This article explores the affordability challenges of private college for low-income students, highlighting how living at home emerges as a crucial strategy to mitigate expenses. It delves into the experiences of various students, showcasing the sacrifices they make to pursue higher education while grappling with financial constraints.

Private colleges, unlike their state-funded counterparts, don't receive direct state subsidies. This stark reality often poses a significant financial challenge, particularly for lower-income families seeking a bachelor's degree. Michael Itzkowitz, a researcher specializing in the value of college, pointed out the affordability gap, stating, 'I can't imagine how a lower-income family can fork up over $80,000 for one student to earn a bachelor's degree' at a private nonprofit college.

Those private colleges, he added, 'continue to be much less affordable for all students in comparison to many of the public institutions located within the state.' The federal government collects data on the net price of attending college, but this information comes with limitations. It primarily focuses on full-time freshmen who utilize federal loans or grants, excluding a substantial portion of well-off families. While the federal government publishes 2022-23 net price data for individual schools, its comprehensive data for all campuses currently ends at 2021-22. Therefore, CalMatters' analysis of school-wide data relied on the 2021-22 figures.For many students, the pursuit of higher education necessitates creative strategies to manage costs. Sophomore Monserrat Herrera, attending Dominican University in the San Francisco Bay Area, exemplifies this approach. She commutes approximately 11 miles from her home in Novato, saving significantly on on-campus housing costs. While she received acceptance into several UC and Cal State campuses, Dominican's proximity and direct-entry nursing program appealed to her. Conversely, Erykah Glass encountered a more challenging financial journey during her sophomore year at the University of San Francisco. To cover her on-campus housing expenses, she took on a demanding midnight to 6 a.m. graveyard shift. This grueling schedule took a toll on her mental health and academic performance. Despite her time constraints, Glass found ways to participate in campus life, joining the women's club soccer team, albeit limited to Mondays due to her work commitments. The federal data on college net price often fails to capture the complexities of student expenses. At the University of La Verne, 57% of full-time freshmen resided at home in 2021-22, according to Laura Evans, director of financial aid. Notably, 59% of low-income students receiving Pell Grants also lived at home. This suggests that many students aren't incurring rent expenses, yet the federal government's cost calculations still factor in a housing cost. Evans advocates for distinguishing between realized costs and theoretical costs, emphasizing that for students living at home, realized costs primarily encompass tuition and fees, which amount to approximately $48,000 annually at La Verne. For commuter students from low-income backgrounds, financial aid often covers a substantial portion of their actual expenses. In 2021-22, the financial aid received by these students largely offset their costs, leaving them with a manageable net price of around $9,780. This remaining amount can be covered through a combination of federal student loans ($5,500) and part-time work (about 5 hours per week). La Verne stands out for its flexibility, not requiring freshmen to reside on campus, which significantly contributes to its affordability. Living at home emerges as a key strategy for low-income students to make a private college education feasible. Leandra Cardenas, a second-year student at Loyola Marymount, exemplifies this approach. By residing with her father, she effectively attends the university for free, as state, federal, and campus grants cover her tuition. Cardenas commutes from Hollywood, spending up to two hours on the bus each day to reach her 8 a.m. class. While driving with her father occasionally helps mitigate transportation costs, the rising price of gas remains a concern. On-campus housing at Loyola Marymount, in a double room, costs approximately $14,000 per year. The financial burdens faced by low-income students extend beyond tuition. They often find themselves working long hours to cover essential expenses like food and transportation. Mika Panahon, a senior at USC, experienced this firsthand during her first year. Despite having her tuition covered almost entirely through financial aid, Panahon worked at grocery stores and fast-food restaurants, spending only two days on campus to meet her financial obligations.

Private College Affordability Low-Income Students Financial Aid Commuter Students College Costs

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Underfunded IRS: A Hidden Cost to the US EconomyThe Republican-led Congress's cuts to the IRS budget have significant implications for the US economy.

Underfunded IRS: A Hidden Cost to the US EconomyThe Republican-led Congress's cuts to the IRS budget have significant implications for the US economy.

Read more »

The Hidden Cost of Juggling Work and ParenthoodThis article explores the effects of busy schedules on working parents, highlighting their strategies for managing time and the potential drawbacks of these strategies.

The Hidden Cost of Juggling Work and ParenthoodThis article explores the effects of busy schedules on working parents, highlighting their strategies for managing time and the potential drawbacks of these strategies.

Read more »

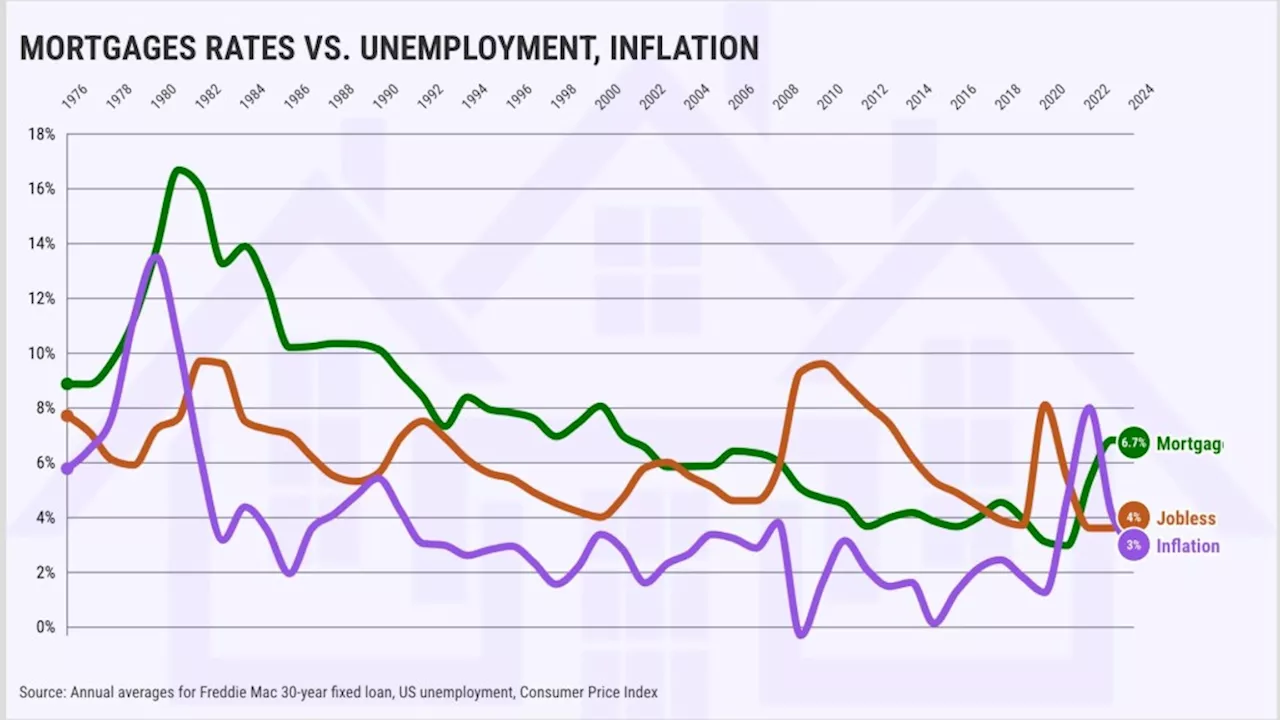

Cheaper Mortgages Often Come With a Hidden CostAnalysis of historical data reveals that while lower mortgage rates can make homeownership more affordable, they often coincide with a weaker economy, potentially leading to higher unemployment and slower home price appreciation.

Cheaper Mortgages Often Come With a Hidden CostAnalysis of historical data reveals that while lower mortgage rates can make homeownership more affordable, they often coincide with a weaker economy, potentially leading to higher unemployment and slower home price appreciation.

Read more »

Credit Card Swipe Fees: A Hidden Cost Impacting Your WalletThe article explores how credit card swipe fees, a significant expense for retailers, are ultimately passed on to consumers, increasing household costs and impacting buying power.

Credit Card Swipe Fees: A Hidden Cost Impacting Your WalletThe article explores how credit card swipe fees, a significant expense for retailers, are ultimately passed on to consumers, increasing household costs and impacting buying power.

Read more »

The Hidden Environmental Cost of AI ChatbotsThis article explores the surprising environmental impact of AI chatbots, highlighting their significant energy and water consumption. It uses the example of ChatGPT to illustrate the resource drain associated with even simple tasks like sending an email. The article connects these findings to the urgency of addressing climate change and the need for sustainable practices.

The Hidden Environmental Cost of AI ChatbotsThis article explores the surprising environmental impact of AI chatbots, highlighting their significant energy and water consumption. It uses the example of ChatGPT to illustrate the resource drain associated with even simple tasks like sending an email. The article connects these findings to the urgency of addressing climate change and the need for sustainable practices.

Read more »

The Hidden Cost of Selling to Unrepresented BuyersA homeowner details his experience navigating the new regulations requiring buyers to pay their own agents, uncovering a hidden fee sellers may be unknowingly paying. He questions the justification for this additional fee, claiming the seller's agent took on no additional meaningful work or liability.

The Hidden Cost of Selling to Unrepresented BuyersA homeowner details his experience navigating the new regulations requiring buyers to pay their own agents, uncovering a hidden fee sellers may be unknowingly paying. He questions the justification for this additional fee, claiming the seller's agent took on no additional meaningful work or liability.

Read more »