American investors are growing less enamored with investment funds that market themselves as focused on environmental, social, and governance (ESG) goals.

21 Apr 2023

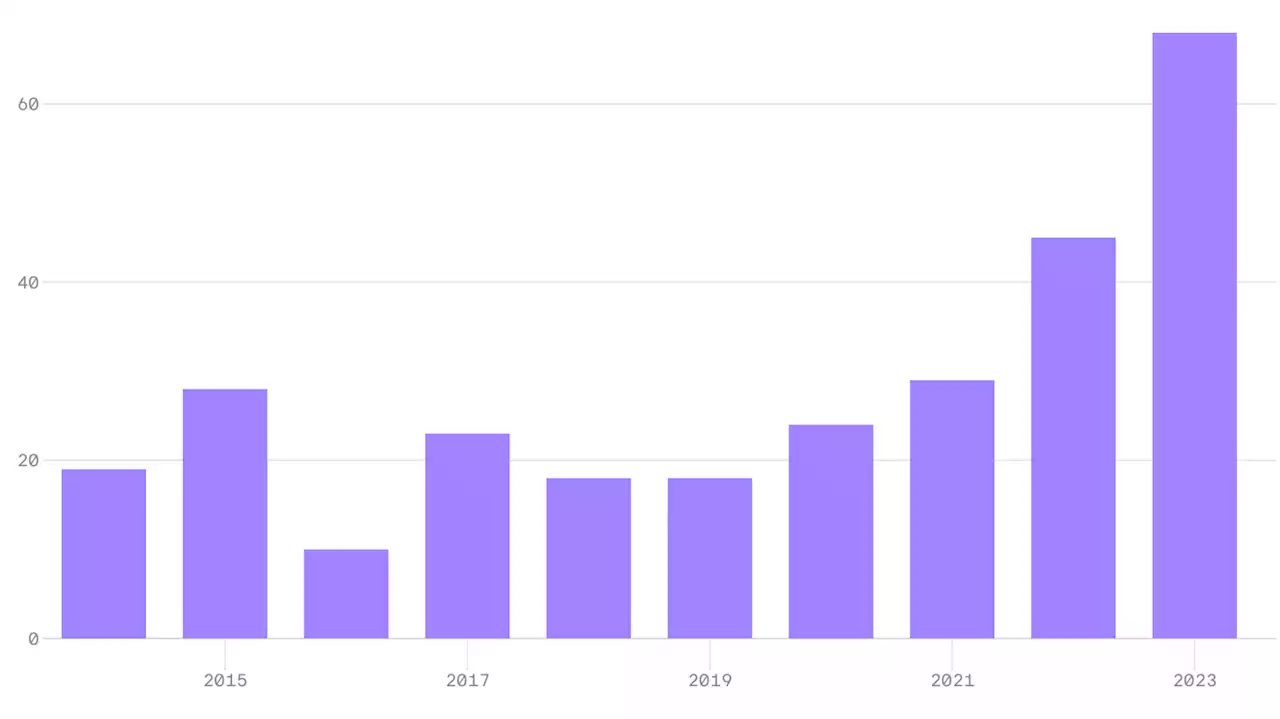

American investors are growing less enamored with investment funds that market themselves as focused on environmental, social, and governance goals. A report on Friday from analysts at Bank of America said that although ESG equity funds outperformed their benchmarks in the first three months of the year, in part because of the surge in tech stocks, March saw the largest outflows on record since 2015. Some $14 billion flowed out of ESG funds.“Waning interest in ESG amid political friction, and a shift to more defensive strategies ahead of an expected recession are likely drivers,” the bank said in a note to clients.

Global ESG stock funds saw outflows of around $11 billion in March, the first global decline of the year. Year-to-date the ESG funds have added around $7.7 billion.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Deutsche Bank plans to cut jobs, shrink boardIt plans to reduce its executive board to nine members from 10, a source said.

Deutsche Bank plans to cut jobs, shrink boardIt plans to reduce its executive board to nine members from 10, a source said.

Read more »

Deutsche Bank plans to cut jobs, shrink board - source By Reuters*DEUTSCHE BANK PLANS TO CUT JOBS, SHRINK EXECUTIVE BOARD IN COST DRIVE $DB 🇩🇪🇩🇪

Deutsche Bank plans to cut jobs, shrink board - source By Reuters*DEUTSCHE BANK PLANS TO CUT JOBS, SHRINK EXECUTIVE BOARD IN COST DRIVE $DB 🇩🇪🇩🇪

Read more »

Companies are laying low on ESG as backlash intensifiesPromoting environmental, social and governance policies was once an easy layup to score good press. Now, it's a way to court controversy, the ire of politicians, and attention from well-funded anti-ESG groups.

Companies are laying low on ESG as backlash intensifiesPromoting environmental, social and governance policies was once an easy layup to score good press. Now, it's a way to court controversy, the ire of politicians, and attention from well-funded anti-ESG groups.

Read more »

GOP bill takes on ESG banking rules to limit ‘woke’ investment decisionsRepublican Rep. Andy Barr is rolling out legislation that would prohibit banks from denying fair access to financial services for political purposes, Fox News Digital has learned.

GOP bill takes on ESG banking rules to limit ‘woke’ investment decisionsRepublican Rep. Andy Barr is rolling out legislation that would prohibit banks from denying fair access to financial services for political purposes, Fox News Digital has learned.

Read more »

China funds flock to Hong Kong to sate mainland investorsLarge China-based fund managers are setting up shop in Hong Kong for the first time, seeking to fill Chinese investors' appetite for U.S. dollar-based products and international exposure after the country reopened its borders.

China funds flock to Hong Kong to sate mainland investorsLarge China-based fund managers are setting up shop in Hong Kong for the first time, seeking to fill Chinese investors' appetite for U.S. dollar-based products and international exposure after the country reopened its borders.

Read more »