$USDJPY continues with its struggle to make it through 145.00 and edges lower on Tuesday

psychological mark. Spot prices remain depressed through the first half of the European session and currently trade just below mid-144.00s, down 0.15% for the day.

Speculations for a potential intervention by the Japanese government to curb any further sharp decline in the domestic currency turn out to be a key factor acting as a headwind for the USD/JPY pair. In fact, Japan's Finance Minister Shunichi Suzuki warned last week that the government will take appropriate steps should the Japanese Yen weaken excessively.

Apart from this, worries about a global economic downturn further benefits the safe-haven JPY, which, along with subdued US Dollar price action, contributes to the mildly offered tone surrounding the USD/JPY pair. That said, a big divergence in the monetary policy stance adopted by the Bank of Japan and the Federal Reserve helps limit the downside.

In contrast, the US central bank signalled in June that borrowing costs may still need to rise as much as 50 bps by the end of this year and the

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

USD/JPY sticks to strong intraday gains, remains below 145.00/YTD top set on FridayThe USD/JPY pair regains strong positive traction on the first day of a new week and reverses a major part of Friday's pullback from its highest level

USD/JPY sticks to strong intraday gains, remains below 145.00/YTD top set on FridayThe USD/JPY pair regains strong positive traction on the first day of a new week and reverses a major part of Friday's pullback from its highest level

Read more »

USD/JPY aims to recapture 145.00 as US Manufacturing PMI hogs limelightThe USD/JPY pair is looking to recapture the previous week’s high of 145.00 in the early London session. The asset is broadly having strength despite

USD/JPY aims to recapture 145.00 as US Manufacturing PMI hogs limelightThe USD/JPY pair is looking to recapture the previous week’s high of 145.00 in the early London session. The asset is broadly having strength despite

Read more »

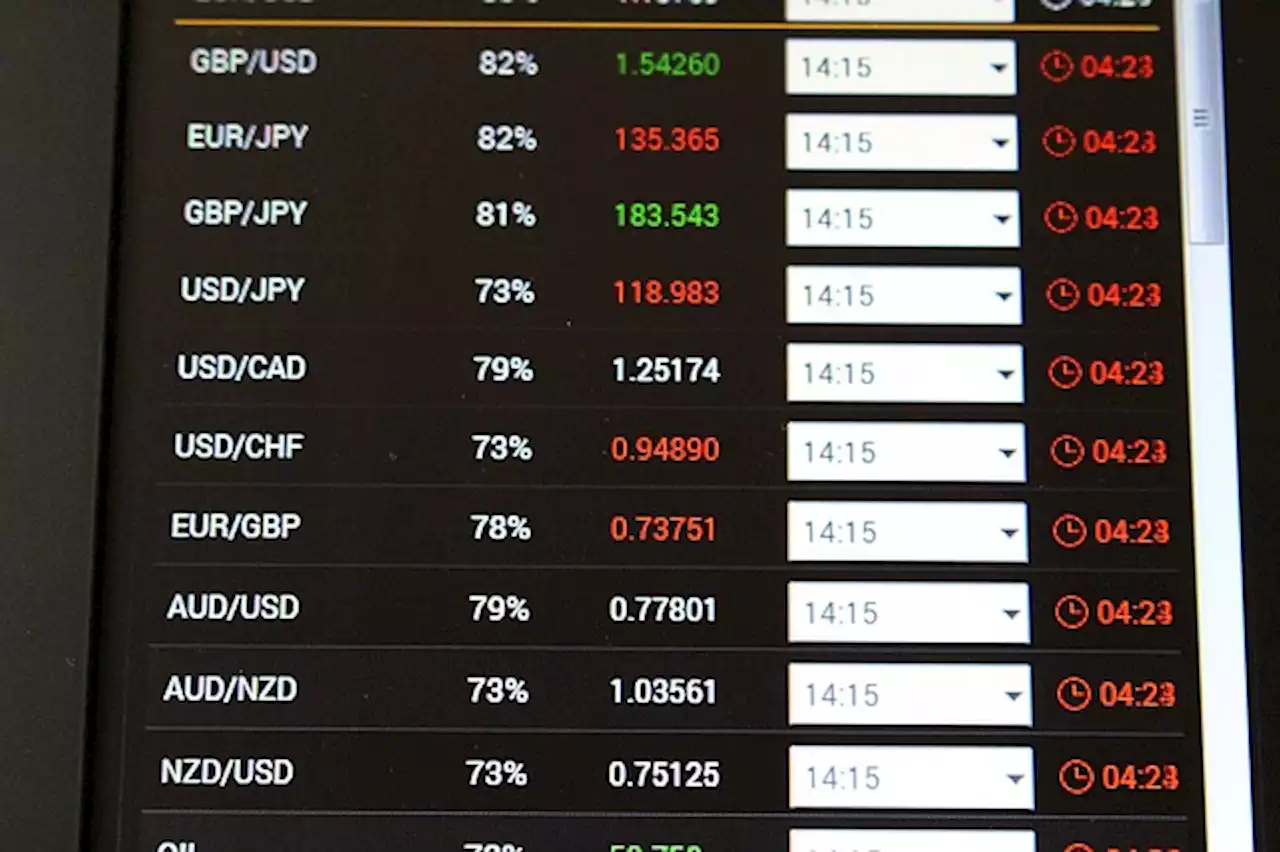

Weekly Forex Forecast \u2013 NASDAQ 100 Index, USD/JPY, EUR/JPYThe difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which

Weekly Forex Forecast \u2013 NASDAQ 100 Index, USD/JPY, EUR/JPYThe difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which

Read more »

Pairs in Focus This Week\u2013 EUR/USD, GBP/USD, USD/CAD, USD/JPYGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of July 2nd, 2022 here.

Pairs in Focus This Week\u2013 EUR/USD, GBP/USD, USD/CAD, USD/JPYGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of July 2nd, 2022 here.

Read more »

USD/JPY Signal: Potential Buying Opportunity TodayThe US dollar initially attempted to rally during Friday, but profit-taking activities dominated the market as traders sought to capitalize on recent gains.

USD/JPY Signal: Potential Buying Opportunity TodayThe US dollar initially attempted to rally during Friday, but profit-taking activities dominated the market as traders sought to capitalize on recent gains.

Read more »

Yen tentative, dollar soft as traders weigh Fed rate hike pathThe Asian currency briefly passed 145 per dollar, hitting a near eight-month low as investors keep an eye on whether Japanese authorities will intervene.

Yen tentative, dollar soft as traders weigh Fed rate hike pathThe Asian currency briefly passed 145 per dollar, hitting a near eight-month low as investors keep an eye on whether Japanese authorities will intervene.

Read more »