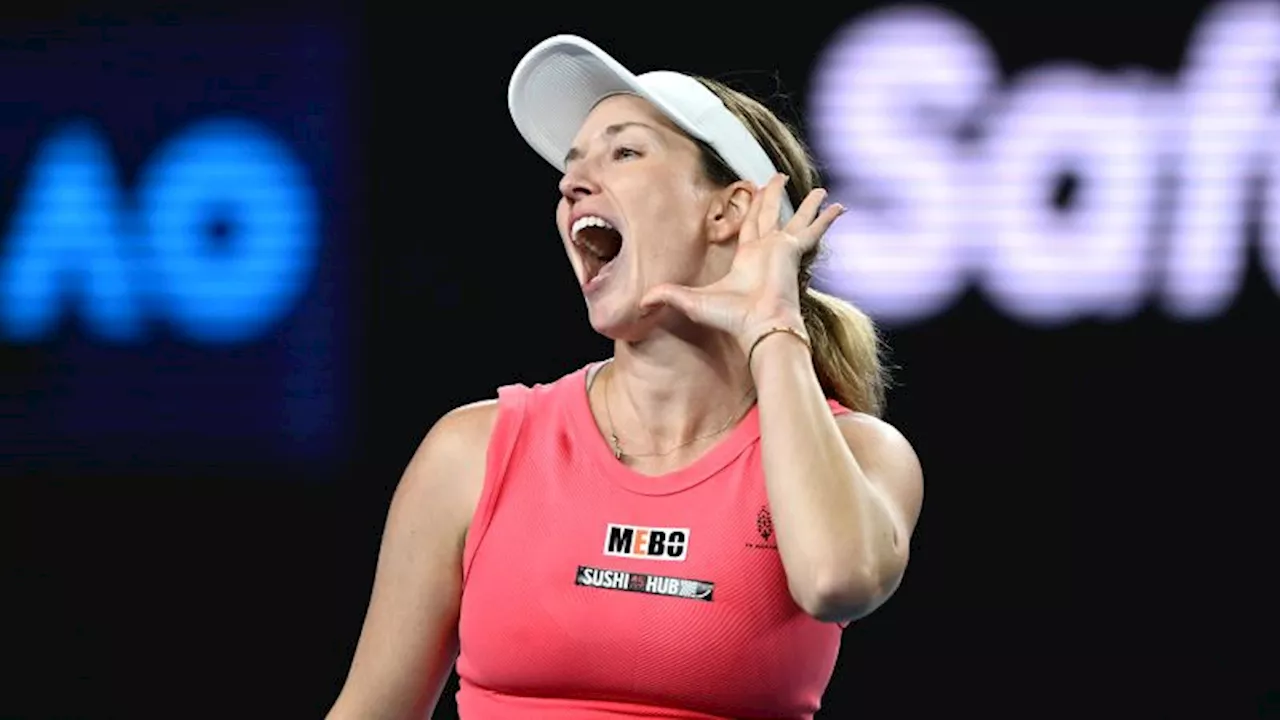

Danielle Collins Embraces Villain Role, Thrives on Australian Open Crowd's HostilityDanielle Collins capitalized on a hostile Australian Open crowd, defeating Destanee Aiava in a thrilling match. Despite facing boos and jeers, Collins embraced the negativity, turning it into fuel for her performance. She continued to provoke the crowd even after the match, joking about using their money for a luxurious vacation. This fiery display drew praise from Novak Djokovic, who admired her ability to handle the pressure and turn it into an advantage.

Danielle Collins Embraces Villain Role, Thrives on Australian Open Crowd's HostilityDanielle Collins capitalized on a hostile Australian Open crowd, defeating Destanee Aiava in a thrilling match. Despite facing boos and jeers, Collins embraced the negativity, turning it into fuel for her performance. She continued to provoke the crowd even after the match, joking about using their money for a luxurious vacation. This fiery display drew praise from Novak Djokovic, who admired her ability to handle the pressure and turn it into an advantage.

Read more »

Wall Street's Biggest Calls WednesdayA roundup of the most notable upgrades and downgrades by analysts on Wall Street.

Wall Street's Biggest Calls WednesdayA roundup of the most notable upgrades and downgrades by analysts on Wall Street.

Read more »