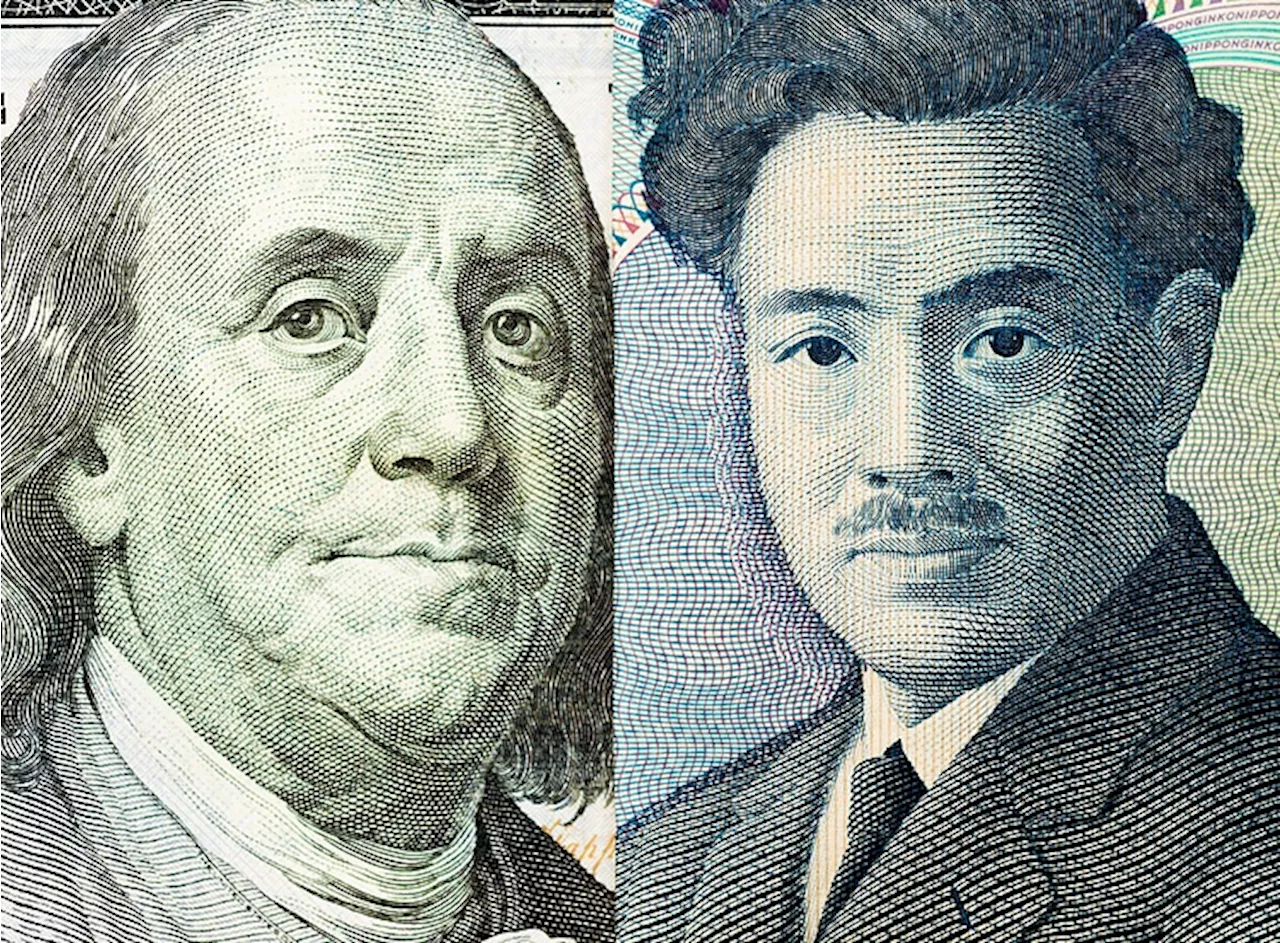

USD/JPY continued to trade higher, in line with our near-term caution about the reciprocal tariff uncertainty.

USD/JPY was last seen at 153.45 levels, OCBC's FX analysts Frances Cheung and Christopher Wong note. Rebound risks likely in the interim Bearish momentum on daily chart intact but shows signs of fading while RSI is turning higher from near oversold conditions. Rebound risks likely in the interim. Resistance at 155.20 levels . Support at 152.70/80 levels , 151.50 , 150 levels.

As a recap, Trump mentioned that reciprocal tariff will be applied on all nations, and we believe Japan may not be spared. When it comes to automobile, Japanese cars are amongst the top 5 most popular in US and Korean cars are on the top 10 list. On agricultural products, Japan has a high tariff rate of 204.3% for rice and 23.3% for meat. The risk is a direct tariff hit on Japanese goods and JPY may come under pressure in this scenario.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

USD/JPY declines to near 157.30 despite USD Index refreshes two-year highThe USD/JPY pair slumps to near 157.30 in Monday’s European session.

USD/JPY declines to near 157.30 despite USD Index refreshes two-year highThe USD/JPY pair slumps to near 157.30 in Monday’s European session.

Read more »

USD/JPY Surges Near 158.00 as Yen Safe-Haven Appeal EasesThe USD/JPY pair climbs sharply higher, approaching 158.00, as the safe-haven demand for the Japanese Yen weakens. Investors are eagerly awaiting US inflation data for insights on future interest rate decisions. Recent upbeat US labor market data has tempered expectations of a dovish Federal Reserve.

USD/JPY Surges Near 158.00 as Yen Safe-Haven Appeal EasesThe USD/JPY pair climbs sharply higher, approaching 158.00, as the safe-haven demand for the Japanese Yen weakens. Investors are eagerly awaiting US inflation data for insights on future interest rate decisions. Recent upbeat US labor market data has tempered expectations of a dovish Federal Reserve.

Read more »

Japanese Yen remains on the front foot; USD/JPY holds above 156.00 ahead of US dataThe Japanese Yen (JPY) attracts buyers for the second consecutive day on Thursday on the back of the Bank of Japan Governor Kazuo Ueda's hawkish comments, signaling a potential rate hike next week.

Japanese Yen remains on the front foot; USD/JPY holds above 156.00 ahead of US dataThe Japanese Yen (JPY) attracts buyers for the second consecutive day on Thursday on the back of the Bank of Japan Governor Kazuo Ueda's hawkish comments, signaling a potential rate hike next week.

Read more »

USD/JPY Dips on BoJ Hike ExpectationsUSD/JPY trades lower as markets anticipate a 22bp hike from the Bank of Japan (BoJ) next week. BoJ officials' comments and media reports suggest a high likelihood of a rate increase, citing positive wage growth and a favorable economic outlook. Risks remain skewed to the downside with support levels identified at 154.80, 154.30, and 152.80.

USD/JPY Dips on BoJ Hike ExpectationsUSD/JPY trades lower as markets anticipate a 22bp hike from the Bank of Japan (BoJ) next week. BoJ officials' comments and media reports suggest a high likelihood of a rate increase, citing positive wage growth and a favorable economic outlook. Risks remain skewed to the downside with support levels identified at 154.80, 154.30, and 152.80.

Read more »

USD/JPY: Bearish bias on the dayUSD/JPY continued to trade lower, as expectations on BoJ hike next week continues to build. Markets are pricing in 22bp hike at the upcoming MPC (vs. 11bp hike expectations at the start of the new year). Pair was last at 155.69 levels, OCBC's FX analysts Frances Cheung and Christopher Wong note.

USD/JPY: Bearish bias on the dayUSD/JPY continued to trade lower, as expectations on BoJ hike next week continues to build. Markets are pricing in 22bp hike at the upcoming MPC (vs. 11bp hike expectations at the start of the new year). Pair was last at 155.69 levels, OCBC's FX analysts Frances Cheung and Christopher Wong note.

Read more »

USD/JPY decline is likely part of a lower rangeWeakness has not stabilized, but any further US Dollar (USD) decline is likely part of a lower range of 154.90/156.15. In the longer run, USD remains weak; if it breaks below 154.90, the next objective will be at 154.40, UOB Group's FX analysts Quek Ser Leang and Peter Chia note.

USD/JPY decline is likely part of a lower rangeWeakness has not stabilized, but any further US Dollar (USD) decline is likely part of a lower range of 154.90/156.15. In the longer run, USD remains weak; if it breaks below 154.90, the next objective will be at 154.40, UOB Group's FX analysts Quek Ser Leang and Peter Chia note.

Read more »