The USD/CAD pair drops sharply below the crucial support of 1.3550 as the Bank of Canada (BoC) reduces its key borrowing rates by 25 basis points (bps) for the third straight time, pushing them lower to 4.25%.

USD/CAD slips below 1.3550 as the BoC reduces interest rates by 25 bps to 4.25% as expected. The US Dollar corrects sharply after weak US JOLTS Job Openings data for July. Investors await the US NFP for August for fresh guidance on interest rates. The USD/CAD pair drops sharply below the crucial support of 1.3550 asthe Bank of Canada reduces its key borrowing rates by 25 basis points for the third straight time, pushing them lower to 4.25%.

The US Dollar Index , which tracks the Greenback's value against six major currencies, tumbles below 101.40. On Tuesday, the US Dollar corrected after the release of thedownbeat United States ISM Manufacturing PMI for August, whichpromptedexpectations that the Federal Reserve could begin the policy-easing process aggressively, which is expected this month. The ISM agency reported that activities in the manufacturing sector contracted at a faster-than-projected pace, with PMI landing at 47.

Fed BOC Inflation Interestrate

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

USD/CAD weakens below 1.3550, eyes on BoC rate decisionThe USD/CAD pair trades on a weaker note around 1.3545 during the early Asian session on Wednesday.

USD/CAD weakens below 1.3550, eyes on BoC rate decisionThe USD/CAD pair trades on a weaker note around 1.3545 during the early Asian session on Wednesday.

Read more »

USD/CAD consolidates near 1.3550 ahead of BoC's monetary policy decisionThe USD/CAD pair trades sideways near 1.3550 in Wednesday’s European trading hours.

USD/CAD consolidates near 1.3550 ahead of BoC's monetary policy decisionThe USD/CAD pair trades sideways near 1.3550 in Wednesday’s European trading hours.

Read more »

USD/CAD: Path of Least Resistance Remains to the Downside Ahead of BoC, Jobs DataForex Analysis by Fawad Razaqzada covering: USD/CAD, US Dollar Index Futures. Read Fawad Razaqzada's latest article on Investing.com

USD/CAD: Path of Least Resistance Remains to the Downside Ahead of BoC, Jobs DataForex Analysis by Fawad Razaqzada covering: USD/CAD, US Dollar Index Futures. Read Fawad Razaqzada's latest article on Investing.com

Read more »

USD/CAD: BoC policy decision is expected to result in a 25bpsThe Canadian Dollar (CAD) is losing ground in line with the core majors so far today and is outperforming its commodity cousins (AUD and NZD) by a fair margin as a result, Scotiabank’s Chief FX Strategist Shaun Osborne notes.

USD/CAD: BoC policy decision is expected to result in a 25bpsThe Canadian Dollar (CAD) is losing ground in line with the core majors so far today and is outperforming its commodity cousins (AUD and NZD) by a fair margin as a result, Scotiabank’s Chief FX Strategist Shaun Osborne notes.

Read more »

USD/CAD: BOC rate cut this weekUSD/CAD found support around 1.3450 ahead of the Bank of Canada’s third consecutive rate cut expected this week, DBS’ Senior FX Strategist Philip Wee notes.

USD/CAD: BOC rate cut this weekUSD/CAD found support around 1.3450 ahead of the Bank of Canada’s third consecutive rate cut expected this week, DBS’ Senior FX Strategist Philip Wee notes.

Read more »

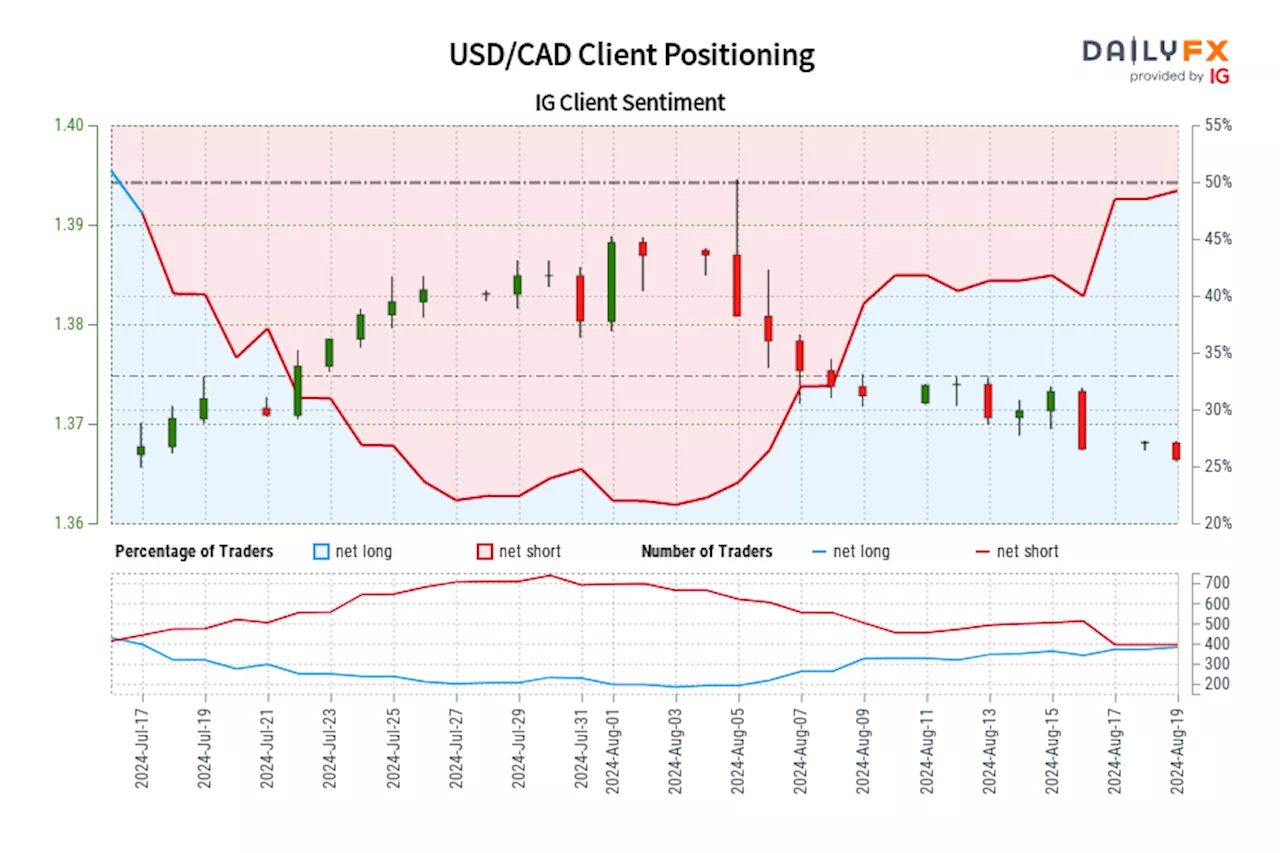

USD/CAD IG Client Sentiment: Our data shows traders are now net-long USD/CAD for the first time since Jul 18, 2024 when USD/CAD traded near 1.37.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias.

USD/CAD IG Client Sentiment: Our data shows traders are now net-long USD/CAD for the first time since Jul 18, 2024 when USD/CAD traded near 1.37.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias.

Read more »