Asset management giant Vanguard has been fined over $100 million by the Securities and Exchange Commission (SEC) for failing to disclose the potential impact of changes to minimum investment requirements for its target date funds. The SEC found that Vanguard's 2020 decision to lower the minimum investment requirement for institutional target date funds led to redemptions and taxable distributions for remaining shareholders in the retail versions.

Asset management giant Vanguard has been fined more than $100 million to settle charges related to disclosures around target date investment funds, the Sec urities and Exchange Commission announced Friday. The alleged violations stem from a 2020 change where Vanguard lowered the minimum investment requirement for its institutional target date funds .

Typically, this is done by replacing riskier stocks with higher exposure to income-generating bonds as the retirement date nears. The fine highlights how investors can see large tax bills even when they themselves do not make any asset sales during a calendar year.

INVESTMENT FUNDS SEC VANGUARD TAX LIABILITY TARGET DATE FUNDS

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Vanguard Fined $106 Million for Target Date Fund DisclosuresThe Securities and Exchange Commission (SEC) penalized Vanguard for failing to adequately disclose the potential impact of changes to minimum investment requirements for its institutional target date funds. The SEC found that the changes led to large taxable distributions for remaining investors in the retail share class, resulting in a financial disadvantage.

Vanguard Fined $106 Million for Target Date Fund DisclosuresThe Securities and Exchange Commission (SEC) penalized Vanguard for failing to adequately disclose the potential impact of changes to minimum investment requirements for its institutional target date funds. The SEC found that the changes led to large taxable distributions for remaining investors in the retail share class, resulting in a financial disadvantage.

Read more »

Can the SEC dominate college football when Alabama’s not dominating the SEC?No pressure, Steve Sarkisian, but it’s about time a Nick Saban disciple other than Kirby Smart rises to the occasion this deep in the season.

Can the SEC dominate college football when Alabama’s not dominating the SEC?No pressure, Steve Sarkisian, but it’s about time a Nick Saban disciple other than Kirby Smart rises to the occasion this deep in the season.

Read more »

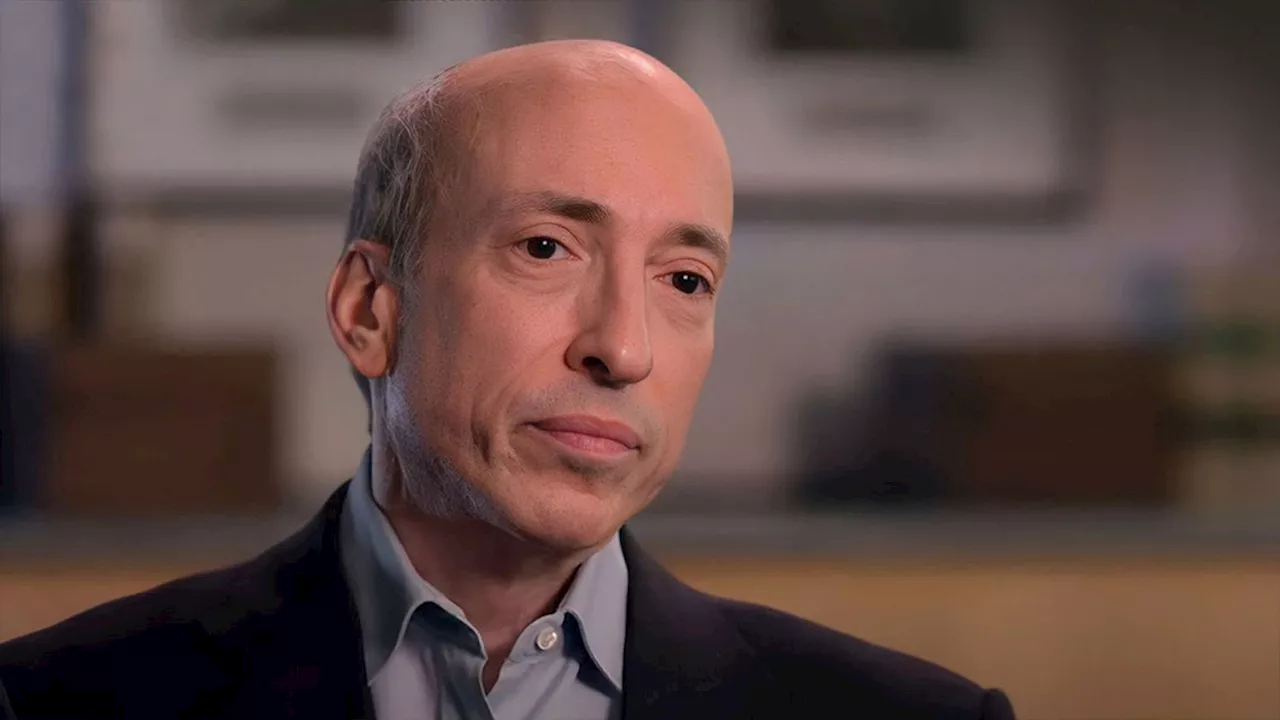

Ripple vs. SEC: New SEC Chair Raises Hopes for Resolution as Deadline LoomsRipple's ongoing legal battle with the SEC reaches a crucial stage as the agency must submit its opening brief by January 15. With the departure of pro-crypto critic Gary Gensler on January 20, incoming SEC Chair Paul Atkins offers optimism for a favorable outcome. However, the case's complexity dampens expectations. Despite Judge Analisa Torres's ruling that Ripple's programmatic sales of XRP to retail clients through exchanges weren't illegal, the lawsuit persists. The SEC's stance under Gensler has been known for its hostility towards the crypto industry, but the change in leadership fuels hopes for a less adversarial approach.

Ripple vs. SEC: New SEC Chair Raises Hopes for Resolution as Deadline LoomsRipple's ongoing legal battle with the SEC reaches a crucial stage as the agency must submit its opening brief by January 15. With the departure of pro-crypto critic Gary Gensler on January 20, incoming SEC Chair Paul Atkins offers optimism for a favorable outcome. However, the case's complexity dampens expectations. Despite Judge Analisa Torres's ruling that Ripple's programmatic sales of XRP to retail clients through exchanges weren't illegal, the lawsuit persists. The SEC's stance under Gensler has been known for its hostility towards the crypto industry, but the change in leadership fuels hopes for a less adversarial approach.

Read more »

South Carolina Women's Basketball Eyes Undefeated SEC SeasonSouth Carolina women's basketball team aims for a historic third consecutive undefeated SEC season. The Gamecocks boast a dominant record, including two back-to-back perfect SEC seasons and a strong overall performance in recent years. Coach Dawn Staley's leadership has propelled South Carolina to become a force in the SEC, with eight SEC regular-season titles and eight SEC tournament titles since the 2013-14 season.

South Carolina Women's Basketball Eyes Undefeated SEC SeasonSouth Carolina women's basketball team aims for a historic third consecutive undefeated SEC season. The Gamecocks boast a dominant record, including two back-to-back perfect SEC seasons and a strong overall performance in recent years. Coach Dawn Staley's leadership has propelled South Carolina to become a force in the SEC, with eight SEC regular-season titles and eight SEC tournament titles since the 2013-14 season.

Read more »

Ripple's Alderoty Claims SEC Refused to Delay Appeal FilingStuart Alderoty, Ripple's chief legal officer, alleges that the company requested the SEC postpone filing its appeal in the ongoing Ripple case. However, the SEC declined the request. Ripple expresses optimism about working with the incoming pro-crypto SEC administration under Paul Atkins. The SEC filed its notice of appeal in October, prompting a cross-appeal from Ripple. Gensler defended the SEC's crypto crackdown during his tenure, emphasizing the prevalence of fraudulent actors in the industry.

Ripple's Alderoty Claims SEC Refused to Delay Appeal FilingStuart Alderoty, Ripple's chief legal officer, alleges that the company requested the SEC postpone filing its appeal in the ongoing Ripple case. However, the SEC declined the request. Ripple expresses optimism about working with the incoming pro-crypto SEC administration under Paul Atkins. The SEC filed its notice of appeal in October, prompting a cross-appeal from Ripple. Gensler defended the SEC's crypto crackdown during his tenure, emphasizing the prevalence of fraudulent actors in the industry.

Read more »

B. Riley Faces More SEC Scrutiny Over Franchise Group DealingsB. Riley Financial Inc. received additional subpoenas from the U.S. Securities and Exchange Commission (SEC) seeking information about its dealings with now-bankrupt Franchise Group (FRG) and a personal loan for Chairman Bryant Riley. The SEC is investigating B. Riley's past investments in FRG and Riley's pledge of B. Riley shares as collateral for a personal loan. This comes amid an ongoing SEC probe into B. Riley's relationship with former FRG CEO Brian Kahn. B. Riley maintains it is cooperating fully with the SEC and that the subpoenas do not indicate any violations of law.

B. Riley Faces More SEC Scrutiny Over Franchise Group DealingsB. Riley Financial Inc. received additional subpoenas from the U.S. Securities and Exchange Commission (SEC) seeking information about its dealings with now-bankrupt Franchise Group (FRG) and a personal loan for Chairman Bryant Riley. The SEC is investigating B. Riley's past investments in FRG and Riley's pledge of B. Riley shares as collateral for a personal loan. This comes amid an ongoing SEC probe into B. Riley's relationship with former FRG CEO Brian Kahn. B. Riley maintains it is cooperating fully with the SEC and that the subpoenas do not indicate any violations of law.

Read more »