The USD/CAD pair trades on a flat note near 1.3585 during the early Asian session on Tuesday.

USD/CAD flat lines around 1.3585 in Monday’s early Asian session. The US Fed is widely anticipated to cut interest rates on Wednesday, its first in four years. The Canadian CPI inflation report is due later on Tuesday. Further decline in the US Dollar ahead of the key US Federal Reserve interest rate decision is likely to cap the upside for the pair. Later on Tuesday, investors will monitor the Canadian Consumer Price Index and US Retail Sales for August for fresh impetus.

As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar. How do the decisions of the Bank of Canada impact the Canadian Dollar? The Bank of Canada has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down.

Majors Macroeconomics Inflation

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

USD/CAD slides below 1.3600 amid rebounding Oil prices, weaker USD ahead of US CPIThe USD/CAD pair struggles to capitalize on the overnight breakout momentum through the very important 200-day Simple Moving Average (SMA) and retreats from a nearly three-week top, around the 1.3615 area touched earlier this Wednesday.

USD/CAD slides below 1.3600 amid rebounding Oil prices, weaker USD ahead of US CPIThe USD/CAD pair struggles to capitalize on the overnight breakout momentum through the very important 200-day Simple Moving Average (SMA) and retreats from a nearly three-week top, around the 1.3615 area touched earlier this Wednesday.

Read more »

USD/CAD bounces from 1.3600 as Canada’s annual CPI declines expectedlyThe USD/CAD pair rebounds sharply from the round-level support of 1.3600 in Tuesday’s New York session after the release of Canada’s Consumer Price Index (CPI) data for July.

USD/CAD bounces from 1.3600 as Canada’s annual CPI declines expectedlyThe USD/CAD pair rebounds sharply from the round-level support of 1.3600 in Tuesday’s New York session after the release of Canada’s Consumer Price Index (CPI) data for July.

Read more »

USD/CAD Price Prediction: Breaks above key trendline after strong Canadian GDP dataUSD/CAD is decisively breaking above a key trendline for the downtrend it has been in since the start of August.

USD/CAD Price Prediction: Breaks above key trendline after strong Canadian GDP dataUSD/CAD is decisively breaking above a key trendline for the downtrend it has been in since the start of August.

Read more »

USD/CAD seems vulnerable below 1.3600 ahead of Canadian Retail Sales, Powell’s speechThe USD/CAD pair struggles to capitalize on the previous day's recovery from the 1.3570 area or the lowest level since April 10 and attracts fresh sellers during the Asian session on Friday.

USD/CAD seems vulnerable below 1.3600 ahead of Canadian Retail Sales, Powell’s speechThe USD/CAD pair struggles to capitalize on the previous day's recovery from the 1.3570 area or the lowest level since April 10 and attracts fresh sellers during the Asian session on Friday.

Read more »

USD/CAD Price Forecast: Hangs near weekly low, below 1.3500 ahead of US/Canadian jobs dataThe USD/CAD pair attracts sellers for the third straight day and remains depressed below the 1.3500 psychological mark, or the weekly low through the early European session on Friday.

USD/CAD Price Forecast: Hangs near weekly low, below 1.3500 ahead of US/Canadian jobs dataThe USD/CAD pair attracts sellers for the third straight day and remains depressed below the 1.3500 psychological mark, or the weekly low through the early European session on Friday.

Read more »

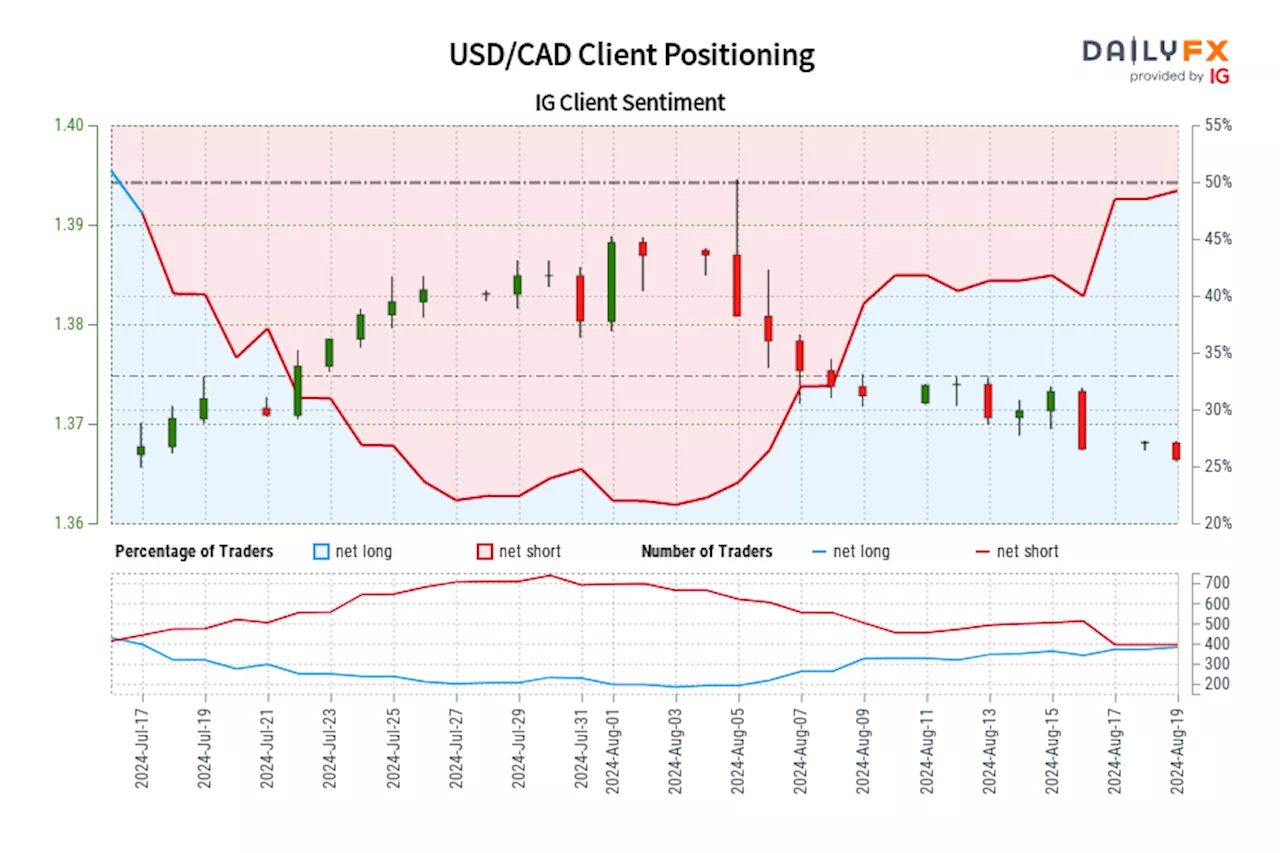

USD/CAD IG Client Sentiment: Our data shows traders are now net-long USD/CAD for the first time since Jul 18, 2024 when USD/CAD traded near 1.37.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias.

USD/CAD IG Client Sentiment: Our data shows traders are now net-long USD/CAD for the first time since Jul 18, 2024 when USD/CAD traded near 1.37.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias.

Read more »