US Dollar jumps as China’s imports plunge sparks global recession fears and weaker Yuan DollarIndex Macroeconomics UnitedStates SEO

r Index . Meanwhile, this Tuesday the Greenback is back in favor after Chinese import numbers plunged even worse than during the pandemic. This triggers someOn the economic front, a chunky calendar includes the National Federation of Independent Business Optimism Index and the TechnoMetrica Institute of Policy & Politics Economic Optimism Index .

Around 12:30 GMT, the Goods and Services Trade Balance for June is expected to bear a slightly smaller deficit, moving from $-69B to $-65B. The US Goods Trade Balance will come out as well and was at $-87.8B with no forecast pencilled in. The Japanese Topix index saw the closing bell coming in right on time in order to still close this Tuesday with a 0.34% gain. The Chinese Hang Seng Index declined near 2% on the back of those weak Chinese import numbers. European and US equities are being dragged along as global recession fears are creeping back into the markets.

For the upside, 102.31 remains a key level to watch in the form of the 100-day Simple Moving Average and needs to see a daily close above in order to be turned into support going forward. Even should the DXY be able to break and close above there, US Dollar bulls are not out of the woods yet, with the 55-day SMA just above there at 102.48. Two key levels need to be broken and closed above in order to avoid any large pullbacks before targeting 103 to the upside.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other . It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Analysis: Yuan loses core support as firms leave ChinaSince China opened to foreign investment in 1978 under Deng Xiaoping, global firms have ploughed in hundreds of billions of dollars to buy and build factories for market access and cheap labour, bolstering the Chinese currency.

Analysis: Yuan loses core support as firms leave ChinaSince China opened to foreign investment in 1978 under Deng Xiaoping, global firms have ploughed in hundreds of billions of dollars to buy and build factories for market access and cheap labour, bolstering the Chinese currency.

Read more »

Rupee to weaken on dollar rally, RBI likely to interveneThe Indian rupee is expected to open lower on Tuesday, weighed down by the recovery in the dollar index and a decline in Asian peers. Non-deliverable forwards indicate rupee will open at around 82.85 to the U.S. dollar, down from 82.7425 on Monday. The dollar index rose in Asia, and has now recovered a large part of its losses suffered post the U.S. jobs data. Asian currencies were down between 0.2% and 0.6%, with the offshore Chinese yuan slipping to 7.2250 to the dollar.

Rupee to weaken on dollar rally, RBI likely to interveneThe Indian rupee is expected to open lower on Tuesday, weighed down by the recovery in the dollar index and a decline in Asian peers. Non-deliverable forwards indicate rupee will open at around 82.85 to the U.S. dollar, down from 82.7425 on Monday. The dollar index rose in Asia, and has now recovered a large part of its losses suffered post the U.S. jobs data. Asian currencies were down between 0.2% and 0.6%, with the offshore Chinese yuan slipping to 7.2250 to the dollar.

Read more »

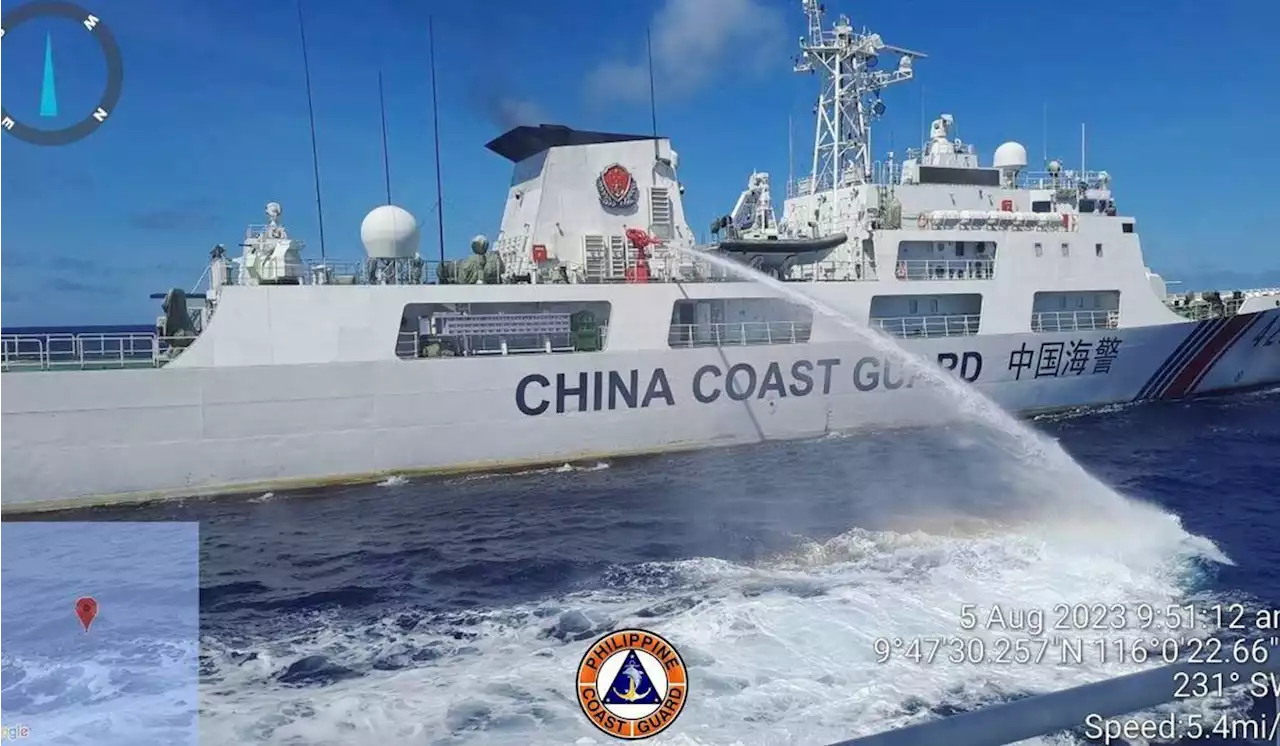

Philippines, US slam China for blocking resupply of disputed South China Sea siteThe State Department has joined the Philippines in condemning 'dangerous actions' by China's coast guard in the latest flare-up of tensions over clashing territorial claims in the South China Sea.

Philippines, US slam China for blocking resupply of disputed South China Sea siteThe State Department has joined the Philippines in condemning 'dangerous actions' by China's coast guard in the latest flare-up of tensions over clashing territorial claims in the South China Sea.

Read more »

Philippines, U.S. slam China for blocking resupply of disputed South China Sea siteThe State Department has joined the Philippines in condemning “dangerous actions” by China’s coast guard in the latest flare-up of tensions over clashing territorial claims in the South China Sea.

Philippines, U.S. slam China for blocking resupply of disputed South China Sea siteThe State Department has joined the Philippines in condemning “dangerous actions” by China’s coast guard in the latest flare-up of tensions over clashing territorial claims in the South China Sea.

Read more »

Montgomery riverfront brawl: ‘Justice will be served,’ mayor says as police obtain 4 warrantsPolice said four active warrants have been issued and more might be coming in the aftermath of a Saturday evening brawl on the Montgomery waterfront, a fracas the city’s mayor described as “an unfortunate incident which never should have occurred.”

Montgomery riverfront brawl: ‘Justice will be served,’ mayor says as police obtain 4 warrantsPolice said four active warrants have been issued and more might be coming in the aftermath of a Saturday evening brawl on the Montgomery waterfront, a fracas the city’s mayor described as “an unfortunate incident which never should have occurred.”

Read more »

GLP Capital Raises $556 Million for Renewable Investment in ChinaGLP Capital Partners, an asset manager, has raised 4 billion yuan ($556.17 million) from China's green development fund and state-owned energy investment firm for renewable energy investments in China. The overall investment of the fund is expected to reach about 20 billion yuan, targeting wind, solar, energy storage infrastructure, and related energy management solutions.

GLP Capital Raises $556 Million for Renewable Investment in ChinaGLP Capital Partners, an asset manager, has raised 4 billion yuan ($556.17 million) from China's green development fund and state-owned energy investment firm for renewable energy investments in China. The overall investment of the fund is expected to reach about 20 billion yuan, targeting wind, solar, energy storage infrastructure, and related energy management solutions.

Read more »