USD/CAD retraces its recent losses, trading around 1.3500 during the Asian session on Monday.

USD/CAD appreciates as commodity-linked CAD faces challenges due to lower Oil prices. WTI price falls as Eight OPEC+ members are set to raise production by 180,000 barrels per day in October. The US Dollar advanced following July's US Personal Consumption Expenditures Index data. This upside is attributed to the tepid commodity-linked Canadian Dollar following the lower crude Oil prices. Given the fact that Canada is the largest Oil exporter to the United States .

As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar. How do the decisions of the Bank of Canada impact the Canadian Dollar? The Bank of Canada has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down.

Oil Majors Macroeconomics Canada

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

USD/CAD rebounds above 1.3700 on lower crude oil prices, traders await US Retail Sales dataThe USD/CAD pair trades on a stronger note near 1.3715 on Thursday during the Asian trading hours.

USD/CAD rebounds above 1.3700 on lower crude oil prices, traders await US Retail Sales dataThe USD/CAD pair trades on a stronger note near 1.3715 on Thursday during the Asian trading hours.

Read more »

USD/CAD remains under selling pressure below 1.3600 as Fed Minutes point to September rate cutThe USD/CAD pair edges lower to 1.3585 during the early Asian session on Thursday.

USD/CAD remains under selling pressure below 1.3600 as Fed Minutes point to September rate cutThe USD/CAD pair edges lower to 1.3585 during the early Asian session on Thursday.

Read more »

USD/CAD remains below 1.3750 despite lower Oil prices, US PPI eyedUSD/CAD edges lower to near 1.3740 during the early European session on Tuesday.

USD/CAD remains below 1.3750 despite lower Oil prices, US PPI eyedUSD/CAD edges lower to near 1.3740 during the early European session on Tuesday.

Read more »

USD/CAD holds below 1.3500 amid dovish Fed, higher crude oil pricesThe USD/CAD pair extends downside around 1.3485 during the early Asian session on Tuesday.

USD/CAD holds below 1.3500 amid dovish Fed, higher crude oil pricesThe USD/CAD pair extends downside around 1.3485 during the early Asian session on Tuesday.

Read more »

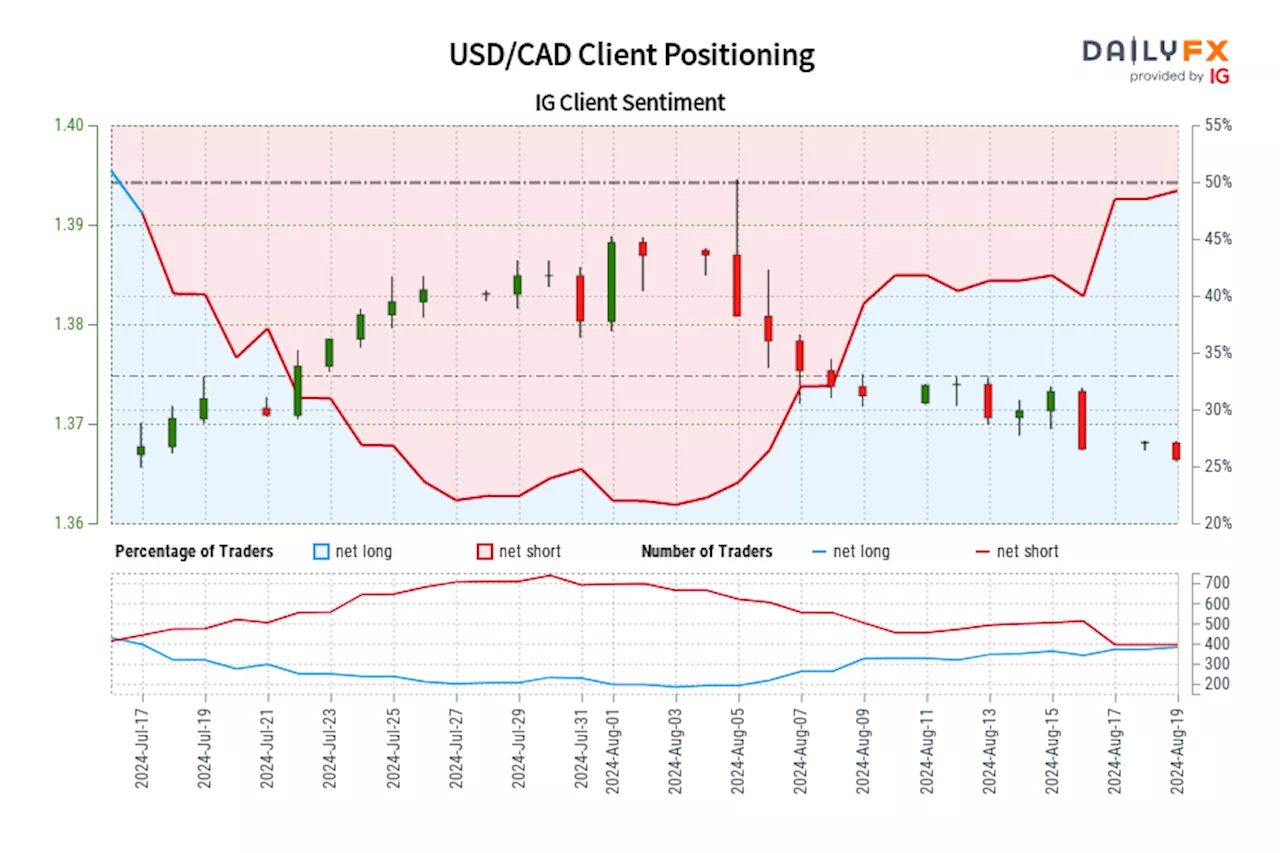

USD/CAD IG Client Sentiment: Our data shows traders are now net-long USD/CAD for the first time since Jul 18, 2024 when USD/CAD traded near 1.37.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias.

USD/CAD IG Client Sentiment: Our data shows traders are now net-long USD/CAD for the first time since Jul 18, 2024 when USD/CAD traded near 1.37.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias.

Read more »

USD/CAD remains below 1.3500 due to higher Oil prices, US PCE eyedUSD/CAD snaps its two-day winning streak, trading around 1.3480 during the European session on Friday.

USD/CAD remains below 1.3500 due to higher Oil prices, US PCE eyedUSD/CAD snaps its two-day winning streak, trading around 1.3480 during the European session on Friday.

Read more »