An 8.5% average mortgage rate would be “another big shock to the housing market.”

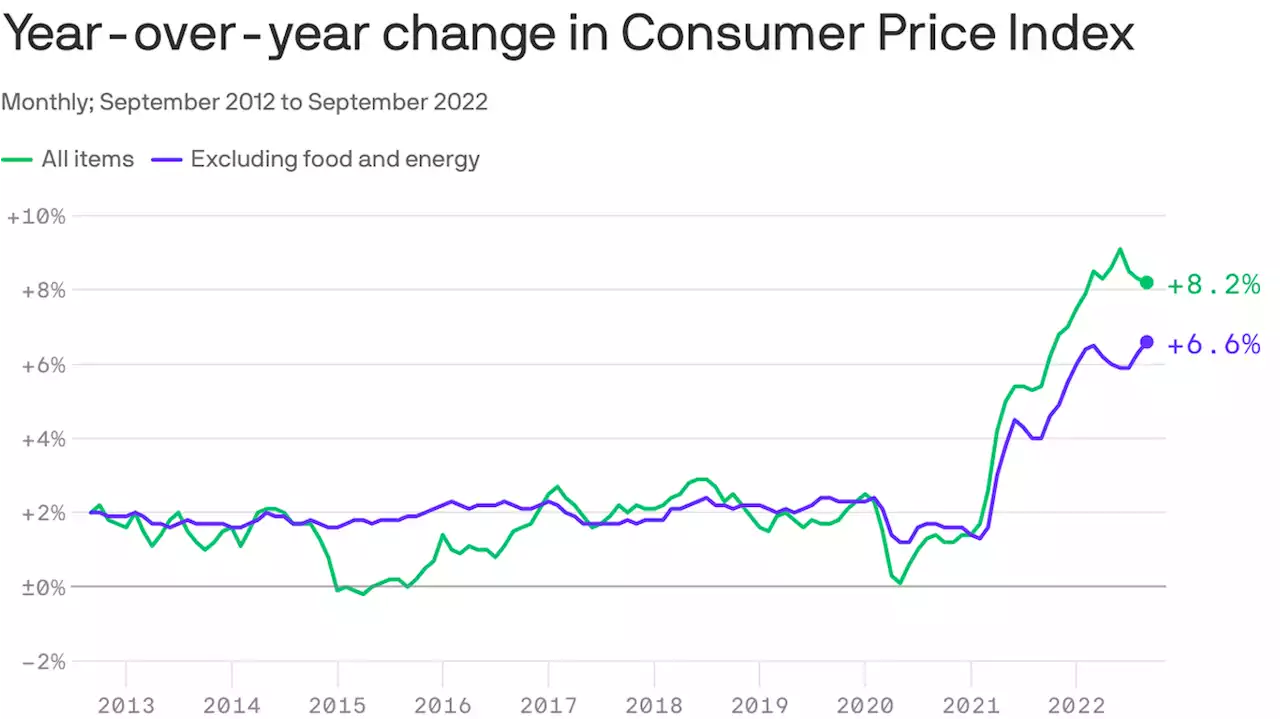

Surging US mortgage rates could rise well above the critical 7% threshold in the wake of another alarming inflation report for September, according to a prominent economist.in September. The Federal Reserve is all but assured to implement more sharp interest rate hikes in response – a policy move that will lead mortgage rates to test highs not seen in more than two decades.this week, with the average 30-year fixed loan hitting 6.92%, according to Freddie Mac.

. “Once it’s broken, the next level of resistance is 8.5%, which would be another big shock to the housing market.”Mortgage rates approached 7% this week.Yun based his prediction on an analysis of mortgage rate trends and identified 8.5% as the next key level of resistance for the market. In other words, an 8.5% average mortgage rate is the next level at which the market could retrench in the coming months.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

US inflation still elevated, Fed to continue to raise interest rates sharply – CommerzbankUS inflation was again higher than expected in September. Further significant rate hikes are thus virtually certain, in the opinion of economists at C

US inflation still elevated, Fed to continue to raise interest rates sharply – CommerzbankUS inflation was again higher than expected in September. Further significant rate hikes are thus virtually certain, in the opinion of economists at C

Read more »

US producer price inflation eases to still-high 8.5%Inflation at the wholesale level rose 8.5% in September from a year earlier, the third straight decline though costs remain at painfully high levels.

US producer price inflation eases to still-high 8.5%Inflation at the wholesale level rose 8.5% in September from a year earlier, the third straight decline though costs remain at painfully high levels.

Read more »

US producer price inflation eases to still-high 8.5%Stubbornly-high inflation is draining Americans' bank accounts, frustrating small businesses and raising alarm bells at the Federal Reserve.

US producer price inflation eases to still-high 8.5%Stubbornly-high inflation is draining Americans' bank accounts, frustrating small businesses and raising alarm bells at the Federal Reserve.

Read more »

Inflation stays hot in September with 8.2% increase from last yearOverall inflation came in hotter than economists expected.

Inflation stays hot in September with 8.2% increase from last yearOverall inflation came in hotter than economists expected.

Read more »

Mortgage applications fall as rates rise to the highest level in 16 yearsMortgage applications fell 2% this week, as rates continue to inch higher, adding hundreds of dollars in costs to potential homebuyers. Rates are a hop and a skip away from 7%, a trajectory which has deeply hit buyer demand.

Mortgage applications fall as rates rise to the highest level in 16 yearsMortgage applications fell 2% this week, as rates continue to inch higher, adding hundreds of dollars in costs to potential homebuyers. Rates are a hop and a skip away from 7%, a trajectory which has deeply hit buyer demand.

Read more »

US CPI: Significantly higher number to give the greenback a further boost – CommerzbankIt is clear that today's upcoming September inflation data are the absolute data highlight. Economists at Commerzbank expect the US dollar to enjoy fu

US CPI: Significantly higher number to give the greenback a further boost – CommerzbankIt is clear that today's upcoming September inflation data are the absolute data highlight. Economists at Commerzbank expect the US dollar to enjoy fu

Read more »