USD/JPY remains on the defensive below YTD peak amid softer USD, bullish potential intact – by hareshmenghani USDJPY BOJ Fed RiskAppetite Currencies

The Fed-BoJ policy divergence acts as a tailwind for the pair and helps limit the downside.USD/JPY pair

corrects from a fresh YTD top touched earlier this Monday and remains on the defensive through the first half of the European session. Spot prices, however, manage to hold above the 136.00 mark and seem poised to prolong the recent upward trajectory witnessed since the beginning of this month.pullback from a seven-week high, which, in turn, is seen exerting some downward pressure on the USD/JPY pair.

The Japanese Yen is weighed down by dovish remarks from the incoming Bank of Japan Governor Kazuo Ueda, stressing the need to maintain the ultra-loose policy to support the fragile economy. Ueda further added that it is possible to push up prices and wages with monetary easing. This, along with a modest recovery in the US equity futures, undermines the safe-haven JPY.

Apart from this, expectations that the Federal Reserve will stick to its hawkish stance should act as a tailwind for the US bond yields and lend some support to the Greenback. Meanwhile, the divergent Fed-BoJ policysupports prospects for the emergence of some dip-buying at lower levels and suggests that the path of least resistance for spot prices is to the upside.

Market participants now look forward to the US economic docket, featuring the release of Durable Goods Orders and Pending Home Sales data later during the early North American session. This, along with the US bond yields, will influence the USD price dynamics. Traders will further take cues from the broader risk sentiment to grab short-term opportunities around the USD/JPY pair.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Pairs in Focus This Week \u2013 EUR/USD, GBP/USD, USD/JPY, AUD/USGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of February 26th, 2022 here.

Pairs in Focus This Week \u2013 EUR/USD, GBP/USD, USD/JPY, AUD/USGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of February 26th, 2022 here.

Read more »

EUR/USD to move lower, USD/JPY risks lean higher – TDSEconomists at TD Securities discuss the outlook of the EUR/USD, USD/CAD and USD/JPY pairs. Key support for S&P 500 aligns at 3950 “We have been biased

EUR/USD to move lower, USD/JPY risks lean higher – TDSEconomists at TD Securities discuss the outlook of the EUR/USD, USD/CAD and USD/JPY pairs. Key support for S&P 500 aligns at 3950 “We have been biased

Read more »

Weekly Forex Forecast \u2013 USD/JPY, S\u0026P 500 Index, NASDAQ 100The difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade.

Weekly Forex Forecast \u2013 USD/JPY, S\u0026P 500 Index, NASDAQ 100The difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade.

Read more »

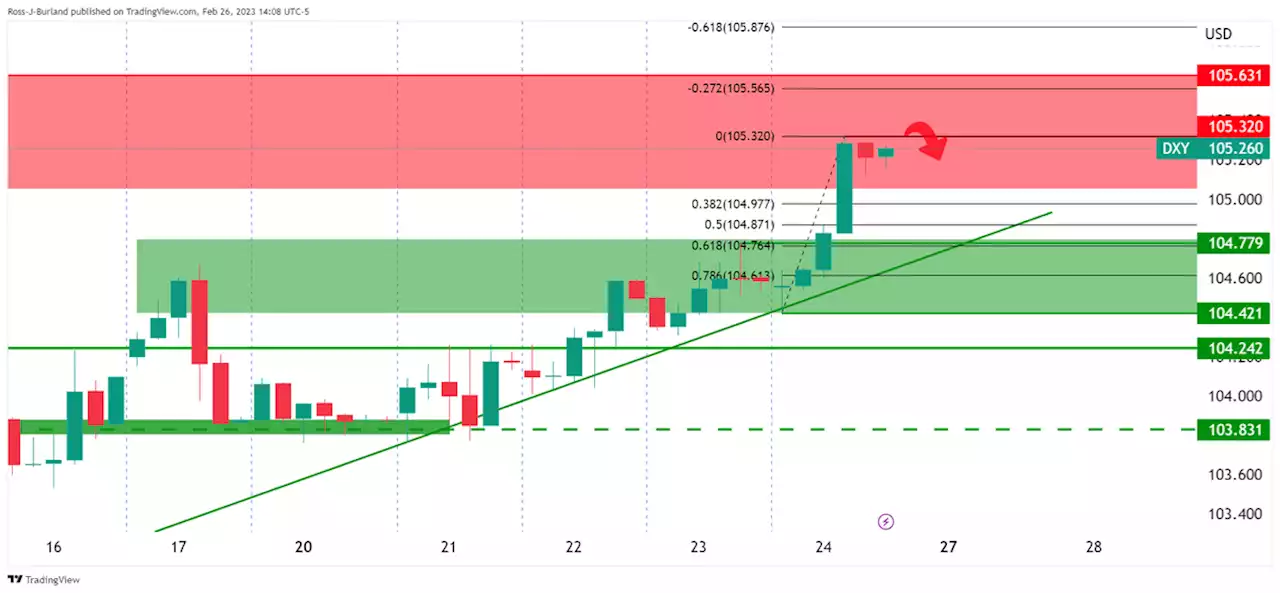

USD/JPY Price Analysis: Bears lurking near 136.50Following the hotter-than-expected US data, the US Dollar index rallied through the 105.20s to a seven-week high and putting it on track to post its l

USD/JPY Price Analysis: Bears lurking near 136.50Following the hotter-than-expected US data, the US Dollar index rallied through the 105.20s to a seven-week high and putting it on track to post its l

Read more »

USD/JPY: The Yen weakness to stay limited – Goldman SachsEconomists at Goldman Sachs outlined their view on the Japanese Yen, in the face of the incoming Bank of Japan (BoJ) Governor Kazuo Ueda and hawskish

USD/JPY: The Yen weakness to stay limited – Goldman SachsEconomists at Goldman Sachs outlined their view on the Japanese Yen, in the face of the incoming Bank of Japan (BoJ) Governor Kazuo Ueda and hawskish

Read more »

USD/JPY retraces to 136.00 as yields pull back from multi-day high, BoJ talks eyedUSD/JPY consolidates the biggest daily gains in three weeks as it renews its intraday low near 136.00 while reversing from the highest levels in two m

USD/JPY retraces to 136.00 as yields pull back from multi-day high, BoJ talks eyedUSD/JPY consolidates the biggest daily gains in three weeks as it renews its intraday low near 136.00 while reversing from the highest levels in two m

Read more »