Americans spent a bit more at retailers last month, providing a small boost to the economy just as the Federal Reserve considers how much to cut its key interes

t rate.

The impact of inflation and consumers' health has been an ongoing issue in the presidential campaign, with former President Donald Trump blaming the Biden-Harris administration for the post-pandemic jump in prices. Vice President Kamala Harris has, in turn, charged that Trump's claim that he will slap 10% to 20% tariffs on all imports would amount to a "Trump tax" that will raise prices further.

The Fed could provide a further boost to consumers and the economy by lowering borrowing costs. It is likely to reduce its key rate at its meetings in November and December as well as on Wednesday. Such cuts should, over time, lower rates for mortgages, auto loans, and credit cards. Average mortgage rates have already fallen in anticipation of the Fed's actions.

Gas stations reported a 1.2% drop in sales, which mostly reflected a decline in prices last month. Auto sales also ticked lower.

Consumer Resilience Inflation Federal Reserve Interest Rates Online Retailers Economic Growth Discretionary Spending

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Federal Reserve welcomes a ‘soft landing’ even as many Americans lament elevated pricesA majority of Americans still complain about elevated prices, given that the costs of such necessities as food, gas and housing remain far above where they were before the pandemic erupted in 2020.

Federal Reserve welcomes a ‘soft landing’ even as many Americans lament elevated pricesA majority of Americans still complain about elevated prices, given that the costs of such necessities as food, gas and housing remain far above where they were before the pandemic erupted in 2020.

Read more »

Federal Reserve Rate Cut Meeting: What To ExpectCNBC Daily Open dives into the upcoming Federal Reserve meeting and what it means for investors. The Fed is widely expected to cut interest rates, but the size of the cut remains uncertain. The article also explores the potential policy trajectory beyond this initial rate cut and highlights the uncertainties surrounding future economic outlook.

Federal Reserve Rate Cut Meeting: What To ExpectCNBC Daily Open dives into the upcoming Federal Reserve meeting and what it means for investors. The Fed is widely expected to cut interest rates, but the size of the cut remains uncertain. The article also explores the potential policy trajectory beyond this initial rate cut and highlights the uncertainties surrounding future economic outlook.

Read more »

Federal Reserve unveils toned-down banking regulation in victory for Wall StreetBank CEOs led by JPMorgan Chase CEO Jamie Dimon have lambasted the proposed Basel Endgame regulation since it was unveiled last year.

Federal Reserve unveils toned-down banking regulation in victory for Wall StreetBank CEOs led by JPMorgan Chase CEO Jamie Dimon have lambasted the proposed Basel Endgame regulation since it was unveiled last year.

Read more »

EUR/USD Forecast: Caution mounts ahead of Federal Reserve’s announcementThe EUR/USD pair maintains its positive tone on Tuesday, currently retreating from an intraday high of 1.1145, ahead of the United States (US) opening.

EUR/USD Forecast: Caution mounts ahead of Federal Reserve’s announcementThe EUR/USD pair maintains its positive tone on Tuesday, currently retreating from an intraday high of 1.1145, ahead of the United States (US) opening.

Read more »

Market Bullies Federal Reserve AgainRecent economic data fueled market speculation of a 50-basis point interest rate cut by the Federal Reserve, despite expectations leaning towards a quarter-point reduction. This shift in market sentiment reflects the ongoing debate surrounding inflation and economic growth.

Market Bullies Federal Reserve AgainRecent economic data fueled market speculation of a 50-basis point interest rate cut by the Federal Reserve, despite expectations leaning towards a quarter-point reduction. This shift in market sentiment reflects the ongoing debate surrounding inflation and economic growth.

Read more »

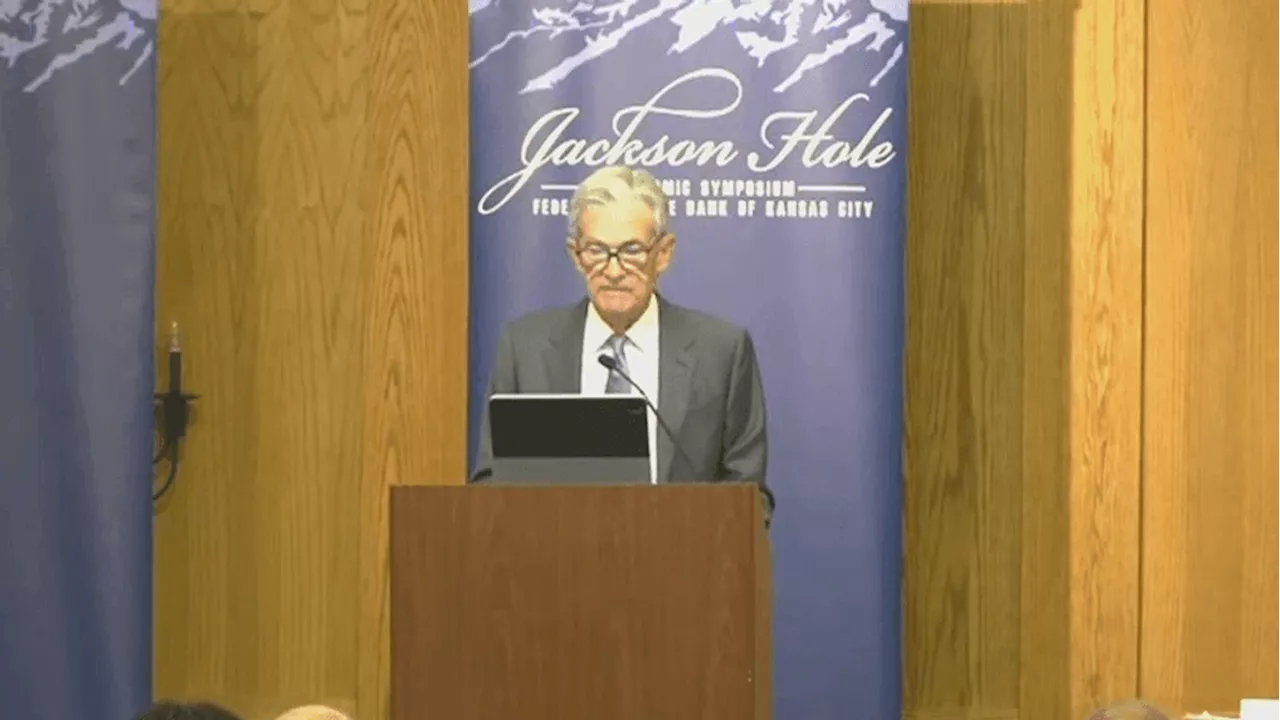

Federal Reserve chair: 'Time has come' to cut interest ratesWith inflation nearly defeated and the job market cooling, the Federal Reserve is prepared to start cutting its key interest rate from its current 23-year high.

Federal Reserve chair: 'Time has come' to cut interest ratesWith inflation nearly defeated and the job market cooling, the Federal Reserve is prepared to start cutting its key interest rate from its current 23-year high.

Read more »