USD Index climbs to fresh tops north of 105.00 ahead of key data – by pabspiovano DollarIndex Currencies Majors

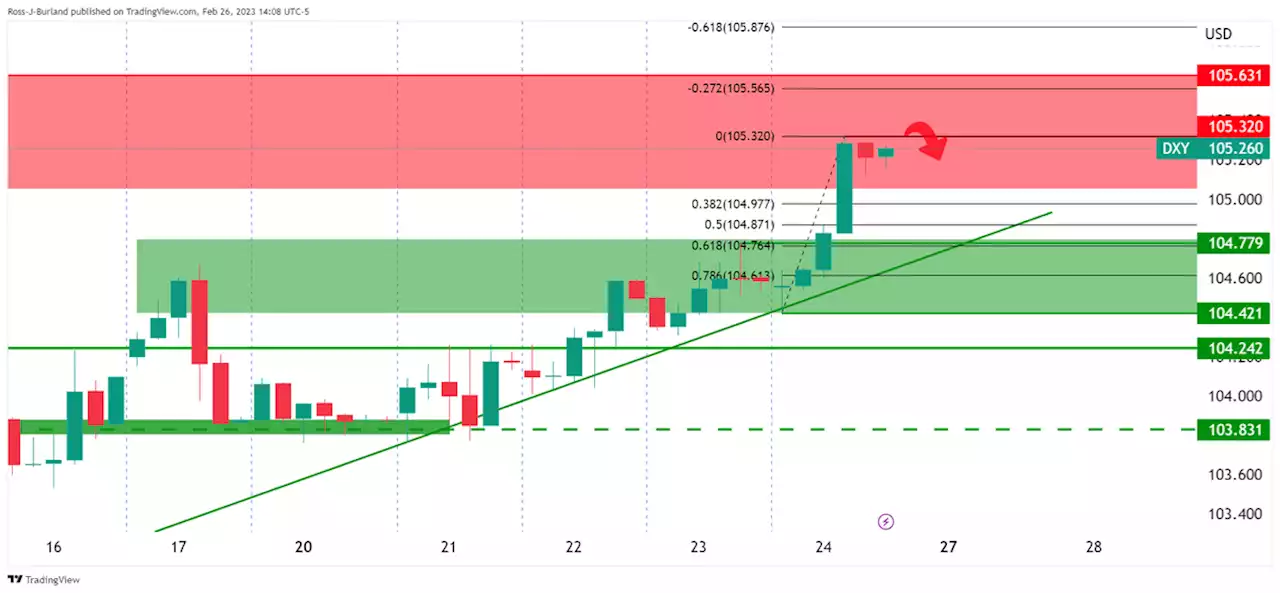

US 2-year yields reach new multi-year peaks past 4.80%., which gauges the greenback vs. a bundle of its main competitors, advances marginally and maintains the multi-session rally well in place for the time being.The index rises for the fifth consecutive session and looks to extend the recent breakout of the key barrier at 105.

In the US data space, all the attention will be on the release of Durable Goods Orders seconded by Pending Home Sales and the speech by FOMC P.Jefferson .The dollar remains bid north of the 105.00 barrier amidst the generalized lack of traction in the risk complex at the beginning of the week. The loss of traction in wage inflation – as per the latest US jobs report - however, seems to lend some support to the view that the Fed’s tightening cycle have started to impact on the still robust US labour markets somewhat.: Durable Goods Orders, Pending Home Sales – Advanced Goods Trade Balance, FHFA House

Now, the index is gaining 0.02% at 105.28 and faces the next hurdle at 105.35 seconded by 105.63 and then 106.48 . On the other hand, the breach of 103.43 would open the door to 102.58 and finally 100.82 .Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Pairs in Focus This Week \u2013 EUR/USD, GBP/USD, USD/JPY, AUD/USGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of February 26th, 2022 here.

Pairs in Focus This Week \u2013 EUR/USD, GBP/USD, USD/JPY, AUD/USGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of February 26th, 2022 here.

Read more »

NZD/USD crushed on a firmer US Dollar and hawkish US dataNZD/USD was pressured at the end of last week due to a late surge in the USD as demand for the currency took off, sending the DXY index through 105 in

NZD/USD crushed on a firmer US Dollar and hawkish US dataNZD/USD was pressured at the end of last week due to a late surge in the USD as demand for the currency took off, sending the DXY index through 105 in

Read more »

Weekly Forex Forecast \u2013 USD/JPY, S\u0026P 500 Index, NASDAQ 100The difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade.

Weekly Forex Forecast \u2013 USD/JPY, S\u0026P 500 Index, NASDAQ 100The difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade.

Read more »

USD/JPY Price Analysis: Bears lurking near 136.50Following the hotter-than-expected US data, the US Dollar index rallied through the 105.20s to a seven-week high and putting it on track to post its l

USD/JPY Price Analysis: Bears lurking near 136.50Following the hotter-than-expected US data, the US Dollar index rallied through the 105.20s to a seven-week high and putting it on track to post its l

Read more »

New Shiba Inu (SHIB) Pair Added by Binance US ExchangeLeading US exchange has kicked off new SHIB pair after delisting KSHIB/USD

New Shiba Inu (SHIB) Pair Added by Binance US ExchangeLeading US exchange has kicked off new SHIB pair after delisting KSHIB/USD

Read more »

US Dollar Index: Hawkish Fed concerns keep DXY bulls hopefulUS Dollar Index (DXY) clings to mild losses around 105.15 as it consolidates recent gains at the highest levels since early January during Monday’s As

US Dollar Index: Hawkish Fed concerns keep DXY bulls hopefulUS Dollar Index (DXY) clings to mild losses around 105.15 as it consolidates recent gains at the highest levels since early January during Monday’s As

Read more »