U.S. stocks closed out a strong week with rallies driven by optimism concerning the economy and interest rates. Investors anticipate policy changes under the incoming Trump administration. The Dow reached its biggest weekly percentage gain since early November, while the Nasdaq recorded its best performance since early December.

U.S. stocks surged on Friday, marking the completion of a strong week driven by optimism surrounding the economy's health and the trajectory of interest rates. Investors were preparing for a wave of policy changes under the incoming Trump administration. The Dow Industrials achieved its largest weekly percentage gain since early November, while the Nasdaq recorded its best performance since early December. This week's economic data alleviated concerns about a resurgence of inflation.

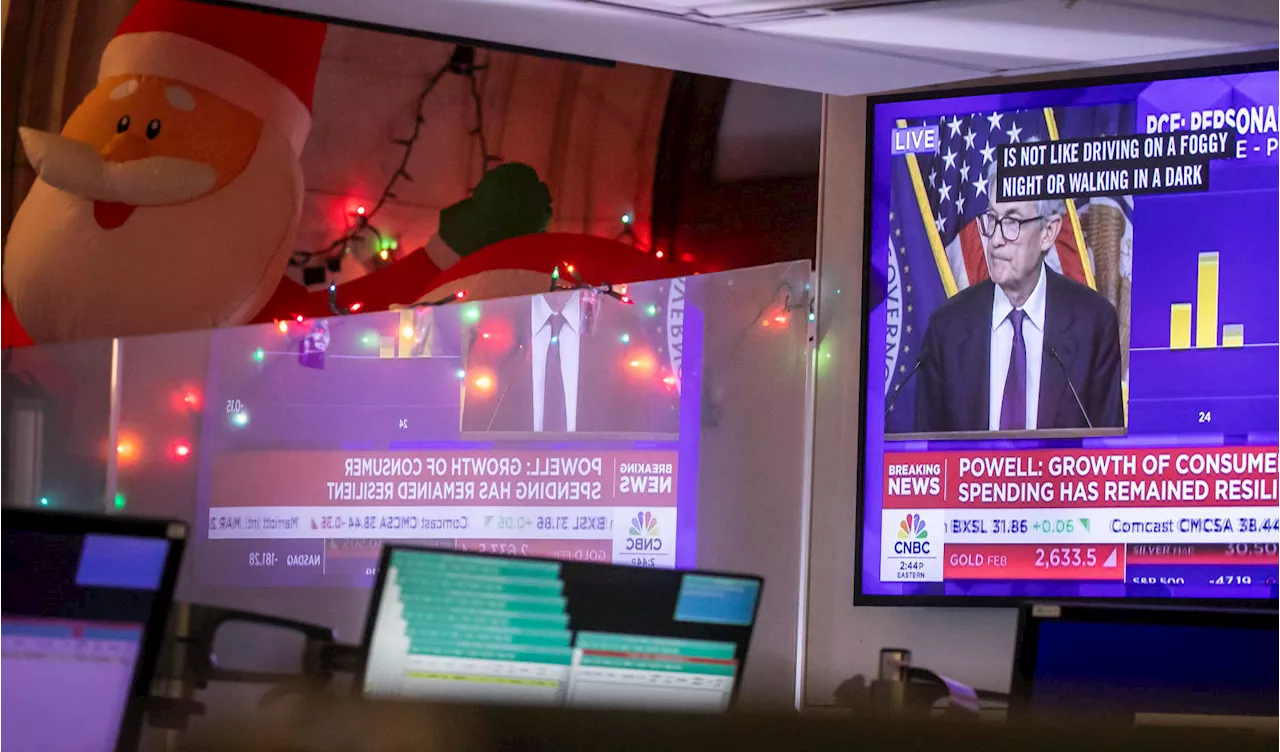

Expectations of the Federal Reserve accelerating the timing and extent of rate cuts this year also strengthened. The Commerce Department reported a 10-month high in U.S. single-family homebuilding on Friday, although rising mortgage rates and an oversupply of new properties are expected to likely curb demand. President-elect Donald Trump's inauguration on Monday, a day when U.S. markets are closed for the Martin Luther King Jr. Day holiday, is approaching. Uncertainty regarding the potential impact of some of Trump's policies, such as tariffs, on inflation and the Fed's rate cut path has weighed on equities in recent weeks. However, a positive start to the corporate earnings season, with strong results from several major banks, has also provided support to the stock market this week. The S&P 500 bank index rose by 7.41% over the week. 'Stronger growth, feeding into better corporate earnings, you're kind of getting off to a start to the year here that there's plenty of questions both in terms of fiscal and monetary policy and what the Trump agenda will look like, or what shape it will take,' said Jim Baird, chief investment officer at Plante Moran Financial Advisors in Southfield, Michigan. 'Despite all those questions, we're starting the year on a reasonably better footing than we've been on perhaps in the last few years.'The Dow Jones Industrial Average rose 334.70 points, or 0.78%, to 43,487.83. The S&P 500 gained 59.32 points, or 1.00%, to 5,996.66, and the Nasdaq Composite increased 208.43 points, or 1.71%, to 12,226.22. For the week, the Dow rose 3.69%, the S&P gained 2.92%, and the Nasdaq climbed 2.43%. The benchmark 10-year U.S. Treasury note yield edged up 1.3 basis points to 4.619%, but has eased off a 14-month high of 4.809% hit earlier this week. Cleveland Fed President Beth Hammack stated that inflation persists as recent data indicates a resilient economy. However, Fed Governor Christopher Waller indicated on Thursday that the central bank could lower rates sooner and more aggressively than anticipated, as inflation is projected to continue easing. The Fed is widely expected to maintain rates steady at its policy meeting later this month. Market forecasts indicate a greater than 50% chance of a cut of at least 25 basis points by June, according to LSEG data. Nine out of the 11 S&P 500 sectors advanced, led by a 1.7% increase in consumer discretionary stocks. Healthcare and real estate declined. Meta shares edged up 0.24% while Snap dipped 3.21%. The S&P 500 recorded 24 new 52-week highs and no new lows, while the Nasdaq Composite registered 66 new highs and 73 new lows. Volume on U.S. exchanges was 14.57 billion shares, compared with the 15.65 billion average for the full session over the last 20 trading days

U.S. Stocks Dow Jones Industrial Average S&P 500 Nasdaq Composite Economy Interest Rates Trump Administration Corporate Earnings Inflation

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

European Stocks Rise on Optimism for Rate Cuts, Mining Stocks Lead GainsThe pan-European Stoxx 600 index climbed, fueled by hopes for interest rate cuts from the Bank of England. Mining stocks surged after reports of potential merger talks between Glencore and Rio Tinto. European economic data showed a slight uptick, but UK retail sales disappointed, leading to speculation about further easing by the Bank of England. Meanwhile, Wall Street futures also edged higher.

European Stocks Rise on Optimism for Rate Cuts, Mining Stocks Lead GainsThe pan-European Stoxx 600 index climbed, fueled by hopes for interest rate cuts from the Bank of England. Mining stocks surged after reports of potential merger talks between Glencore and Rio Tinto. European economic data showed a slight uptick, but UK retail sales disappointed, leading to speculation about further easing by the Bank of England. Meanwhile, Wall Street futures also edged higher.

Read more »

Honda Merger, Tech Stocks Rally, UK Economy GrowsThis CNBC Daily Open report covers news on a Honda merger, strong performance of tech stocks, growth in the UK economy, MicroStrategy's stock performance, and the impact of Bitcoin.

Honda Merger, Tech Stocks Rally, UK Economy GrowsThis CNBC Daily Open report covers news on a Honda merger, strong performance of tech stocks, growth in the UK economy, MicroStrategy's stock performance, and the impact of Bitcoin.

Read more »

![]() Taiwan Semiconductor Hits Record High, Tech Optimism Fuels RallyTaiwan Semiconductor Manufacturing Company (TSMC) soared to a new record high on Monday, driven by tech optimism spilling over from overnight markets. The surge extended to other chip heavyweights like Samsung Electronics and SK Hynix, while the broader Kosdaq index also saw gains.

Taiwan Semiconductor Hits Record High, Tech Optimism Fuels RallyTaiwan Semiconductor Manufacturing Company (TSMC) soared to a new record high on Monday, driven by tech optimism spilling over from overnight markets. The surge extended to other chip heavyweights like Samsung Electronics and SK Hynix, while the broader Kosdaq index also saw gains.

Read more »

AI16Z Rally Sparks Crypto Optimism Amidst Meme Index HypeThe crypto market is experiencing a surge in activity, led by a 20% jump in AI16Z's price. Meme Index, a new presale project, is also gaining traction after reaching a $2.4 million funding milestone. This renewed interest is fueled by political developments, particularly Donald Trump's potential return to office and its implications for crypto regulation. While some traders remain cautious, AI16Z's breakout and Meme Index's momentum suggest a shift toward optimism in the market.

AI16Z Rally Sparks Crypto Optimism Amidst Meme Index HypeThe crypto market is experiencing a surge in activity, led by a 20% jump in AI16Z's price. Meme Index, a new presale project, is also gaining traction after reaching a $2.4 million funding milestone. This renewed interest is fueled by political developments, particularly Donald Trump's potential return to office and its implications for crypto regulation. While some traders remain cautious, AI16Z's breakout and Meme Index's momentum suggest a shift toward optimism in the market.

Read more »

![]() Semiconductor Stocks Surge on AI OptimismSemiconductor stocks soared on Monday, fueled by positive developments in the artificial intelligence sector. Foxconn's record fourth-quarter revenue, driven by growth in AI-related products, underscored the continued investment in this technology. Nvidia shares jumped to a new high, with investors anticipating CEO Jensen Huang's keynote address at CES 2025.

Semiconductor Stocks Surge on AI OptimismSemiconductor stocks soared on Monday, fueled by positive developments in the artificial intelligence sector. Foxconn's record fourth-quarter revenue, driven by growth in AI-related products, underscored the continued investment in this technology. Nvidia shares jumped to a new high, with investors anticipating CEO Jensen Huang's keynote address at CES 2025.

Read more »

Asian Stocks Rise on Tech OptimismAsian stock markets saw gains on Tuesday, fueled by positive performance in US tech stocks, particularly Nvidia. The US dollar also weakened against major currencies.

Asian Stocks Rise on Tech OptimismAsian stock markets saw gains on Tuesday, fueled by positive performance in US tech stocks, particularly Nvidia. The US dollar also weakened against major currencies.

Read more »