Shock waves reverberate through global financial stocks on Friday, March 10, after the closure of Silicon Valley Bank.

At last glance, financial markets are pricing in a 42.5% chance of a 50-bps rate hike and a 57.5% chance of a smaller, 25-bps increase to the fed funds target rate at the conclusion of the March 21-22 monetary policy meeting.

The Dow Jones Industrial Average fell 345.22 points, or 1.07%, to 31,909.64, the S&P 500 lost 56.73 points, or 1.45%, to 3,861.59, and the Nasdaq Composite dropped 199.47 points, or 1.76%, to 11,138.89. US Treasury yields dropped for the second straight day as risk-averse investors sought safe haven amid brewing troubles in the financial sector.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

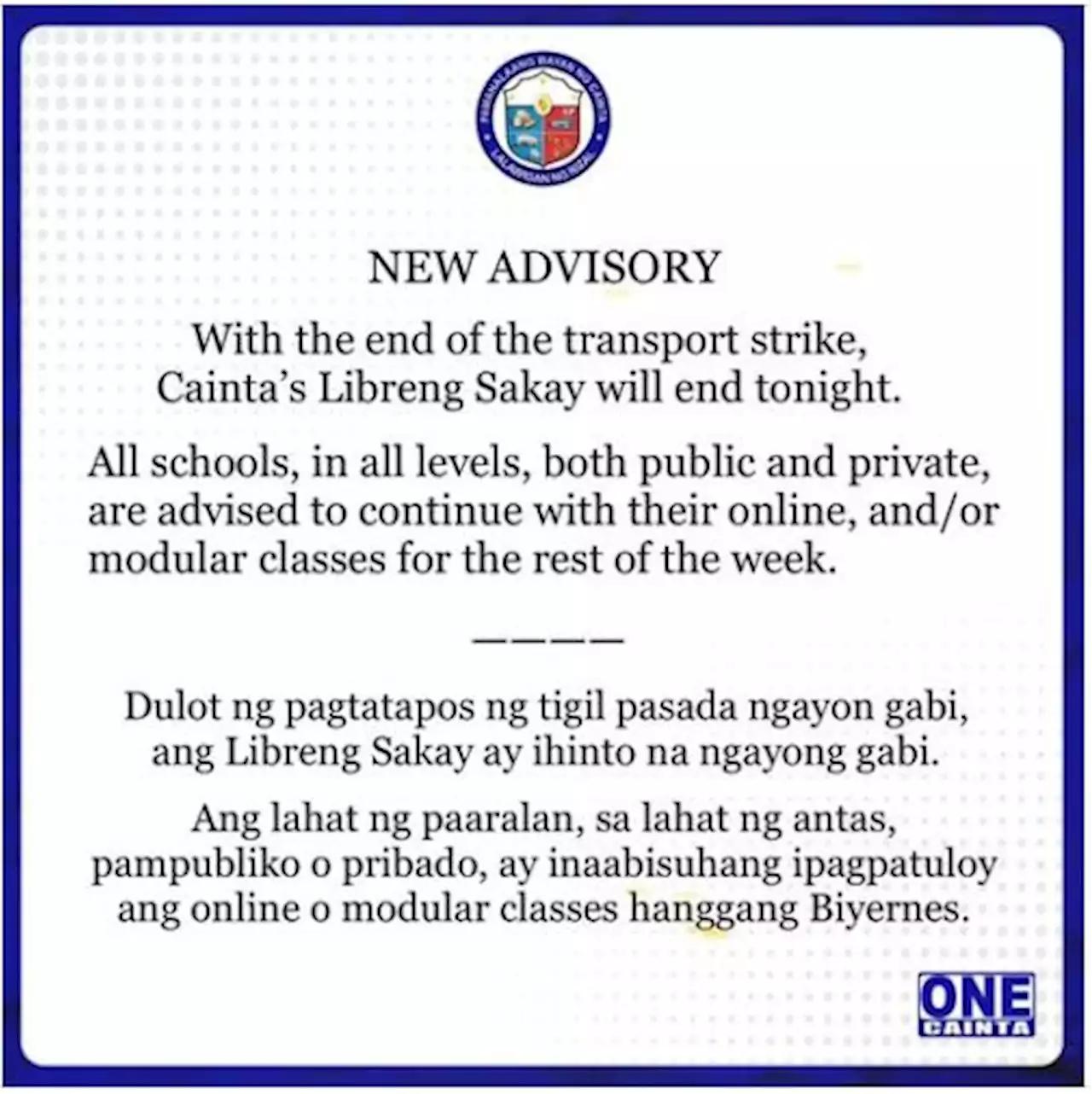

Cainta schools to extend online and modular classes until Friday, March 10The Cainta Municipal Government has recommended the continuation of online and modular classes in all public and private schools in the municipality until Friday, March 10.

Cainta schools to extend online and modular classes until Friday, March 10The Cainta Municipal Government has recommended the continuation of online and modular classes in all public and private schools in the municipality until Friday, March 10.

Read more »

RECAP: Moon Dong-eun was only getting started with her revenge in 'The Glory' Part 1To refresh everyone's memory, here's a recap of key events in 'The Glory' Part 1 before its second installment comes out tomorrow, March 10. | via philstarlife

RECAP: Moon Dong-eun was only getting started with her revenge in 'The Glory' Part 1To refresh everyone's memory, here's a recap of key events in 'The Glory' Part 1 before its second installment comes out tomorrow, March 10. | via philstarlife

Read more »

![]() Silicon Valley Bank slams global shares, US payrolls loomGlobal shares hit a two-month low as investors dumped banks on fears of contagion after a capital raising at Silicon Valley Bank, with U.S. payrolls figures also a focus ahead of the Federal Reserve meeting later this month. | Reuters

Silicon Valley Bank slams global shares, US payrolls loomGlobal shares hit a two-month low as investors dumped banks on fears of contagion after a capital raising at Silicon Valley Bank, with U.S. payrolls figures also a focus ahead of the Federal Reserve meeting later this month. | Reuters

Read more »

![]() Silicon Valley Bank collapses after failing to raise capitalSilicon Valley Bank collapsed Friday morning after a stunning 48 hours in which it set off fears of a meltdown in the banking industry.

Silicon Valley Bank collapses after failing to raise capitalSilicon Valley Bank collapsed Friday morning after a stunning 48 hours in which it set off fears of a meltdown in the banking industry.

Read more »

![]() US closes Silicon Valley Bank in biggest collapse since 2008US regulators pulled the plug on Silicon Valley Bank on Friday in a spectacular move that sent global banking shares into turmoil, as markets fretted over possible contagion from America&39;s biggest banking failure since the 2008 financial crisis.

US closes Silicon Valley Bank in biggest collapse since 2008US regulators pulled the plug on Silicon Valley Bank on Friday in a spectacular move that sent global banking shares into turmoil, as markets fretted over possible contagion from America&39;s biggest banking failure since the 2008 financial crisis.

Read more »

![]() Silicon Valley Bank is largest failure since financial crisis, billions strandedCalifornia banking regulators close Silicon Valley Bank and appoint the Federal Deposit Insurance Corporation as receiver for later disposition of its assets.

Silicon Valley Bank is largest failure since financial crisis, billions strandedCalifornia banking regulators close Silicon Valley Bank and appoint the Federal Deposit Insurance Corporation as receiver for later disposition of its assets.

Read more »