The USD/CAD pair trades with a bearish bias around 1.3620, the lowest level since July 12, during the early European session on Wednesday.

USD/CAD trades in negative territory for the fourth consecutive day near 1.3620 in Wednesday’s Asian session. Markets are already expecting a 25 bps rate cut in September, with some anticipating a larger 50 bps cut. Canada ’s annual CPI inflation rate fell to 2.5% in July, supporting a third straight BoC rate cut. The expectation that the US Federal Reserve would start its easing cycle in September continues to weigh on the US Dollar .

Other factors include market sentiment – whether investors are taking on more risky assets or seeking safe-havens – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar. How do the decisions of the Bank of Canada impact the Canadian Dollar? The Bank of Canada has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another.

Majors Macroeconomics Inflation Canada

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

USD/CAD falls toward 1.3600 ahead of FOMC MinutesUSD/CAD continues its losing streak, trading around 1.3620 during the Asian session on Wednesday.

USD/CAD falls toward 1.3600 ahead of FOMC MinutesUSD/CAD continues its losing streak, trading around 1.3620 during the Asian session on Wednesday.

Read more »

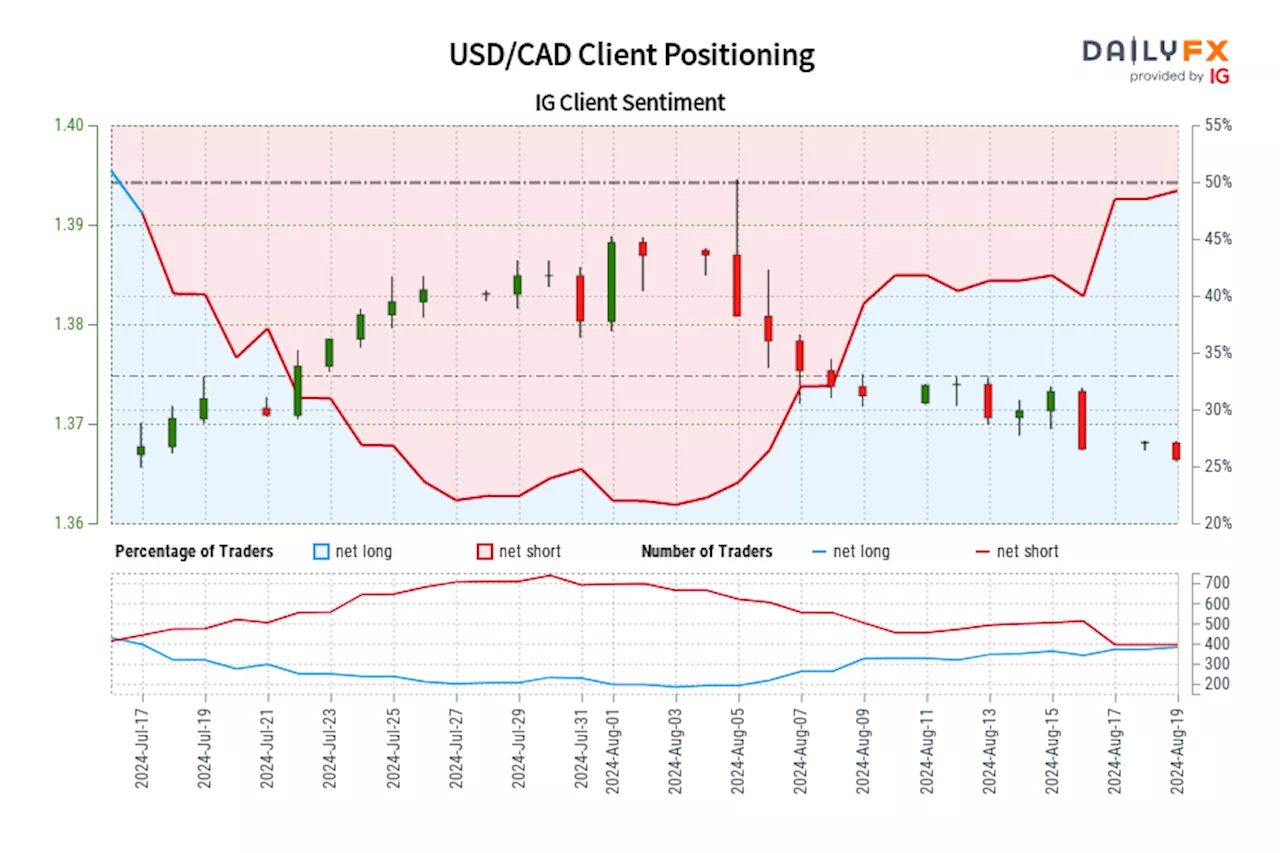

USD/CAD IG Client Sentiment: Our data shows traders are now net-long USD/CAD for the first time since Jul 18, 2024 when USD/CAD traded near 1.37.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias.

USD/CAD IG Client Sentiment: Our data shows traders are now net-long USD/CAD for the first time since Jul 18, 2024 when USD/CAD traded near 1.37.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias.

Read more »

EUR/USD holds below 1.1150 amid cautious mood, all eyes on FOMC MinutesThe EUR/USD pair loses momentum around 1.1120, snapping the three-day winning streak during the early European session on Wednesday.

EUR/USD holds below 1.1150 amid cautious mood, all eyes on FOMC MinutesThe EUR/USD pair loses momentum around 1.1120, snapping the three-day winning streak during the early European session on Wednesday.

Read more »

Gold, Silver Price Action Setups Ahead of FOMC Minutes, Jackson HolePrecious metals and risk assets have witnessed remarkable recoveries since the contained sell-off at the start of August. See how gold, silver and the S&P 500 shape up

Gold, Silver Price Action Setups Ahead of FOMC Minutes, Jackson HolePrecious metals and risk assets have witnessed remarkable recoveries since the contained sell-off at the start of August. See how gold, silver and the S&P 500 shape up

Read more »

Dollar in holding pattern ahead of FOMC minutes, Powell commentsDollar in holding pattern ahead of FOMC minutes, Powell comments

Dollar in holding pattern ahead of FOMC minutes, Powell commentsDollar in holding pattern ahead of FOMC minutes, Powell comments

Read more »

USD/CHF rebounds to near 0.8550 as traders await FOMC MinutesThe USD/CHF pair holds positive ground near 0.8545 on Wednesday during the early European trading hours.

USD/CHF rebounds to near 0.8550 as traders await FOMC MinutesThe USD/CHF pair holds positive ground near 0.8545 on Wednesday during the early European trading hours.

Read more »