Vanguard's recent suggestion to rebalance portfolios towards a 40/60 stock/bond allocation, driven by shrinking equity premiums and rising bond yields, prompts a guide for investors considering this shift. This guide navigates the complexities of bond investing, emphasizing the importance of choosing funds over individual bonds, and addresses key considerations such as duration, credit quality, and inflation exposure.

Stocks have gotten very expensive, bonds very cheap. If you want to move money from equities to fixed income, use this guide.ramatic move this month from Vanguard Group: It’s saying that the classic portfolio of 60% stocks and 40% bonds, with which it has been so enamored for so long, might not be quite right. Consider, it says, going over to 40% stocks and 60% bonds.

A common comparison is between the earnings yield on the S&P 500 and the interest yield on conventional 10-year Treasuries. This comparison is naïve. Stocks provide something close to a real yield, a return that keeps up with inflation. So the comparison should be to the yield on Treasury inflation-protected securities, also known as TIPS.

You get paid to take credit risk. Low-rated corporate bonds have better yields than high-rated corporate bonds, and high-rated corporate bonds have better yields than Treasuries. But losses to defaults take a bite out of the fat coupons on low-rated bonds. A nominal Treasury maturing in 2045 yields 4.9%. The TIPS for that year pays 2.4% plus inflation. If inflation averages more than 2.5%, you’ll do better with the TIPS. If it averages less than 2.5% you’ll do better with the nominal bond.

Here, timing refers to the timing of principal and interest payments. You might want to time the principal repayment, that is, the lump sum at redemption. There is something to be said for buying an individual Treasury bond to cover a specific obligation at a specific date in the future.

INVESTMENT BONDS STOCKS PORTFOLIO VANGUARD

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Vanguard Recommends Boosting Bond Allocations for Future ReturnsVanguard suggests increasing bond allocations in investment portfolios to achieve higher returns in the coming years. The asset manager favors a 40/60 portfolio split, overweighting bonds due to anticipated higher yields and a modest increase in interest rates. This strategy prioritizes U.S. credit and long-term bonds, reflecting Vanguard's 10-year forecasts and the current 10-year Treasury yield trend. The portfolio also leans towards value and small-cap stocks in developed markets.

Vanguard Recommends Boosting Bond Allocations for Future ReturnsVanguard suggests increasing bond allocations in investment portfolios to achieve higher returns in the coming years. The asset manager favors a 40/60 portfolio split, overweighting bonds due to anticipated higher yields and a modest increase in interest rates. This strategy prioritizes U.S. credit and long-term bonds, reflecting Vanguard's 10-year forecasts and the current 10-year Treasury yield trend. The portfolio also leans towards value and small-cap stocks in developed markets.

Read more »

US Equities Dominate Again in 2024, Leaving Global Markets in the DustStocks Analysis by James Picerno covering: Vanguard Total Stock Market Index Fund ETF Shares, Vanguard Total Bond Market Index Fund ETF Shares, Vanguard Global ex-U.S. Real Estate Index Fund ETF Shares. Read James Picerno's latest article on Investing.

US Equities Dominate Again in 2024, Leaving Global Markets in the DustStocks Analysis by James Picerno covering: Vanguard Total Stock Market Index Fund ETF Shares, Vanguard Total Bond Market Index Fund ETF Shares, Vanguard Global ex-U.S. Real Estate Index Fund ETF Shares. Read James Picerno's latest article on Investing.

Read more »

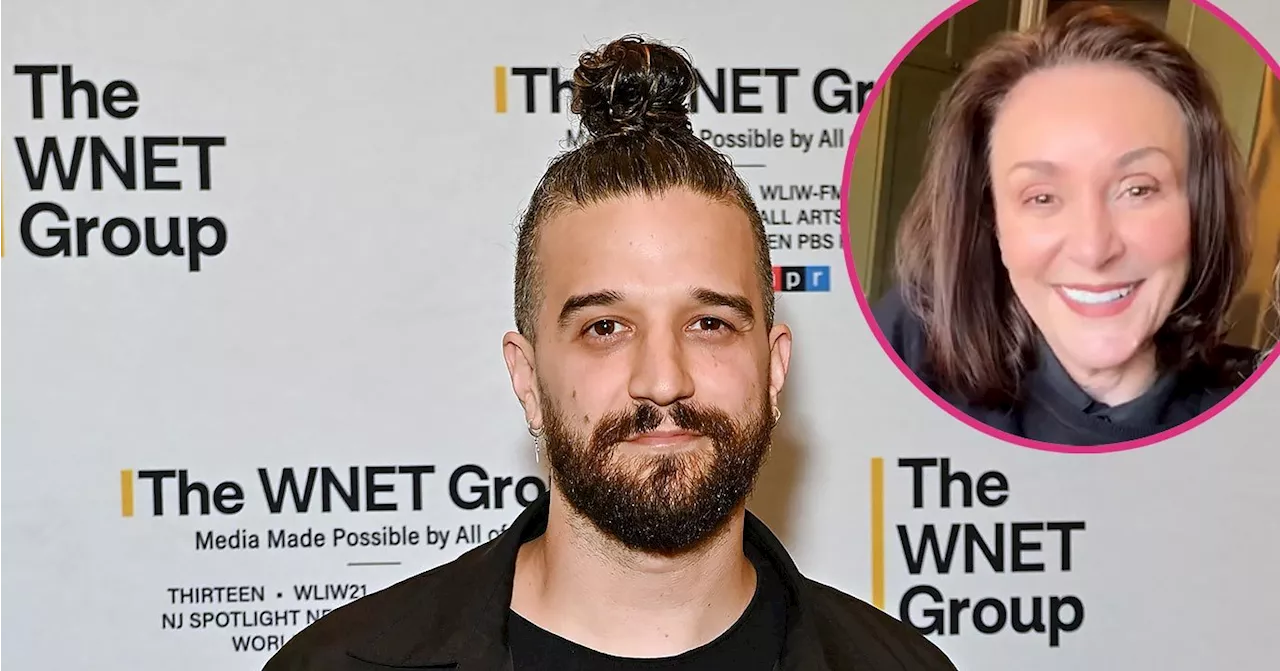

Mark Ballas Explains His Shifting Accent to TikTok FansMark Ballas, a professional dancer known for his work on Dancing With the Stars, addressed fans' confusion about his accent in a recent TikTok video. His mother, Shirley Ballas, explained that Mark's dual accent stems from his English mother and his Texan father, noting that he was raised in Great Britain until the age of 21.

Mark Ballas Explains His Shifting Accent to TikTok FansMark Ballas, a professional dancer known for his work on Dancing With the Stars, addressed fans' confusion about his accent in a recent TikTok video. His mother, Shirley Ballas, explained that Mark's dual accent stems from his English mother and his Texan father, noting that he was raised in Great Britain until the age of 21.

Read more »

Yellowstone Supervolcano Components ShiftingScientists report that parts of the Yellowstone supervolcano are moving northeast, raising concerns about potential future eruptions. However, experts reassure that a catastrophic eruption is not imminent.

Yellowstone Supervolcano Components ShiftingScientists report that parts of the Yellowstone supervolcano are moving northeast, raising concerns about potential future eruptions. However, experts reassure that a catastrophic eruption is not imminent.

Read more »

Tim Allen Talks Returning To The World Of Sitcoms In Shifting GearsTim Allen Talks Returning To The World Of Sitcoms In Shifting Gears

Tim Allen Talks Returning To The World Of Sitcoms In Shifting GearsTim Allen Talks Returning To The World Of Sitcoms In Shifting Gears

Read more »

Tim Allen Teases 'Shifting Gears' Character and Future Casting AnnouncementTim Allen provides insight into his character Matt Parker in the new sitcom 'Shifting Gears', revealing his tragic backstory and hinting at the introduction of his son, who is serving in the Navy.

Tim Allen Teases 'Shifting Gears' Character and Future Casting AnnouncementTim Allen provides insight into his character Matt Parker in the new sitcom 'Shifting Gears', revealing his tragic backstory and hinting at the introduction of his son, who is serving in the Navy.

Read more »