Editorial: The chancellor’s wife may have breached no law, but her deliberate choice sends a socially divisive message

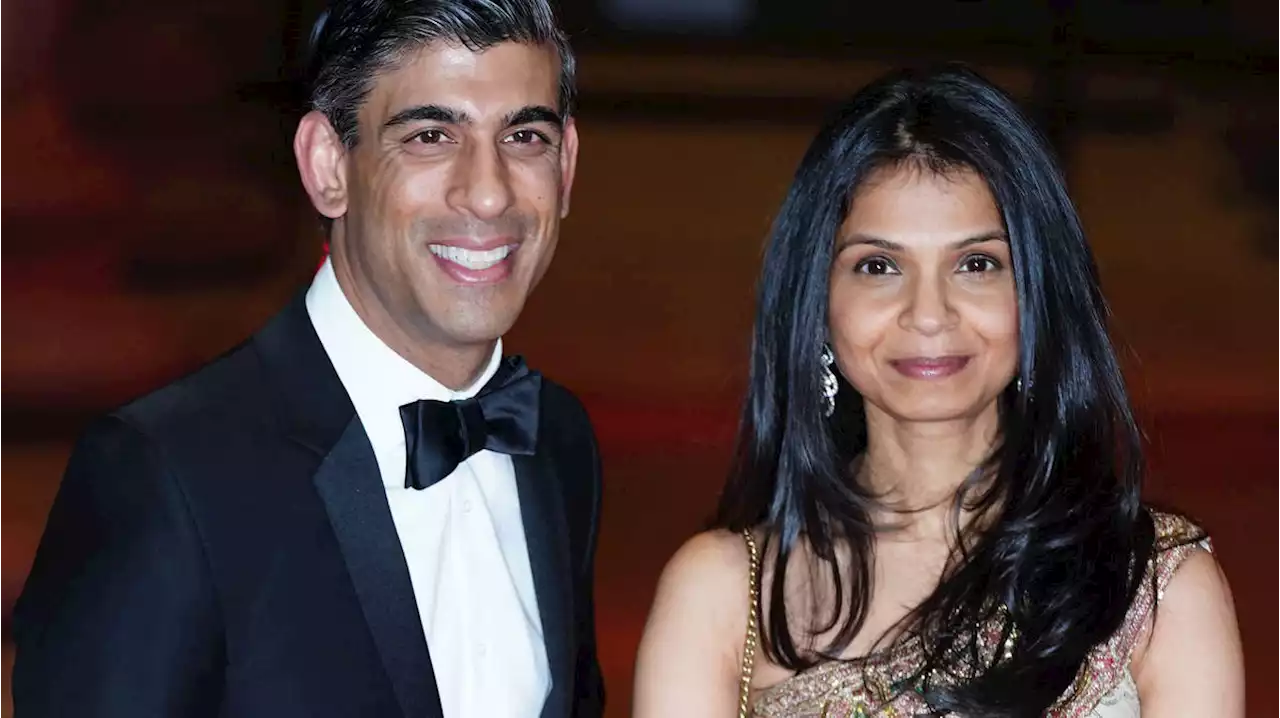

in the UK. This means that she pays no UK tax on her overseas earnings, on the basis that her permanent home is not here. Ms Murty is very, very rich indeed. Her stake in her Indian father’s technology business alone is worth an estimated £690m. She would have received around £11.5m in dividends from these shares in the last tax year. If she was a UK taxpayer, the Treasury would have taxed that at a rate of 38.1%, bringing in well over £4m a year to the public finances.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Akshata Murty’s non-dom status is a choice not an obligation – tax expertsLike other UK non-doms Rishi Sunak’s wife had to apply for the tax status with HMRC, despite her statements

Akshata Murty’s non-dom status is a choice not an obligation – tax expertsLike other UK non-doms Rishi Sunak’s wife had to apply for the tax status with HMRC, despite her statements

Read more »

Labour says Rishi Sunak must ‘come clean’ about wife’s non-dom tax statusKeir Starmer says it would be ‘breathtaking hypocrisy’ if Akshata Murty was using schemes to reduce tax

Labour says Rishi Sunak must ‘come clean’ about wife’s non-dom tax statusKeir Starmer says it would be ‘breathtaking hypocrisy’ if Akshata Murty was using schemes to reduce tax

Read more »

Embarrassment For Rishi Sunak As Wife's Non-Dom Tax Status Is RevealedAkshata Murty does not pay tax on her overseas earnings thanks to her Indian citizenship.

Embarrassment For Rishi Sunak As Wife's Non-Dom Tax Status Is RevealedAkshata Murty does not pay tax on her overseas earnings thanks to her Indian citizenship.

Read more »

Akshata Murthy: What is non-dom status?The Chancellor’s wife has claimed non-dom status and linked it to her Indian citizenship, but is she right to do so and what is a non-dom?

Akshata Murthy: What is non-dom status?The Chancellor’s wife has claimed non-dom status and linked it to her Indian citizenship, but is she right to do so and what is a non-dom?

Read more »

'Keep families out of it' Boris says amid row over non-dom status of Sunak's wifeBoris Johnson has suggested it is wrong to probe Rishi Sunak's wife's non-dom tax status because families should be kept out of politics.

'Keep families out of it' Boris says amid row over non-dom status of Sunak's wifeBoris Johnson has suggested it is wrong to probe Rishi Sunak's wife's non-dom tax status because families should be kept out of politics.

Read more »

Rishi Sunak faces questions over wife Akshata Murty's non-dom tax statusOpposition parties urge the chancellor to 'come clean' over a legal tax status claimed by his wife.

Rishi Sunak faces questions over wife Akshata Murty's non-dom tax statusOpposition parties urge the chancellor to 'come clean' over a legal tax status claimed by his wife.

Read more »