Breakingviews - Uday Kotak is wanting for the market’s support

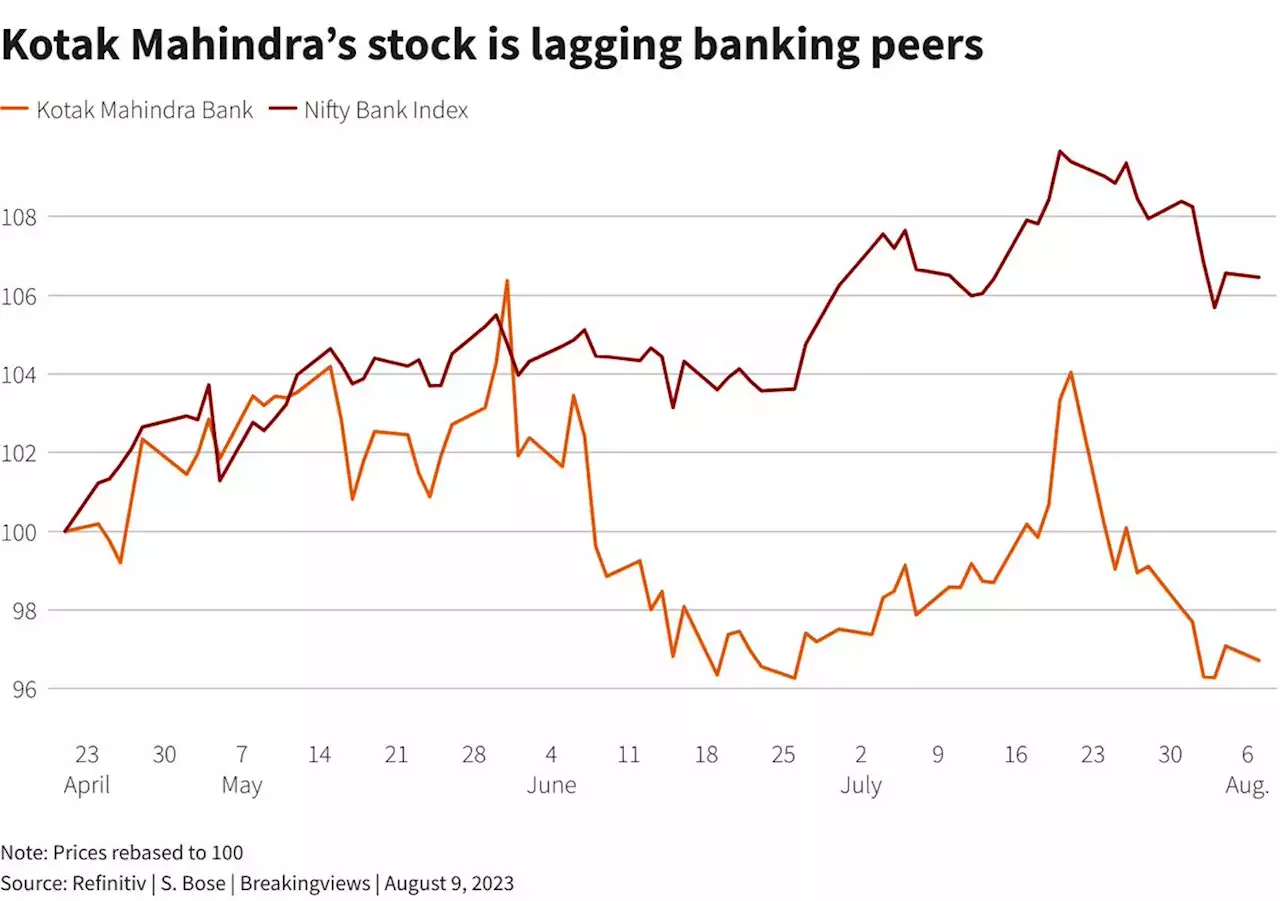

. While promoting family members is common in India’s tycoon-run conglomerates, it is rare for a bank. What’s more, the stock has underperformed the benchmark Nifty Bank Index by nine percentage points since an April vote where 99% of shareholders supported Kotak continuing as a non-executive director. There may be multiple reasons for the lag but it makes the RBI’s decision tougher.

In the past, the regulator has booted out private bank chiefs for poor management of bad loans and overhauled a bankwhere it perceived succession planning was poor. It could back an external successor for Kotak as a measure of caution. Yet few of the industry’s elite see a problem with such a safe pair of hands sticking around.

. Whatever regulators decide for Uday Kotak and his bank, having the market onside will be helpful all around.The Reserve Bank of India is nudging Kotak Mahindra Bank to select someone outside the lender to succeed billionaire founder Uday Kotak as the next CEO, Bloomberg reported on July 31, citing unnamed sources. Kotak’s term ends on December 31.

In a statement issued on the same day, the bank said there has been no communication, formal or informal, from RBI to Kotak Mahindra Bank or its board members on the matter of succession.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Uday Kotak is wanting for the market’s supportAsia’s richest banker, Uday Kotak, plans to remain on the board of Kotak Mahindra Bank after stepping down as CEO. However, the stock's recent underperformance poses a risk to his succession plans. The Reserve Bank of India will consider this as it decides on a successor from within the bank.

Uday Kotak is wanting for the market’s supportAsia’s richest banker, Uday Kotak, plans to remain on the board of Kotak Mahindra Bank after stepping down as CEO. However, the stock's recent underperformance poses a risk to his succession plans. The Reserve Bank of India will consider this as it decides on a successor from within the bank.

Read more »

Uday Kotak Seeks Market's SupportUday Kotak, Asia's richest banker, plans to remain on the board of Kotak Mahindra Bank after stepping down as CEO. However, the bank's recent underperformance poses a risk to his succession plans. The Reserve Bank of India will consider this as it decides on a successor from within the bank.

Uday Kotak Seeks Market's SupportUday Kotak, Asia's richest banker, plans to remain on the board of Kotak Mahindra Bank after stepping down as CEO. However, the bank's recent underperformance poses a risk to his succession plans. The Reserve Bank of India will consider this as it decides on a successor from within the bank.

Read more »

UK's Central Bank Forges Ahead With Plans for a Systemic Stablecoin RegimeThe U.K. has passed a law giving the Bank of England (BoE) powers to establish a systemic stablecoin regime. A recent consultation response revealed that systemic stablecoins would be supervised by both the BoE and the Financial Conduct Authority (FCA), a decision supported by respondents and the government. There is also support for extending the accountability framework to include systemic stablecoins.

UK's Central Bank Forges Ahead With Plans for a Systemic Stablecoin RegimeThe U.K. has passed a law giving the Bank of England (BoE) powers to establish a systemic stablecoin regime. A recent consultation response revealed that systemic stablecoins would be supervised by both the BoE and the Financial Conduct Authority (FCA), a decision supported by respondents and the government. There is also support for extending the accountability framework to include systemic stablecoins.

Read more »

‘Tomorrow’s martyrs’: Inside a Palestinian militant cell in the West BankThe Post spent time with a group of fighters at a Palestinian militant cell, affording a rare window into the lives and actions of fighters on one side of the worst violence to grip the West Bank in decades.

‘Tomorrow’s martyrs’: Inside a Palestinian militant cell in the West BankThe Post spent time with a group of fighters at a Palestinian militant cell, affording a rare window into the lives and actions of fighters on one side of the worst violence to grip the West Bank in decades.

Read more »

State Bank of India bets on private capex to grow corporate credit -ChairmanState Bank of India (SBI) expects to give out 3.5 trillion rupees ($42.30 billion) in corporate loans over the rest of this financial year as private companies step up investments in key sectors, the chairman of the country's largest lender said.

State Bank of India bets on private capex to grow corporate credit -ChairmanState Bank of India (SBI) expects to give out 3.5 trillion rupees ($42.30 billion) in corporate loans over the rest of this financial year as private companies step up investments in key sectors, the chairman of the country's largest lender said.

Read more »

This bank is warning of a summer risk burnout that will keep pressure on marketsWhy a host of factors add up to pressure on the stock market continuing, according to BNP Paribas.

This bank is warning of a summer risk burnout that will keep pressure on marketsWhy a host of factors add up to pressure on the stock market continuing, according to BNP Paribas.

Read more »