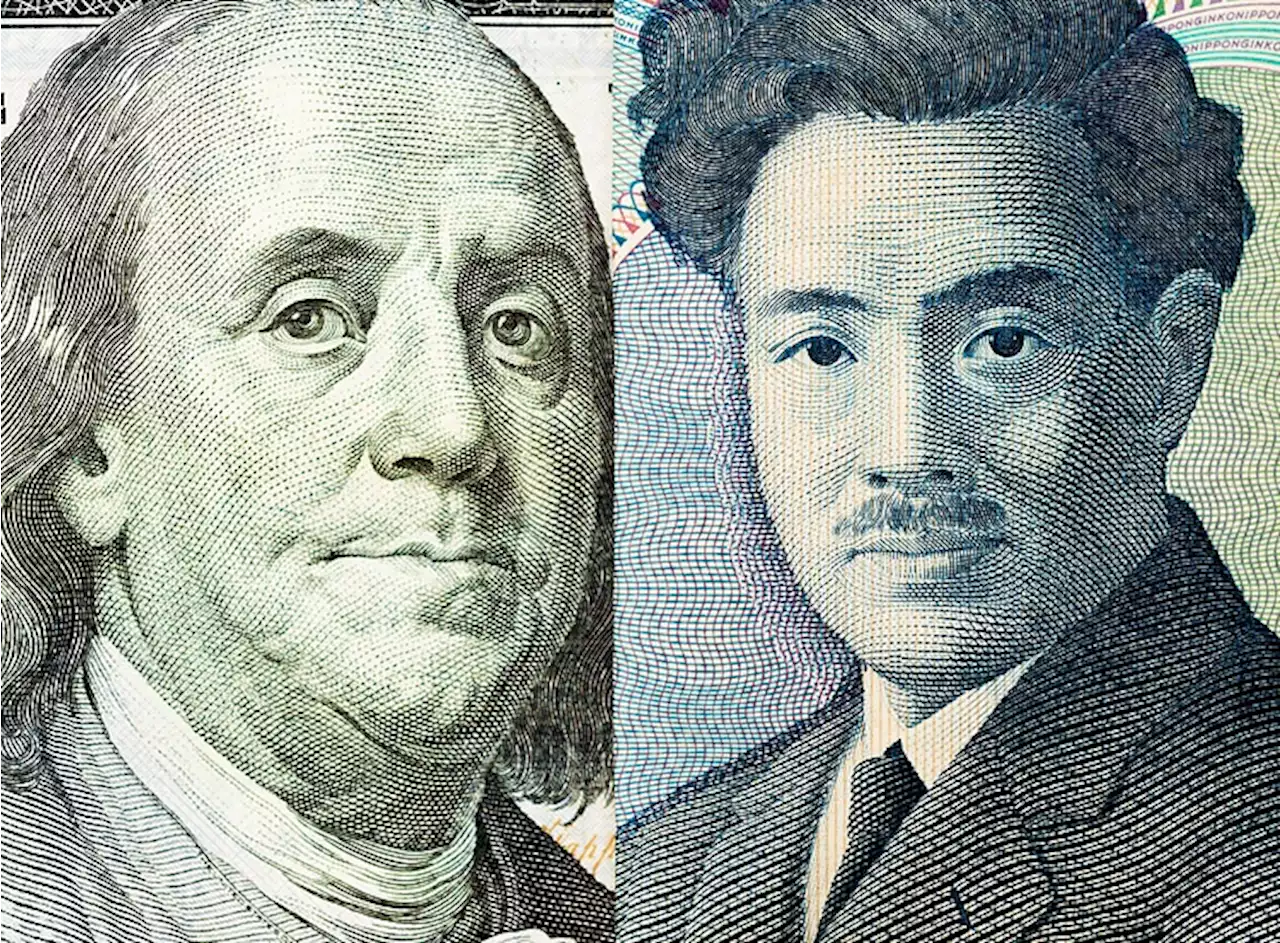

USD/JPY traces mildly bid yields near 142.00, ignores hawkish BoJ concerns ahead of US CPI – by anilpanchal7 USDJPY BOJ Fed YieldCurve Inflation

In the last week, Bank of Japan’s two unscheduled bond-buying programs and the decision-makers’ defenses of the easy-money policy flags fears of the BoJ’s exit from the record low interest rate and/or a tweak to the Yield Curve Control policy.report while stating that Japan's core consumer inflation is likely to gradually slow toward year-end. Bank of Japan Deputy Governor Shinichi Uchida signaled the Japanese central bank’s meddling before the 10-year yield hits 1.

It’s worth noting that the DXY rose in the last three consecutive weeks before retreating amid mixed US data. That said, the US employment report posted a softer-than-expected figure of 187K, versus 185K prior and 200K market forecasts, whereas the Unemployment Rate eased to 3.5% from 3.6% expected and previous readings. Further, the Average Hourly Earnings reprinted 0.4% MoM and 4.4% YoY numbers by defying the expectations of witnessing a slight reduction in wage growth.

Elsewhere, the hawkish comments from Federal Reserve Governor Michelle Bowman might have recently triggered the USD/JPY rebound as she said that the Fed should remain willing to raise the federal funds rate at a future meeting if the incoming data indicate that progress on inflation has stalled. Previously, Atlanta Federal Reserve Bank President Raphael Bostic said on Friday to Bloomberg, that the central bank is likely to keep

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Weekly Forex Forecast \u2013 NASDAQ 100 Index, USD/JPY, Cocoa FutMarkets became increasingly bearish this week after Fitch\u2019s downgrade of its US rating, posting an \u201Ceverything selloff\u201D which saw almost every trend rally hit q

Weekly Forex Forecast \u2013 NASDAQ 100 Index, USD/JPY, Cocoa FutMarkets became increasingly bearish this week after Fitch\u2019s downgrade of its US rating, posting an \u201Ceverything selloff\u201D which saw almost every trend rally hit q

Read more »

USD/JPY flat-lines around 141.65 area, just above Friday’s post-NFP swing lowThe USD/JPY pair surrenders its modest Asian session gains to the 142.00 neighbourhood and retreats to the lower end of the intraday range in the last

USD/JPY flat-lines around 141.65 area, just above Friday’s post-NFP swing lowThe USD/JPY pair surrenders its modest Asian session gains to the 142.00 neighbourhood and retreats to the lower end of the intraday range in the last

Read more »

BoJ Summary of Opinions: Achievement of 2% inflation in a sustainable, stable manner in sightBoJ Summary of Opinions: Achievement of 2% inflation in a sustainable, stable manner in sight – by anilpanchal7 BOJ USDJPY RiskAversion Inflation Japan

BoJ Summary of Opinions: Achievement of 2% inflation in a sustainable, stable manner in sightBoJ Summary of Opinions: Achievement of 2% inflation in a sustainable, stable manner in sight – by anilpanchal7 BOJ USDJPY RiskAversion Inflation Japan

Read more »

BOJ debated prospects of sustained inflation at July meeting - summaryThe Bank of Japan debated growing prospects of sustained inflation at their July meeting with one board member saying wages and prices could keep rising at a pace 'not seen in the past,' according to a summary of opinions released on Monday.

BOJ debated prospects of sustained inflation at July meeting - summaryThe Bank of Japan debated growing prospects of sustained inflation at their July meeting with one board member saying wages and prices could keep rising at a pace 'not seen in the past,' according to a summary of opinions released on Monday.

Read more »

EUR/USD retreats to 1.1000 on fears of ECB peak rates, hawkish Fed moves on upbeat US CPIEUR/USD begins the key inflation week on a back foot, after rising in the last two consecutive days, as sellers attack the 1.1000 psychological magnet

EUR/USD retreats to 1.1000 on fears of ECB peak rates, hawkish Fed moves on upbeat US CPIEUR/USD begins the key inflation week on a back foot, after rising in the last two consecutive days, as sellers attack the 1.1000 psychological magnet

Read more »

Morning Bid: Markets yield to U.S. curveThe surge in bond yields is driving deterioration in risk appetite, especially U.S. market-based borrowing costs.

Morning Bid: Markets yield to U.S. curveThe surge in bond yields is driving deterioration in risk appetite, especially U.S. market-based borrowing costs.

Read more »