Trump's new tariffs on imports, particularly from China, have sent ripples throughout the cryptocurrency market, causing volatility and significant losses. While the short-term impact is undeniable, some experts believe these trade policies could create long-term opportunities for Bitcoin as investors seek safe havens amid economic uncertainty.

Donald Trump 's recent imposition of tariffs on imports from China, with those on Mexico and Canada delayed for a month, has triggered significant turmoil in the cryptocurrency market. The announcement resulted in widespread market reactions, impacting both traditional and crypto markets, leading to widespread sell-offs. Within a single day, the total cryptocurrency market value plummeted, with Bitcoin and Ethereum experiencing substantial declines.

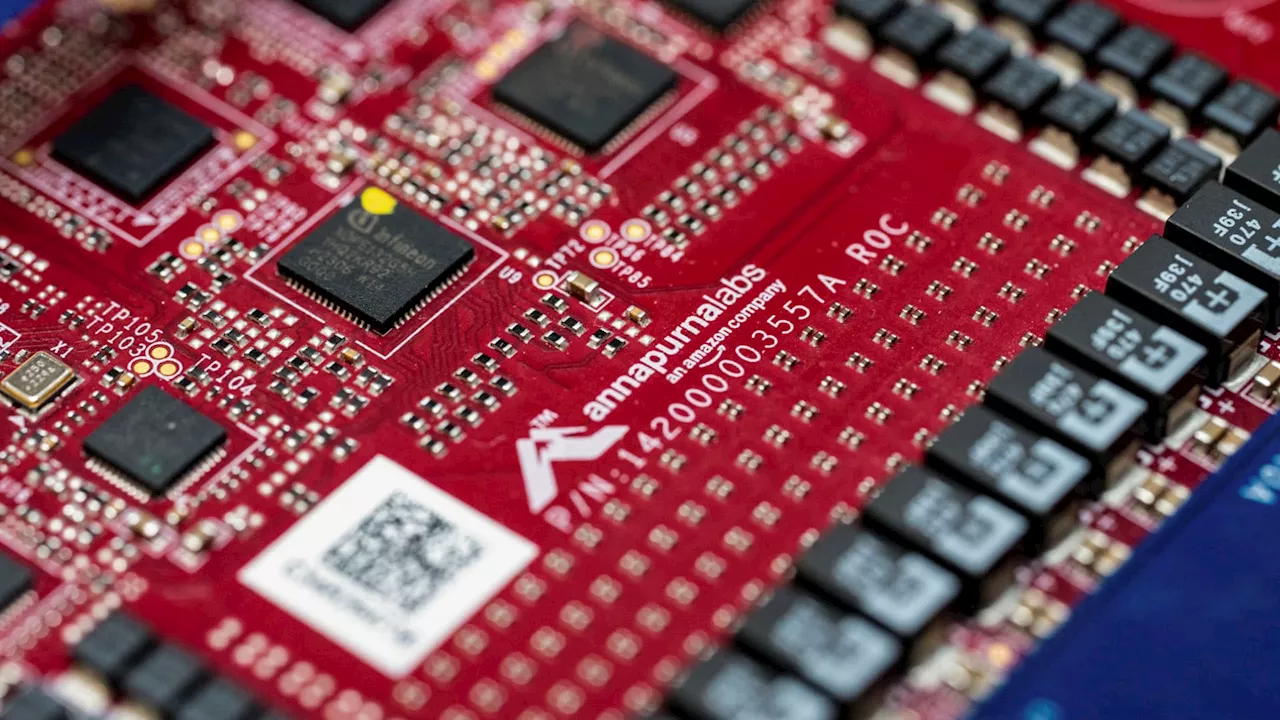

Billions were wiped out in market liquidations. A temporary delay on some tariffs provided a slight reprieve, allowing markets to recover marginally. XRP witnessed a rebound after its initial drop, and Bitcoin saw an uptick due to improved investor sentiment. However, anxieties persist regarding the potential consequences when tariffs are reconsidered next month. Tariffs are implemented by governments to regulate trade deficits and safeguard domestic industries. The U.S., characterized by a trade imbalance due to higher imports from key trading partners than exports, could experience increased prices, reduced demand, and diminished profits for companies reliant on global supply chains. This economic strain may incentivize investors to steer clear of riskier assets, such as cryptocurrencies. Despite the initial market downturn, some industry experts posit that tariffs could ultimately prove beneficial for Bitcoin. Historically, periods of economic instability have prompted investors to seek alternative assets as a hedge against inflation and market uncertainty. If tariffs contribute to inflation, Bitcoin's allure as a decentralized asset could intensify. Analysts suggest that economic pressures could stimulate demand for Bitcoin and digital currencies, particularly if the U.S. continues to signal its support for integrating crypto into financial strategies. A key concern revolves around the impact of these tariffs on cryptocurrency mining. The U.S. heavily relies on imported mining equipment, predominantly from China. The new trade policies have already exerted a detrimental effect on mining companies, with stock values experiencing a decline. Elevated costs for essential equipment could impede mining operations, compelling companies to explore innovative technologies and efficiency enhancements. Some analysts argue that this disruption could motivate the U.S. to bolster domestic production of mining hardware. There has been a growing discourse regarding reducing dependence on foreign manufacturers in crypto mining. Several U.S. companies have commenced producing mining hardware domestically, collaborating with energy providers to optimize efficiency. However, substantial investment is required to compete with major foreign suppliers and develop reliable domestic alternatives. Beyond the realm of cryptocurrency, the U.S. grapples with challenges in semiconductor production, a sector crucial to technology and artificial intelligence (AI). Semiconductors are indispensable for powering advanced technologies, including AI and data processing. Despite being one of the largest importers of semiconductor components, primarily from Asia, the U.S. recognizes the importance of securing a stable semiconductor supply chain, particularly as global competition for AI dominance intensifies. While tariffs induce short-term disruptions, they have the potential to stimulate increased domestic investment in mining, blockchain technology, and semiconductor production. The coming months will be pivotal in determining whether these economic shifts will ultimately fortify or weaken the cryptocurrency industry

Technology CRYPTOCURRENCY BITCOIN TARIFFS TRUMP ECONOMIC UNCERTAINTY INVESTORS MINING BLOCKCHAIN SEMICONDUCTORS AI

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Trump's Tariffs Send Shockwaves Through Global MarketsPresident Donald Trump's surprise implementation of tariffs on China, Canada, and Mexico has triggered a global market downturn. The tariffs are projected to slow economic growth, increase oil prices, raise consumer costs in the U.S., and sustain higher U.S. interest rates, strengthening the U.S. dollar. Businesses worldwide, particularly those in the automotive, chip, and consumer goods sectors, are bracing for impact.

Trump's Tariffs Send Shockwaves Through Global MarketsPresident Donald Trump's surprise implementation of tariffs on China, Canada, and Mexico has triggered a global market downturn. The tariffs are projected to slow economic growth, increase oil prices, raise consumer costs in the U.S., and sustain higher U.S. interest rates, strengthening the U.S. dollar. Businesses worldwide, particularly those in the automotive, chip, and consumer goods sectors, are bracing for impact.

Read more »

Trump's Tariffs Send Shockwaves Through U.S. Stock MarketU.S. President Donald Trump's implementation of tariffs on goods from Mexico, Canada, and China has sent shockwaves through the American stock market, affecting a wide range of industries and corporations. The tariffs, which aim to protect domestic industries and address trade imbalances, have sparked concerns about rising costs, supply chain disruptions, and a potential global trade war.

Trump's Tariffs Send Shockwaves Through U.S. Stock MarketU.S. President Donald Trump's implementation of tariffs on goods from Mexico, Canada, and China has sent shockwaves through the American stock market, affecting a wide range of industries and corporations. The tariffs, which aim to protect domestic industries and address trade imbalances, have sparked concerns about rising costs, supply chain disruptions, and a potential global trade war.

Read more »

Trump's Tariffs Send Shockwaves Through U.S. EconomyPresident Trump's tariffs on imports from Canada and Mexico have triggered a ripple effect across various sectors of the U.S. economy, from automotive manufacturing to technology and retail. The impact is felt most acutely by companies heavily reliant on cross-border trade, facing rising costs and supply chain disruptions.

Trump's Tariffs Send Shockwaves Through U.S. EconomyPresident Trump's tariffs on imports from Canada and Mexico have triggered a ripple effect across various sectors of the U.S. economy, from automotive manufacturing to technology and retail. The impact is felt most acutely by companies heavily reliant on cross-border trade, facing rising costs and supply chain disruptions.

Read more »

Trump tariffs: What do Trump’s executive orders say on tariffs and how would they work?President Donald Trump is using a trio of executive orders to throw the world economy and his own goal of cutting inflation into turmoil.

Trump tariffs: What do Trump’s executive orders say on tariffs and how would they work?President Donald Trump is using a trio of executive orders to throw the world economy and his own goal of cutting inflation into turmoil.

Read more »

Trump Tariffs Live Updates: Trump Approves 25% Steel And Aluminum TariffsEconomists have broadly predicted Trump’s tariffs will raise prices and harm the economy.

Trump Tariffs Live Updates: Trump Approves 25% Steel And Aluminum TariffsEconomists have broadly predicted Trump’s tariffs will raise prices and harm the economy.

Read more »

![]() Trump's Threat of Taiwan Semiconductor Tariffs Sends ShockwavesU.S. President Donald Trump's threat to impose tariffs of up to 100 percent on Taiwan's semiconductor industry has triggered widespread concern. Trump's comments, which came amid worries about China's technological advancements, threaten Taiwan's crucial role in the global chip supply chain.

Trump's Threat of Taiwan Semiconductor Tariffs Sends ShockwavesU.S. President Donald Trump's threat to impose tariffs of up to 100 percent on Taiwan's semiconductor industry has triggered widespread concern. Trump's comments, which came amid worries about China's technological advancements, threaten Taiwan's crucial role in the global chip supply chain.

Read more »