The agency was created to protect consumers after the 2008 financial crisis and subprime mortgage-lending scandal. Now it is effectively shut down.

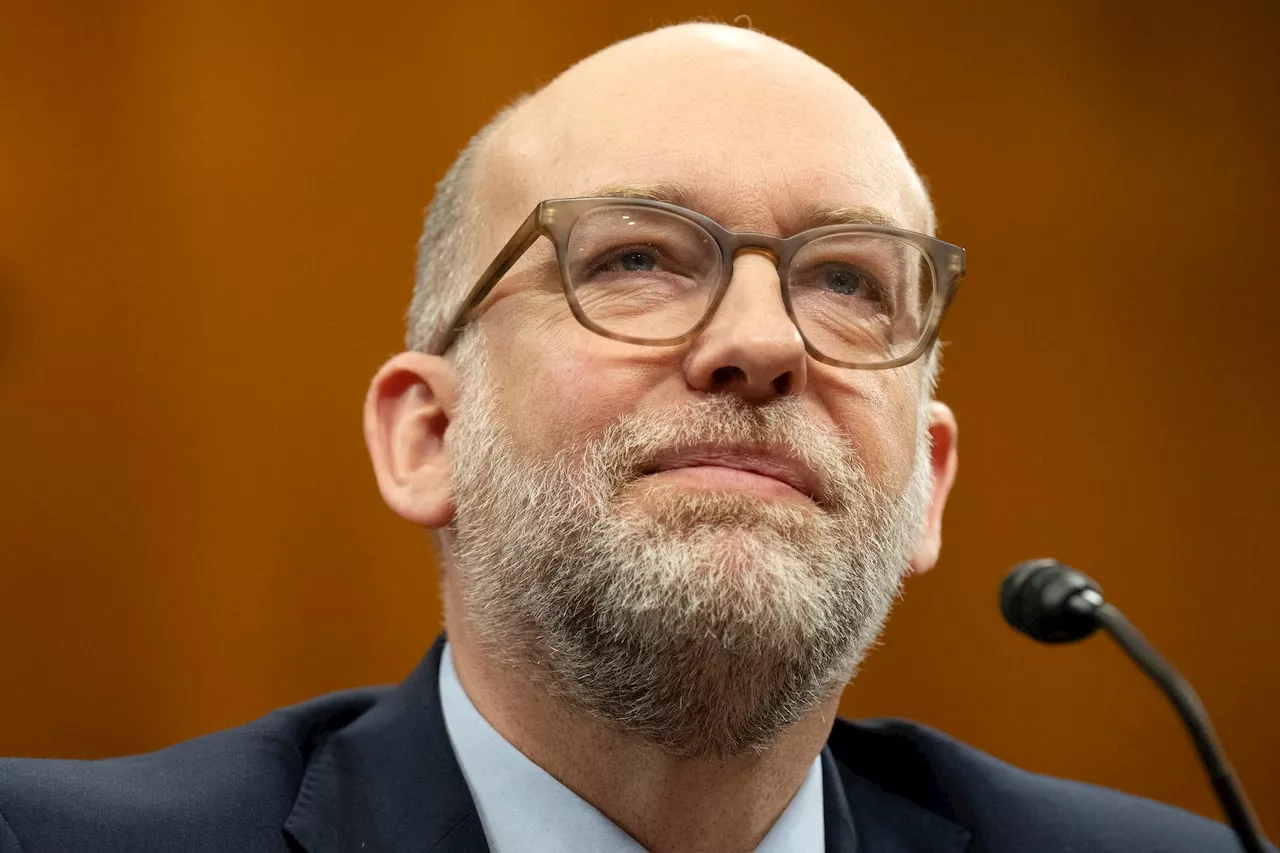

Russell Vought, President Donald Trump's choice for Director of the Office of Management and Budget, attends a Senate Budget Committee hearing on his nomination, on Capitol Hill in Washington, Wednesday, Jan. 22, 2025. administration has ordered the Consumer Financial Protection Bureau to stop nearly all its work, effectively shutting down an agency that was created to protect consumers after the 2008 financial crisis and subprime mortgage-lending scandal.

Also late Saturday, Vought said in a social media post that the CFPB would not withdraw its next round of funding from the Federal Reserve, adding that its current reserves of $711.6 million is “excessive.” Congress directed the bureau to be funded by the Fed to insulate it from political pressures. Dennis Kelleher, president of Better Markets, an advocacy group, said, “that’s why Wall Street’s biggest banks and Trump’s billionaire allies hate the bureau: it’s an effective cop on the finance beat and has stood side-by-side with hundreds of millions of Americans — Republicans and Democrats — battling financial predators, scammers, and crooks.”

The bureau can still take complaints, but it can’t conduct exams or pursue existing investigations, according to a person familiar with the agency who insisted on anonymity to discuss CFPB business. The memo is also interpreted as blocking it from communicating with companies it regulates, consumer advocates or other outside groups.

Obama spearheaded the creation of the bureau in the wake of the 2007-2008 housing bubble and financial crisis, which was caused in part by fraudulent mortgage lending. It was the brainchild of Massachusetts Democratic Sen. Elizabeth Warren and has attracted lawsuits from large banks and financial industry trade associations.

“I know that the Consumer Financial Protection Bureau is a favorite whipping boy of Republicans on this Committee, but the CFPB is the main agency in our government that is actively working to stop unfair de-banking,” she said at a hearing of the Senate Banking, Housing and Urban Affairs Committee.

@Pvigna Donald-Trump Russell-Vought Consumer-Financial-Protection-Agency

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

The 2008 Iron Man Movie Is Not In The MCU According To Wild Marvel TheoryThe 2008 Iron Man Movie Is Not In The MCU According To Wild Marvel Theory

The 2008 Iron Man Movie Is Not In The MCU According To Wild Marvel TheoryThe 2008 Iron Man Movie Is Not In The MCU According To Wild Marvel Theory

Read more »

Birmingham Airport Sees Passenger Traffic Boom, Reaching Best Numbers Since 2008Birmingham Airport experienced a significant surge in passenger traffic in 2023, exceeding 3.2 million travelers and marking the highest yearly total since 2008. This growth represents a 6% increase compared to the previous year and a remarkable recovery from the pandemic year of 2020, when passenger numbers plummeted to 1.27 million. The airport attributes this success to a steady and strong recovery since the pandemic, with enplanements, a key indicator of airport revenue, showing substantial growth.

Birmingham Airport Sees Passenger Traffic Boom, Reaching Best Numbers Since 2008Birmingham Airport experienced a significant surge in passenger traffic in 2023, exceeding 3.2 million travelers and marking the highest yearly total since 2008. This growth represents a 6% increase compared to the previous year and a remarkable recovery from the pandemic year of 2020, when passenger numbers plummeted to 1.27 million. The airport attributes this success to a steady and strong recovery since the pandemic, with enplanements, a key indicator of airport revenue, showing substantial growth.

Read more »

Bank of Japan Raises Rates to Highest Level Since 2008The Bank of Japan (BOJ) increased its policy rate by 25 basis points to 0.5%, marking its highest level since 2008. The decision was driven by the BOJ's aim to normalize its monetary policy. A majority of economists anticipated this hike. One BOJ member dissented, advocating for policy changes only after confirming an increase in firms' earning power. Senior BOJ officials, including Governor Kazuo Ueda and Deputy Governor Ryozo Himino, signaled their intention to raise rates. The BOJ is closely monitoring the 'shunto' wage negotiations and anticipates strong wage hikes in the 2025 fiscal year. Analysts predict a series of gradual hikes, potentially reaching 1% by year-end.

Bank of Japan Raises Rates to Highest Level Since 2008The Bank of Japan (BOJ) increased its policy rate by 25 basis points to 0.5%, marking its highest level since 2008. The decision was driven by the BOJ's aim to normalize its monetary policy. A majority of economists anticipated this hike. One BOJ member dissented, advocating for policy changes only after confirming an increase in firms' earning power. Senior BOJ officials, including Governor Kazuo Ueda and Deputy Governor Ryozo Himino, signaled their intention to raise rates. The BOJ is closely monitoring the 'shunto' wage negotiations and anticipates strong wage hikes in the 2025 fiscal year. Analysts predict a series of gradual hikes, potentially reaching 1% by year-end.

Read more »

Bank of Japan Raises Interest Rates to Highest Level Since 2008The Bank of Japan (BOJ) has made a significant move by raising interest rates for the first time in nearly a decade. This decision aims to normalize the central bank's monetary policy and combat rising inflation. The move was approved by a majority of the board, but one member dissented. Experts predict further gradual hikes in the coming months.

Bank of Japan Raises Interest Rates to Highest Level Since 2008The Bank of Japan (BOJ) has made a significant move by raising interest rates for the first time in nearly a decade. This decision aims to normalize the central bank's monetary policy and combat rising inflation. The move was approved by a majority of the board, but one member dissented. Experts predict further gradual hikes in the coming months.

Read more »

Bank of Japan Raises Interest Rates for First Time Since 2008The Bank of Japan (BOJ) broke with years of ultra-loose monetary policy, raising interest rates by 25 basis points to 0.5%. This move, driven by persistent inflation and rising wages, marks the first rate hike since 2008.

Bank of Japan Raises Interest Rates for First Time Since 2008The Bank of Japan (BOJ) broke with years of ultra-loose monetary policy, raising interest rates by 25 basis points to 0.5%. This move, driven by persistent inflation and rising wages, marks the first rate hike since 2008.

Read more »

Bank of Japan Raises Interest Rates to Highest Level Since 2008The Bank of Japan (BOJ) increased interest rates to their highest point since the 2008 global financial crisis, signaling confidence in rising wages and stable inflation.

Bank of Japan Raises Interest Rates to Highest Level Since 2008The Bank of Japan (BOJ) increased interest rates to their highest point since the 2008 global financial crisis, signaling confidence in rising wages and stable inflation.

Read more »