The Dow Jones Industrial Average gained 1.2% last week. Yet it was anything but a smooth ride for investors.

The Dow on Wednesday suffered a 530-point drop after the Federal Reserve raised rates. Fed Chair Jerome Powell also noted that financial conditions " seem to have tightened " after the failure of three banks in March. The Dow posted solid gains Thursday and Friday, but they came after the 30-stock average swung between intraday gains and losses — as the market assessed future monetary policy moves and the state of the global banking system. .

" However, he added that "inventory accumulation in PCs makes the near-term outlook for Client Computing tougher than previously expected, with continued share loss in server dragging further on revenue recovery." Another stock that made the list is 3M . The Scotch tape and Post-it note maker has sell ratings from 19% of analysts covering it. The average price target on the stock implies upside of roughly 15%, but the stock has fallen 15.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Meet Peter Tuchman, the most photographed stock trader on Wall StreetWhat You Need To Know About Markets And The Economy

Read more »

Wall Street falls as bank contagion fears flare upWall Street's main indexes fell on Friday as investors fled from risky assets on growing concerns that a contagion in the banking sector had not been fully confined despite assurances from key officials.

Wall Street falls as bank contagion fears flare upWall Street's main indexes fell on Friday as investors fled from risky assets on growing concerns that a contagion in the banking sector had not been fully confined despite assurances from key officials.

Read more »

Wall Street ends volatile week higher as Fed officials ease bank fearsU.S. stocks closed higher on Friday, marking the end of a tumultuous week as Federal Reserve officials calmed investor fears over a potential liquidity crisis in the banking sector.

Wall Street ends volatile week higher as Fed officials ease bank fearsU.S. stocks closed higher on Friday, marking the end of a tumultuous week as Federal Reserve officials calmed investor fears over a potential liquidity crisis in the banking sector.

Read more »

Wall Street ends volatile week higher as Fed officials ease bank fears By Reuters*WALL STREET ENDS VOLATILE WEEK HIGHER AS FED OFFICIALS EASE BANK FEARS $DIA $SPY $QQQ 🇺🇸🇺🇸

Wall Street ends volatile week higher as Fed officials ease bank fears By Reuters*WALL STREET ENDS VOLATILE WEEK HIGHER AS FED OFFICIALS EASE BANK FEARS $DIA $SPY $QQQ 🇺🇸🇺🇸

Read more »

Analysis: Wall Street push for bank rescues clashes with Washington realitiesThe banking crisis set off by the swift collapse of Silicon Valley Bank has exposed a sharp disconnect between Washington and Wall Street. Bankers want faster, more aggressive action to shore up the industry, while the Biden White House and regulators argue they've done what they can within the limits of the law.

Analysis: Wall Street push for bank rescues clashes with Washington realitiesThe banking crisis set off by the swift collapse of Silicon Valley Bank has exposed a sharp disconnect between Washington and Wall Street. Bankers want faster, more aggressive action to shore up the industry, while the Biden White House and regulators argue they've done what they can within the limits of the law.

Read more »

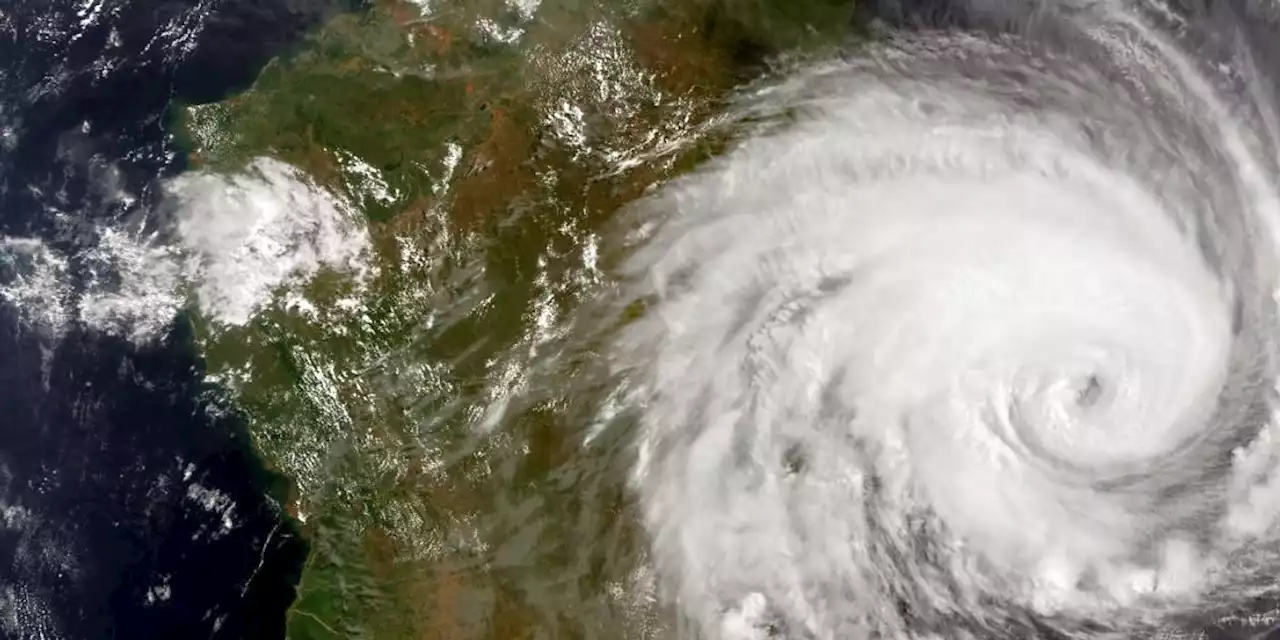

From the African Coast to Towers of Wall Street, the Climate Bombs Are TickingThe devastation of Cyclone Freddy serves as a stark illustration of the warnings included in the new IPCC report.

From the African Coast to Towers of Wall Street, the Climate Bombs Are TickingThe devastation of Cyclone Freddy serves as a stark illustration of the warnings included in the new IPCC report.

Read more »