Stocks Analysis by Michael Kramer covering: S&P 500, CBOE Volatility Index, Iog PLC. Read Michael Kramer's latest article on Investing.com

The stock market started the day higher, but by the end of the day, it had given back most of its gains, with theThe VIX one-day, typically closer to 20 the day before a jobs report, managed to creep up to 11.16 today—a three-point gain. I would have expected a much bigger move in the VIX one day ahead of a major jobs report like this. Historically, as I’ve written and discussed, it’s been closer to 20 since around the August report.

We’re getting closer to a point where implied volatility could expand significantly. You can already see this reflected in the VIX, the VVIX, and realized volatility. Today, 5- and 10-day realized volatility rose slightly, with the 10-day closing at 5.6, up from a recent low of 4.7. Implied correlations are also at the low end of the range. The one-month implied correlation index dropped another 54 basis points to 10.25, close to the historic low of 10. It could go lower, as it did in July 2024 when it hit 2 or 3, but 10 is generally considered the lower bound.

As for tomorrow’s jobs report, it’s becoming critical due to its unpredictability. Analysts expect 220,000 new jobs, an unchanged unemployment rate of 4.1%, a decline in wage growth to 0.3% from 0.4% month-over-month, and a year-over-year rate of 3.9%, down from 4%.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Nvidia's Earnings Were Likely Not Good Enough to Sustain an Overextended MarketStocks Analysis by Michael Kramer covering: NVIDIA Corporation. Read Michael Kramer's latest article on Investing.com

Nvidia's Earnings Were Likely Not Good Enough to Sustain an Overextended MarketStocks Analysis by Michael Kramer covering: NVIDIA Corporation. Read Michael Kramer's latest article on Investing.com

Read more »

The Fed Rate Cutting Cycle May Be OverMarket Overview Analysis by Michael Kramer covering: . Read Michael Kramer's latest article on Investing.com

The Fed Rate Cutting Cycle May Be OverMarket Overview Analysis by Michael Kramer covering: . Read Michael Kramer's latest article on Investing.com

Read more »

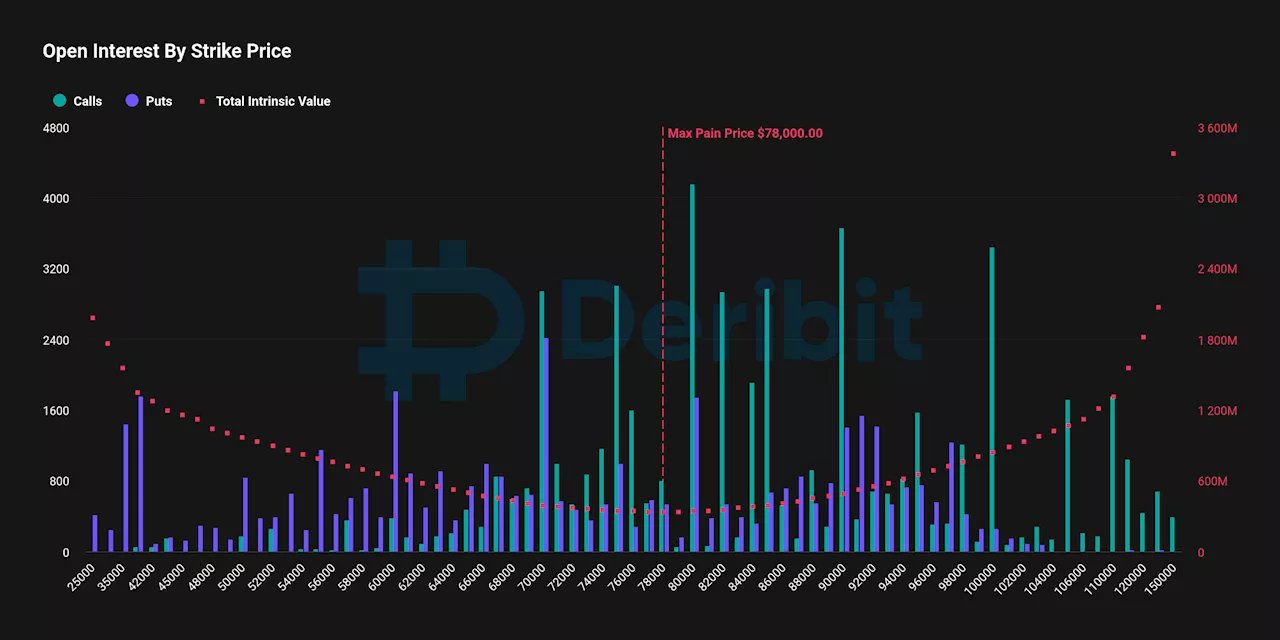

Bitcoin Options Worth $9B Expire Friday, Traders May be Thankful for the Post-Thanksgiving VolatilityApproximately 45% ($4.2 billion) of the notional value in bitcoin that is set to expire is currently 'in the money'.

Bitcoin Options Worth $9B Expire Friday, Traders May be Thankful for the Post-Thanksgiving VolatilityApproximately 45% ($4.2 billion) of the notional value in bitcoin that is set to expire is currently 'in the money'.

Read more »

Volatility May Be Due to Increase Significantly Starting TodayMarket Overview Analysis by Michael Kramer covering: US Dollar Japanese Yen, S&P 500, United States 10-Year, CBOE Volatility Index. Read Michael Kramer's latest article on Investing.com

Volatility May Be Due to Increase Significantly Starting TodayMarket Overview Analysis by Michael Kramer covering: US Dollar Japanese Yen, S&P 500, United States 10-Year, CBOE Volatility Index. Read Michael Kramer's latest article on Investing.com

Read more »

Market Liquidity May Not Be Ample as Some BelieveMarket Overview Analysis by Michael Kramer covering: US Dollar Japanese Yen, S&P 500, US Dollar Index Futures, CBOE Volatility Index. Read Michael Kramer's latest article on Investing.com

Market Liquidity May Not Be Ample as Some BelieveMarket Overview Analysis by Michael Kramer covering: US Dollar Japanese Yen, S&P 500, US Dollar Index Futures, CBOE Volatility Index. Read Michael Kramer's latest article on Investing.com

Read more »

Can Nvidia Save the Market One More Time Today?Stocks Analysis by Michael Kramer covering: S&P 500, NVIDIA Corporation, CBOE Volatility Index, Invesco S&P 500® Equal Weight ETF. Read Michael Kramer's latest article on Investing.com

Can Nvidia Save the Market One More Time Today?Stocks Analysis by Michael Kramer covering: S&P 500, NVIDIA Corporation, CBOE Volatility Index, Invesco S&P 500® Equal Weight ETF. Read Michael Kramer's latest article on Investing.com

Read more »