President Trump is finalizing his nominations for key financial regulatory positions, signaling a potential shift in oversight of the cryptocurrency industry. Jonathan Gould, a former OCC lawyer and Bitfury executive, is nominated to lead the OCC, while Jonathan McKernan, an FDIC official, is tapped for the CFPB.

President Donald Trump is nearing the completion of his nominations for key figures in financial regulation, shaping the future oversight of the cryptocurrency industry. Among the notable picks is Jonathan Gould, a former top lawyer at the Office of the Comptroller of the Currency (OCC) and a previous executive at Bitfury, a cryptocurrency-focused technology company.

Gould's nomination for OCC director could signal a renewed focus on crypto-friendly policies, potentially reviving the concept of limited-purpose national bank charters for crypto-specialized institutions. The selection of Jonathan McKernan, a Republican from the Federal Deposit Insurance Corp., to head the Consumer Financial Protection Bureau (CFPB), adds another layer to the financial regulatory landscape. McKernan's appointment comes amidst ongoing efforts by the Trump administration to reduce the CFPB's influence, which has drawn criticism from congressional Democrats. The CFPB's role in regulating financial products and services, including those related to cryptocurrency, is crucial for consumer protection and market stability. These nominations, along with other recent appointments to key financial regulatory bodies, reflect a pattern of choosing experienced individuals with established backgrounds in finance and regulatory affairs. Notably, Paul Atkins, a longtime securities consultant and former SEC commissioner, has been nominated to lead the Securities and Exchange Commission (SEC). Atkins's appointment, along with Gould's and McKernan's, signals a continuation of the Trump administration's approach to financial regulation: prioritizing stability and continuity over radical changes. The Senate still needs to confirm these nominees, a process that can take months and is not always guaranteed. However, the current selections suggest a strategic focus on filling key regulatory positions with individuals who possess the necessary experience and understanding of the evolving financial landscape, particularly in the context of emerging technologies like cryptocurrency

CRYPTOCURRENCY FINANCIAL REGULATION OFFICE OF THE COMPTROLLER OF THE CURRENCY CONSUMER FINANCIAL PROTECTION BUREAU NOMINATIONS PRESIDENT TRUMP

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Pentagon Leadership in Limbo as Trump Presidency NearsThe incoming Trump administration faces uncertainty regarding the leadership of the Pentagon and military services as key officials prepare to resign. The lack of confirmed civilian appointments has raised the possibility of military leaders temporarily assuming control.

Pentagon Leadership in Limbo as Trump Presidency NearsThe incoming Trump administration faces uncertainty regarding the leadership of the Pentagon and military services as key officials prepare to resign. The lack of confirmed civilian appointments has raised the possibility of military leaders temporarily assuming control.

Read more »

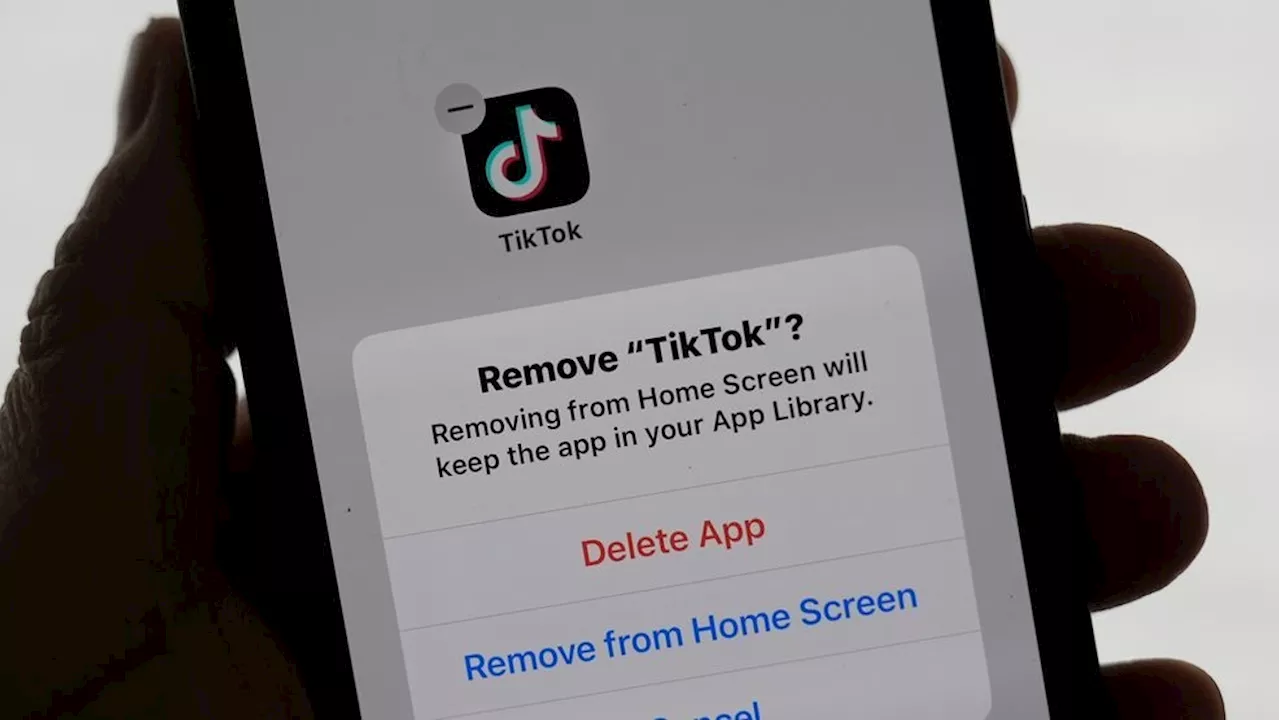

Trump Signals TikTok Extension as US Ban NearsPresident-elect Donald Trump indicates he is likely to grant TikTok a 90-day extension to avoid a US ban, leaving the fate of the popular video app hanging in the balance as the transition of power commences.

Trump Signals TikTok Extension as US Ban NearsPresident-elect Donald Trump indicates he is likely to grant TikTok a 90-day extension to avoid a US ban, leaving the fate of the popular video app hanging in the balance as the transition of power commences.

Read more »

TRUMP Overtakes SHIB in Meme Coin Battle, BTC Nears $105K (Weekend Watch)Crypto Blog

TRUMP Overtakes SHIB in Meme Coin Battle, BTC Nears $105K (Weekend Watch)Crypto Blog

Read more »

'People's March' in NYC rallies for social justice as second Trump inauguration nears |Two days before Donald Trump's second inauguration as president, a few thousand New Yorkers took to the streets Saturday for the 'People's March,' reminding

'People's March' in NYC rallies for social justice as second Trump inauguration nears |Two days before Donald Trump's second inauguration as president, a few thousand New Yorkers took to the streets Saturday for the 'People's March,' reminding

Read more »

Trump Approval Rating Nears First Net Positive—Can it Last?For how long will Donald Trump enjoy this surge in favorability when he takes office? Experts weigh in.

Trump Approval Rating Nears First Net Positive—Can it Last?For how long will Donald Trump enjoy this surge in favorability when he takes office? Experts weigh in.

Read more »

Wall Street Nears Record Highs Amid Trump's Pro-Business AgendaMajor US stock indexes are surging towards record highs, fueled by optimism surrounding President Trump's second term policies, including deregulation and potential tax cuts. While trade tensions with key partners like Canada, Mexico and China pose a risk, many analysts predict a continued upward trend for equities.

Wall Street Nears Record Highs Amid Trump's Pro-Business AgendaMajor US stock indexes are surging towards record highs, fueled by optimism surrounding President Trump's second term policies, including deregulation and potential tax cuts. While trade tensions with key partners like Canada, Mexico and China pose a risk, many analysts predict a continued upward trend for equities.

Read more »