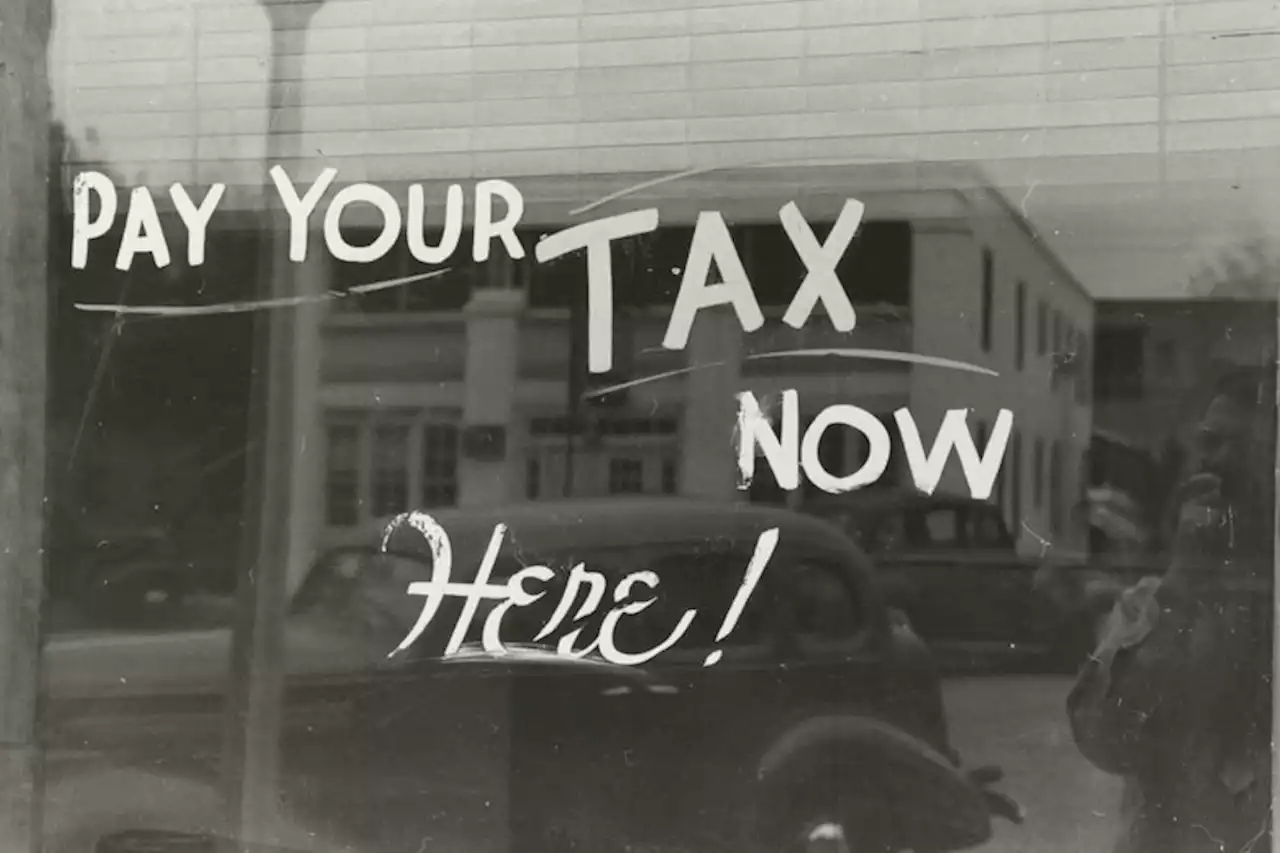

For 20 years, Intuit tried to ensure that as few people as possible used the truly free version of its product TurboTax.

For the vast majority of Americans, the IRS already knows what we owe in taxes. Instead of telling us, though, the IRS tasks us with filling out a slew of complicated forms and doing a bunch of arithmetic, which drives many people to tax-prep services.has been investigating the No. 1 tax prep software in the country: Intuit’s TurboTax.

To keep the IRS from moving in on its business, Intuit amped up its lobbying machine. One line of argument was that the IRS shouldn’t be in the business of being both the tax collector and the tax preparer, and Intuit seemed to offer a compromise.The industry led by Intuit, made a counteroffer to the Bush administration: a public-private partnership that became known as the free file program.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Tax Day 2022: How To Get A Bigger Tax RefundDon't miss these special tax breaks that are new or expanded and good for only 2021 tax year returns due on Monday, April 18, 2022 for most taxpayers.

Tax Day 2022: How To Get A Bigger Tax RefundDon't miss these special tax breaks that are new or expanded and good for only 2021 tax year returns due on Monday, April 18, 2022 for most taxpayers.

Read more »

Tax Day 2022: 5 Steps To A Faster Tax RefundThe IRS has issued 70 million tax refunds already this tax season. Get yours faster.

Tax Day 2022: 5 Steps To A Faster Tax RefundThe IRS has issued 70 million tax refunds already this tax season. Get yours faster.

Read more »

Tax Day 2022: 5 Steps To A Faster Tax RefundThe IRS has issued 70 million tax refunds already this tax season. Get yours faster.

Tax Day 2022: 5 Steps To A Faster Tax RefundThe IRS has issued 70 million tax refunds already this tax season. Get yours faster.

Read more »

Tax Day 2022: 5 Steps To A Faster Tax RefundThe IRS has issued 70 million tax refunds already this tax season. Get yours faster.

Tax Day 2022: 5 Steps To A Faster Tax RefundThe IRS has issued 70 million tax refunds already this tax season. Get yours faster.

Read more »

Tax Day 2022: 5 Steps To A Faster Tax RefundThe IRS has issued 70 million tax refunds already this tax season. Get yours faster.

Tax Day 2022: 5 Steps To A Faster Tax RefundThe IRS has issued 70 million tax refunds already this tax season. Get yours faster.

Read more »

FP Answers: What are the tax implications of joint investment accounts?There are some benefits to having your assets held jointly with your spouse, especially from an estate planning perspective

FP Answers: What are the tax implications of joint investment accounts?There are some benefits to having your assets held jointly with your spouse, especially from an estate planning perspective

Read more »