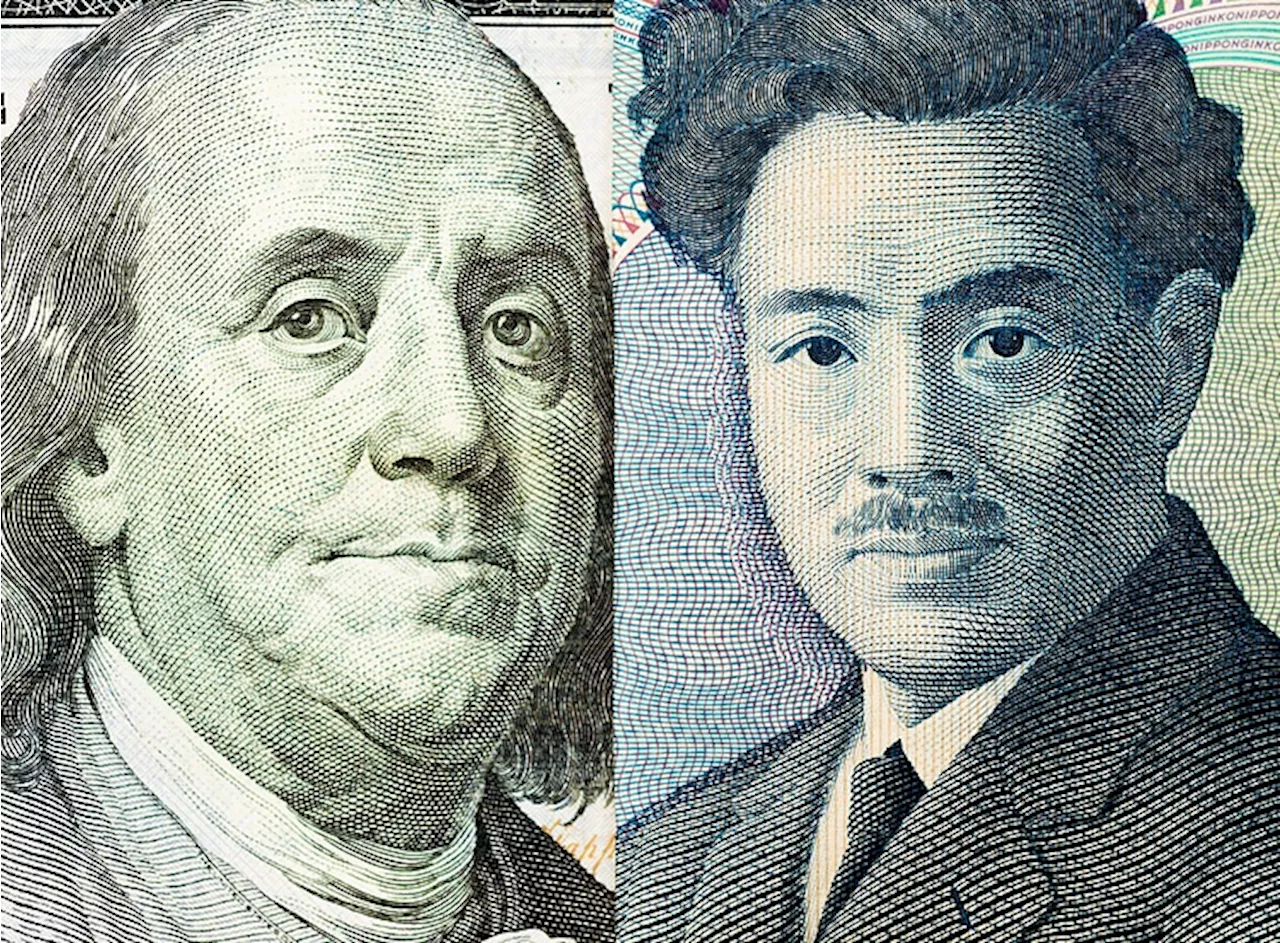

Chance for US Dollar (USD) to retest 156.70 before a more sustained pullback is likely. In the longer run, USD weakness has stabilized; it is likely to consolidate between 155.30 and 157.55 for the time being, UOB Group's FX analysts Quek Ser Leang and Peter Chia note.

Chance for US Dollar to retest 156.70 before a more sustained pullback is likely. In the longer run, USD weakness has stabilized; it is likely to consolidate between 155.30 and 157.55 for the time being, UOB Group's FX analysts Quek Ser Leang and Peter Chia note. USD weakness has stabilized24-HOUR VIEW: Two days ago, USD dropped to 154.73 and then rebounded.

That said, there is a chance for USD to retest 156.70 level before a more sustained pullback is likely. The major resistance at 157.55 is unlikely to come under threat. Support is at 156.00; a breach of 155.60 would indicate that the current upward pressure has faded. 1-3 WEEKS VIEW: We turned negative in USD a week ago. Tracking the decline, we indicated yesterday that 'despite no pickup in downward momentum, there is a chance for USD to drop further to 154.40.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Japanese Yen remains on the front foot; USD/JPY holds above 156.00 ahead of US dataThe Japanese Yen (JPY) attracts buyers for the second consecutive day on Thursday on the back of the Bank of Japan Governor Kazuo Ueda's hawkish comments, signaling a potential rate hike next week.

Japanese Yen remains on the front foot; USD/JPY holds above 156.00 ahead of US dataThe Japanese Yen (JPY) attracts buyers for the second consecutive day on Thursday on the back of the Bank of Japan Governor Kazuo Ueda's hawkish comments, signaling a potential rate hike next week.

Read more »

USD/JPY Climbs Above 156.00, Trump's Trade Rhetoric Bolsters GreenbackThe US Dollar strengthened against the Japanese Yen as President Trump threatened new tariffs on Chinese and European goods. The Bank of Japan's potential rate hike had a limited impact on the Yen despite improving wage growth and inflation.

USD/JPY Climbs Above 156.00, Trump's Trade Rhetoric Bolsters GreenbackThe US Dollar strengthened against the Japanese Yen as President Trump threatened new tariffs on Chinese and European goods. The Bank of Japan's potential rate hike had a limited impact on the Yen despite improving wage growth and inflation.

Read more »

USD/JPY declines to near 157.30 despite USD Index refreshes two-year highThe USD/JPY pair slumps to near 157.30 in Monday’s European session.

USD/JPY declines to near 157.30 despite USD Index refreshes two-year highThe USD/JPY pair slumps to near 157.30 in Monday’s European session.

Read more »

AUD/USD Holds Near 2022 Lows, USD/JPY Pauses Ahead of US NFPThe article discusses the latest forex market movements, highlighting AUD/USD consolidation near its lowest levels since October 2022, USD/JPY's pause above 158.00 after Japan's household spending data, and gold's consolidation ahead of the US Nonfarm Payrolls data. It also mentions key trends expected in the crypto market in 2025.

AUD/USD Holds Near 2022 Lows, USD/JPY Pauses Ahead of US NFPThe article discusses the latest forex market movements, highlighting AUD/USD consolidation near its lowest levels since October 2022, USD/JPY's pause above 158.00 after Japan's household spending data, and gold's consolidation ahead of the US Nonfarm Payrolls data. It also mentions key trends expected in the crypto market in 2025.

Read more »

USD/JPY holds below 158.00 after Tokyo CPI inflation dataThe USD/JPY pair loses traction to near 157.75 during the early Asian session on Friday.

USD/JPY holds below 158.00 after Tokyo CPI inflation dataThe USD/JPY pair loses traction to near 157.75 during the early Asian session on Friday.

Read more »

USD/JPY Dips Below 157.00 on Holiday-Thinned TradingThe USD/JPY pair declined 0.7% on Monday, dropping below the 157.00 level amidst low trading volumes due to the year-end holidays. Market uncertainty persists regarding the Bank of Japan's (BoJ) potential trigger for a rate hike, as they continue to combat the two-year decline in the Japanese Yen. The US PMI figures are anticipated to provide further direction for the pair.

USD/JPY Dips Below 157.00 on Holiday-Thinned TradingThe USD/JPY pair declined 0.7% on Monday, dropping below the 157.00 level amidst low trading volumes due to the year-end holidays. Market uncertainty persists regarding the Bank of Japan's (BoJ) potential trigger for a rate hike, as they continue to combat the two-year decline in the Japanese Yen. The US PMI figures are anticipated to provide further direction for the pair.

Read more »