The list of negatives surrounding stocks is growing, according to BCA Research.

Chief strategist Irene Tunkel warned in a note Monday that she doesn't "anticipate new market highs within the next three months — there are too many negative crosscurrents for equities." "Over the next three months, U.S. equity investors face slowing economic growth, the unwinding of carry trades, skepticism about , uncertainty about the Fed easing campaign, and a run-up to the Presidential election," Tunkel added.

Earlier this year it called for a decline of 1%. Shares were down slightly in the premarket. BCA also pointed out that, even though the stock market has been clamoring for lower interest rates to boost valuations and lift consumers, equities have a history of correcting after the first rate reduction of a cycle — "even if it were to stave off recession.

Stock Markets Wells Fargo & Co Business News

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

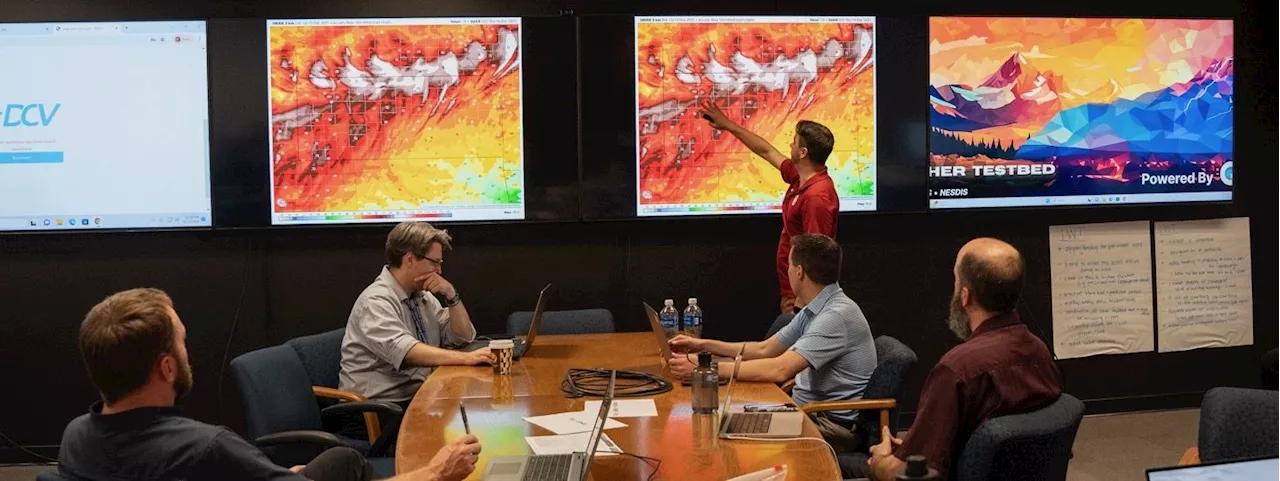

NOAA tests next-generation wildfire detection and warning toolsOceanic and Atmospheric Research (OAR) - or NOAA Research - provides the research foundation for understanding the complex systems that support our planet.

NOAA tests next-generation wildfire detection and warning toolsOceanic and Atmospheric Research (OAR) - or NOAA Research - provides the research foundation for understanding the complex systems that support our planet.

Read more »

S&P 500 to drop to 3750 in 2025: BCAS&P 500 to drop to 3750 in 2025: BCA

S&P 500 to drop to 3750 in 2025: BCAS&P 500 to drop to 3750 in 2025: BCA

Read more »

There's not enough money on the sidelines to sustain the S&P 500 rally: BCAThere's not enough money on the sidelines to sustain the S&P 500 rally: BCA

There's not enough money on the sidelines to sustain the S&P 500 rally: BCAThere's not enough money on the sidelines to sustain the S&P 500 rally: BCA

Read more »

Eurozone heading into recession, sell EUR/USDEurozone heading into recession, sell EUR/USD - BCA

Eurozone heading into recession, sell EUR/USDEurozone heading into recession, sell EUR/USD - BCA

Read more »

6 reasons why U.S. economy may not achieve soft landing: BCA6 reasons why U.S. economy may not achieve soft landing: BCA

6 reasons why U.S. economy may not achieve soft landing: BCA6 reasons why U.S. economy may not achieve soft landing: BCA

Read more »

6 reasons why U.S. economy may not achieve soft landing: BCA6 reasons why U.S. economy may not achieve soft landing: BCA

6 reasons why U.S. economy may not achieve soft landing: BCA6 reasons why U.S. economy may not achieve soft landing: BCA

Read more »