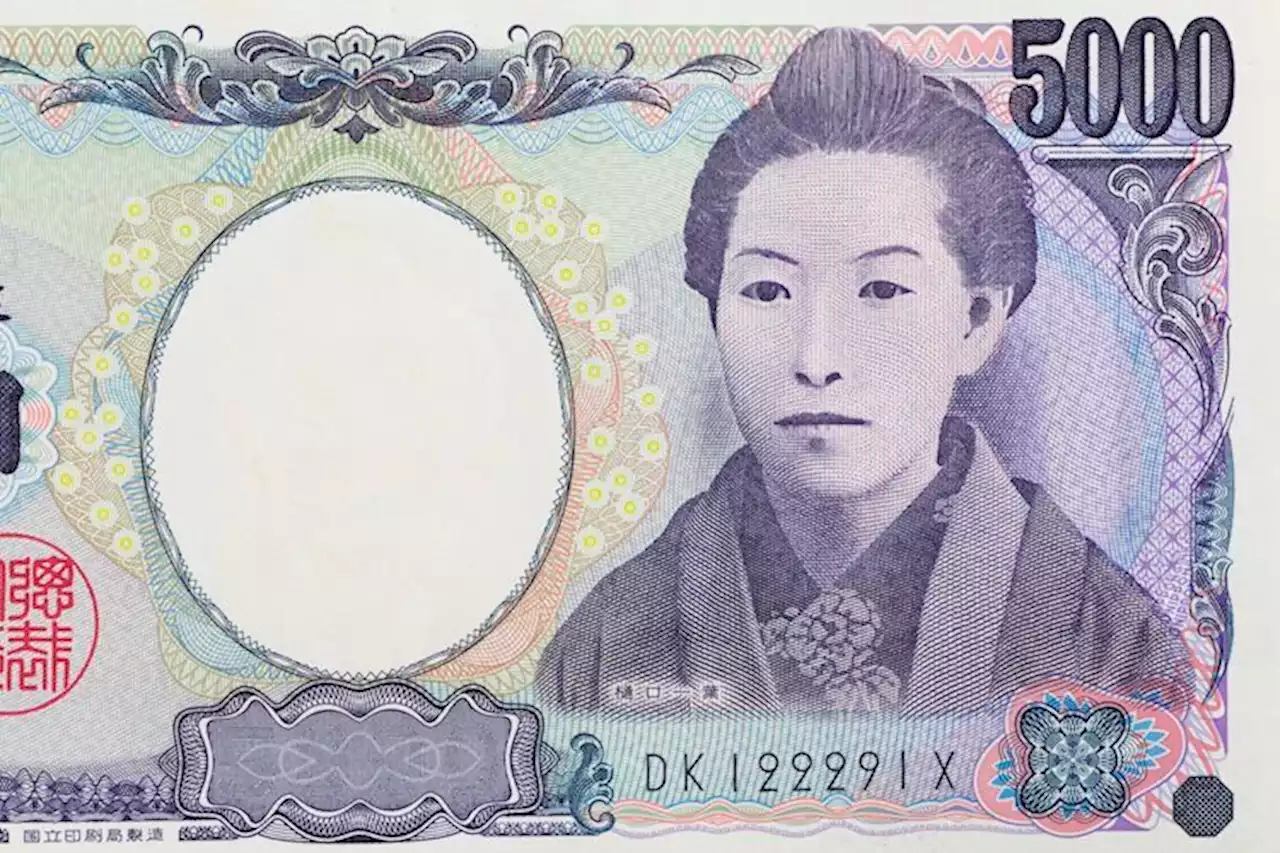

USDJPY is likely most affected if US rates have indeed peaked – JP Morgan – by anilpanchal7 USDJPY Banks RiskAppetite Currencies

The durability of a broad USD sell-off is fragile with macro uncertainty near 5-decade highs and the dollar yielding more than half of global FX.USD performance around the last four Fed pauses was not consistent and growth-dependent; more consistent was the decline in US rates regardless of the growth outcome.

The mix of growth/ inflation surprises matters for composition of USD moves. Such high odds of a US recession keeps us more cautious on high beta FX but USD/JPY is likely most affected if US rates have indeed peaked.Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

USDJPY rebounds firmly from 140.00 on Japan’s negative GDP, US Retail Sales eyedThe USDJPY pair has delivered an upside break of the consolidation formed in a 140.00-140.20 range after the Japanese Cabinet Office reported a negati

USDJPY rebounds firmly from 140.00 on Japan’s negative GDP, US Retail Sales eyedThe USDJPY pair has delivered an upside break of the consolidation formed in a 140.00-140.20 range after the Japanese Cabinet Office reported a negati

Read more »

USDJPY Price Analysis: Stays firmer past 140.00 support confluenceUSDJPY Price Analysis: Stays firmer past 140.00 support confluence – by anilpanchal7 USDJPY Technical Analysis SwingTrading ChartPatterns SupportResistance

USDJPY Price Analysis: Stays firmer past 140.00 support confluenceUSDJPY Price Analysis: Stays firmer past 140.00 support confluence – by anilpanchal7 USDJPY Technical Analysis SwingTrading ChartPatterns SupportResistance

Read more »

USDJPY: Further losses still appear in the pipeline – UOBIn the opinion of UOB Group’s Economist Lee Sue Ann and Markets Strategist Quek Ser Leang, further decline in USDJPY should meet a solid support aroun

USDJPY: Further losses still appear in the pipeline – UOBIn the opinion of UOB Group’s Economist Lee Sue Ann and Markets Strategist Quek Ser Leang, further decline in USDJPY should meet a solid support aroun

Read more »

USDJPY bounces off daily low, keeps the red around mid-139.00s amid fresh USD slumpThe USDJPY pair retreats nearly 150 pips from the daily swing high and drops to a fresh intraday low, around the 139.20-139.15 region during the first

USDJPY bounces off daily low, keeps the red around mid-139.00s amid fresh USD slumpThe USDJPY pair retreats nearly 150 pips from the daily swing high and drops to a fresh intraday low, around the 139.20-139.15 region during the first

Read more »

USDJPY to reverse back lower to 130 in 12 months – Danske BankEconomists at Danske Bank expect USDJPY to inch higher in the next few months but expect the pair to turn back lower in the long-run. Pressure on JPY

USDJPY to reverse back lower to 130 in 12 months – Danske BankEconomists at Danske Bank expect USDJPY to inch higher in the next few months but expect the pair to turn back lower in the long-run. Pressure on JPY

Read more »

USDJPY: Rate spread and energy price moves are consistent with further declines – MUFGThe drop in USDJPY last week was the largest since October 2008. Economists at MUFG Bank expect the pair to see further falls. JPY remains best placed

USDJPY: Rate spread and energy price moves are consistent with further declines – MUFGThe drop in USDJPY last week was the largest since October 2008. Economists at MUFG Bank expect the pair to see further falls. JPY remains best placed

Read more »