This article provides crucial advice for homeowners on navigating the complexities of home insurance in the aftermath of a widespread natural disaster. It emphasizes the importance of reviewing your policy to understand coverage options, such as replacement cost value versus actual cash value, and highlights the benefits of state laws regulating advanced insurance payments during emergencies.

Trump won't rule out deploying US troops to support rebuilding Gaza, sees 'long-term' US ownershipStill locked out of federal funding, several Head Start preschools may need to close temporarilyLuka Doncic is excited to join the Lakers after the shock of his stunning trade away from DallasThe man charged with stabbing Salman Rushdie is going on trial. The author will take the standAP Entertainment WiretestChina counters with tariffs on US products.

If you do nothing else, check your policy now to see if you have “replacement cost value” coverage. That’s the comprehensive standard, which will grant you the amount of money needed to get a new replacement of what you lost in case of a major disaster like a wildfire. Amy Bach of the consumer advocacy group United Policyholders says the two are apples and oranges in terms of payouts. She describes it this way: “Actual cash value is the Craigslist price. It’s not the replacement cost price.”From finding a new place to live to buying yourself clothes and toiletries, it’s expensive to survive the immediate aftermath of an emergency, so get familiar with any state laws regulating insurance companies on advanced payments.

Home Insurance Natural Disasters Replacement Cost Value Actual Cash Value Insurance Claims Emergency Preparedness

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Insurance Industry Disputes Kamala Harris' Claims on Wildfire Insurance CancellationsInsurance leaders are refuting Vice President Kamala Harris's statement that many insurance companies have canceled policies for wildfire-affected families in Los Angeles. They argue that her claims are false and dangerous, emphasizing that California law prevents policy cancellations during the policy term except in specific circumstances.

Insurance Industry Disputes Kamala Harris' Claims on Wildfire Insurance CancellationsInsurance leaders are refuting Vice President Kamala Harris's statement that many insurance companies have canceled policies for wildfire-affected families in Los Angeles. They argue that her claims are false and dangerous, emphasizing that California law prevents policy cancellations during the policy term except in specific circumstances.

Read more »

Sunny Hostin's Husband Sued for Insurance Fraud by Ride-Share Insurance CompanyThe View co-host Sunny Hostin's husband, Dr. Emmanuel 'Manny' Hostin, is facing accusations of insurance fraud in a federal lawsuit filed by American Transit, a company that provides insurance to ride-share drivers. Hostin vehemently denies the allegations and claims the lawsuit is an attempt by a failing insurance company to avoid paying for legitimate medical claims.

Sunny Hostin's Husband Sued for Insurance Fraud by Ride-Share Insurance CompanyThe View co-host Sunny Hostin's husband, Dr. Emmanuel 'Manny' Hostin, is facing accusations of insurance fraud in a federal lawsuit filed by American Transit, a company that provides insurance to ride-share drivers. Hostin vehemently denies the allegations and claims the lawsuit is an attempt by a failing insurance company to avoid paying for legitimate medical claims.

Read more »

Insurance attorney, Woolsey Fire victims offer advice on how to file insurance claimsVictims of the Woolsey Fire and an insurance attorney share tips for wildfire victims on how to file insurance claims.

Insurance attorney, Woolsey Fire victims offer advice on how to file insurance claimsVictims of the Woolsey Fire and an insurance attorney share tips for wildfire victims on how to file insurance claims.

Read more »

California Senate Insurance Committee still without leader amid corruption probe, insurance crisisAs California faces the largest insurance crisis in the state's history, there is still no leader of the state Senate Insurance Committee.

California Senate Insurance Committee still without leader amid corruption probe, insurance crisisAs California faces the largest insurance crisis in the state's history, there is still no leader of the state Senate Insurance Committee.

Read more »

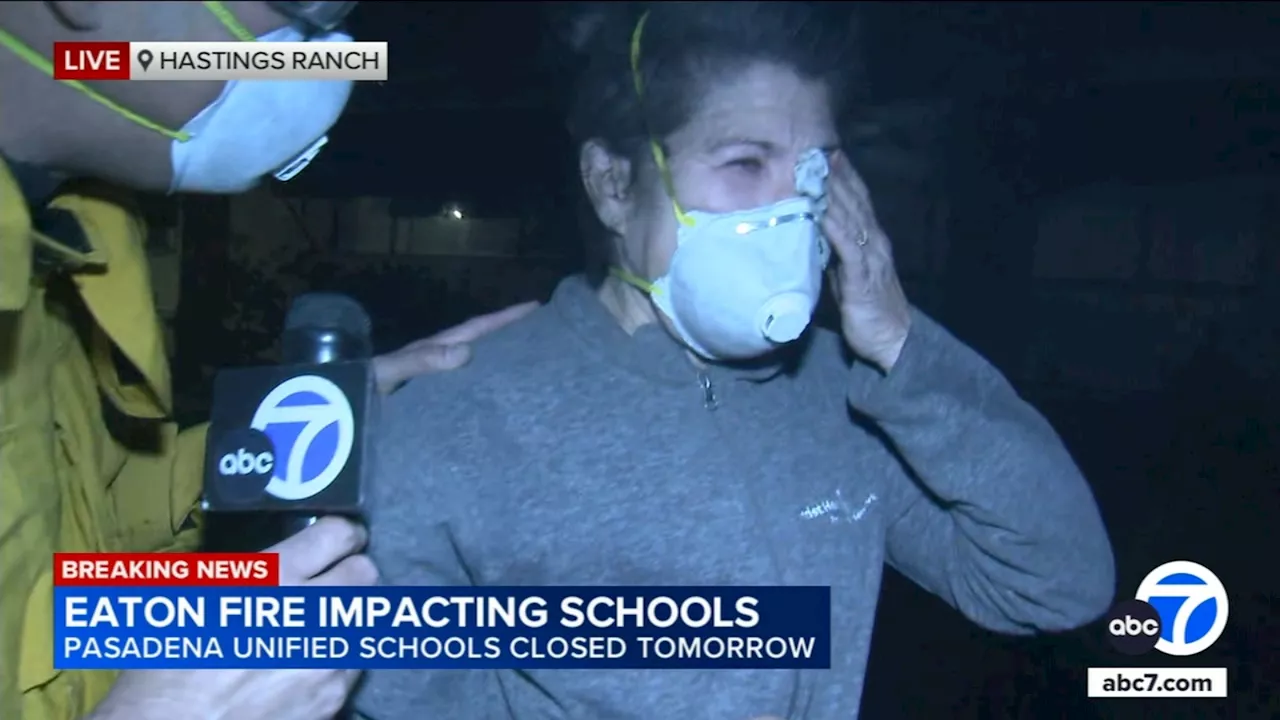

ER Nurse Fights Eaton Fire to Save Parents' Home After Insurance CancellationA dedicated ER nurse risks her own safety to protect her parents' 75-year-old home in Hastings Ranch from the raging Eaton Fire. She expresses anger at the insurance company that recently canceled their fire coverage, leaving them vulnerable during the crisis.

ER Nurse Fights Eaton Fire to Save Parents' Home After Insurance CancellationA dedicated ER nurse risks her own safety to protect her parents' 75-year-old home in Hastings Ranch from the raging Eaton Fire. She expresses anger at the insurance company that recently canceled their fire coverage, leaving them vulnerable during the crisis.

Read more »

California Wildfires Fuel Fears of Soaring Home Insurance CostsThe devastating wildfires in Los Angeles County are raising alarm bells about the potential for another wave of skyrocketing home insurance premiums across California. Experts warn that insurance companies will leverage the fires to justify price hikes for all policyholders, exacerbating an already strained situation.

California Wildfires Fuel Fears of Soaring Home Insurance CostsThe devastating wildfires in Los Angeles County are raising alarm bells about the potential for another wave of skyrocketing home insurance premiums across California. Experts warn that insurance companies will leverage the fires to justify price hikes for all policyholders, exacerbating an already strained situation.

Read more »