The internet is spreading misinformation about using FERPA complaints to erase student loan debt. Legal experts and student debt advocates clarify the limitations of FERPA and advise borrowers to prioritize staying current on payments and exploring alternative repayment options.

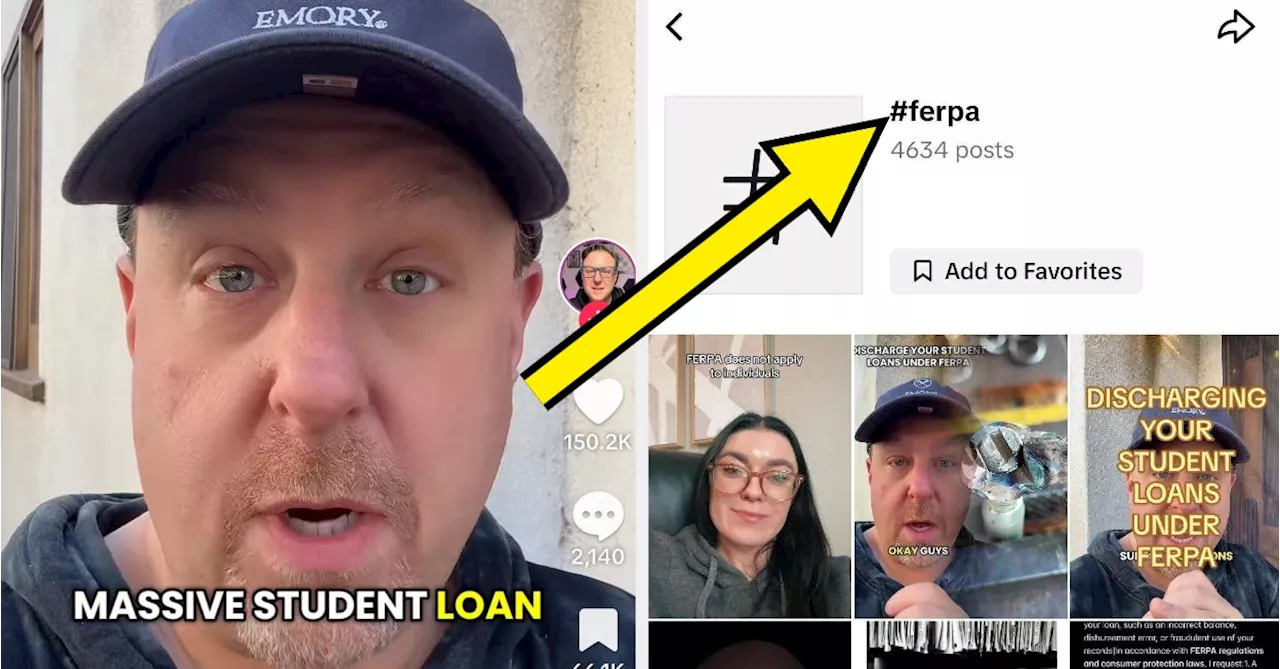

The internet is abuzz with claims that filing a specific privacy complaint under FERPA (the Family Education al Rights and Privacy Act ) can erase student loan debt. This viral theory stems from concerns about Elon Musk and the DOGE community potentially accessing student loan borrower information without consent. A federal suit aims to prevent DOGE from accessing student financial aid data, citing the Privacy Act of 1974.

While a judge has temporarily halted DOGE's access, this hold is set to expire soon, prompting discussions about individual rights and data privacy in this context.However, legal experts caution against relying on FERPA complaints for student loan forgiveness. Attorney Daniel Fleischman, a seasoned consumer law specialist, explains that FERPA does not grant individuals the right to sue for violations. He emphasizes that the US Supreme Court has ruled against such private lawsuits, stating that the right to enforce FERPA falls solely to the federal government, specifically the US Department of Education or the Consumer Financial Protection Bureau (CFPB). Fleischman's video has gained traction on TikTok, clarifying the legal limitations surrounding FERPA complaints and shedding light on the misconception that they can lead to student loan discharge.The Student Debt Crisis Center, a non-profit advocating for student debt cancellation, also debunks the FERPA claim. They state that no known cases have resulted in debt relief through FERPA complaints. Additionally, they highlight the potential consequences of missed payments while borrowers await a resolution to this issue. They advise borrowers to stay current on their payments and explore income-driven repayment plans, such as the SAVE plan, which offers $0 monthly payments for certain lower-income individuals. The center emphasizes the importance of informed decision-making and realistic expectations regarding student debt relief strategies

Finance Legal FERPA Student Loans Debt Relief Privacy Act Consumer Protection Income-Driven Repayment

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Federal Student Loan Defaults to Resume Collection Activity Including Wage GarnishmentThe Biden administration warns of the resumption of collection activities on defaulted federal student loans, including wage garnishment and Social Security benefit offsets, starting in October 2024 and August 2024 respectively. The memo outlines strategies to help borrowers stay current on their payments and avoid default, such as making it easier to enroll in income-driven repayment plans and offering greater protection of Social Security benefits from offsets.

Federal Student Loan Defaults to Resume Collection Activity Including Wage GarnishmentThe Biden administration warns of the resumption of collection activities on defaulted federal student loans, including wage garnishment and Social Security benefit offsets, starting in October 2024 and August 2024 respectively. The memo outlines strategies to help borrowers stay current on their payments and avoid default, such as making it easier to enroll in income-driven repayment plans and offering greater protection of Social Security benefits from offsets.

Read more »

Republicans Propose to Eliminate Student Loan ForgivenessThe House Freedom Caucus has introduced a proposal to repeal much of President Biden's student loan forgiveness initiatives, potentially impacting millions of Americans. The proposal, known as the '218' Reconciliation Proposal, aims to cut funds for Biden's student loan forgiveness programs, including the SAVE income-driven repayment plan, and eliminate forgiveness options for students who have incurred excessive loan interest.

Republicans Propose to Eliminate Student Loan ForgivenessThe House Freedom Caucus has introduced a proposal to repeal much of President Biden's student loan forgiveness initiatives, potentially impacting millions of Americans. The proposal, known as the '218' Reconciliation Proposal, aims to cut funds for Biden's student loan forgiveness programs, including the SAVE income-driven repayment plan, and eliminate forgiveness options for students who have incurred excessive loan interest.

Read more »

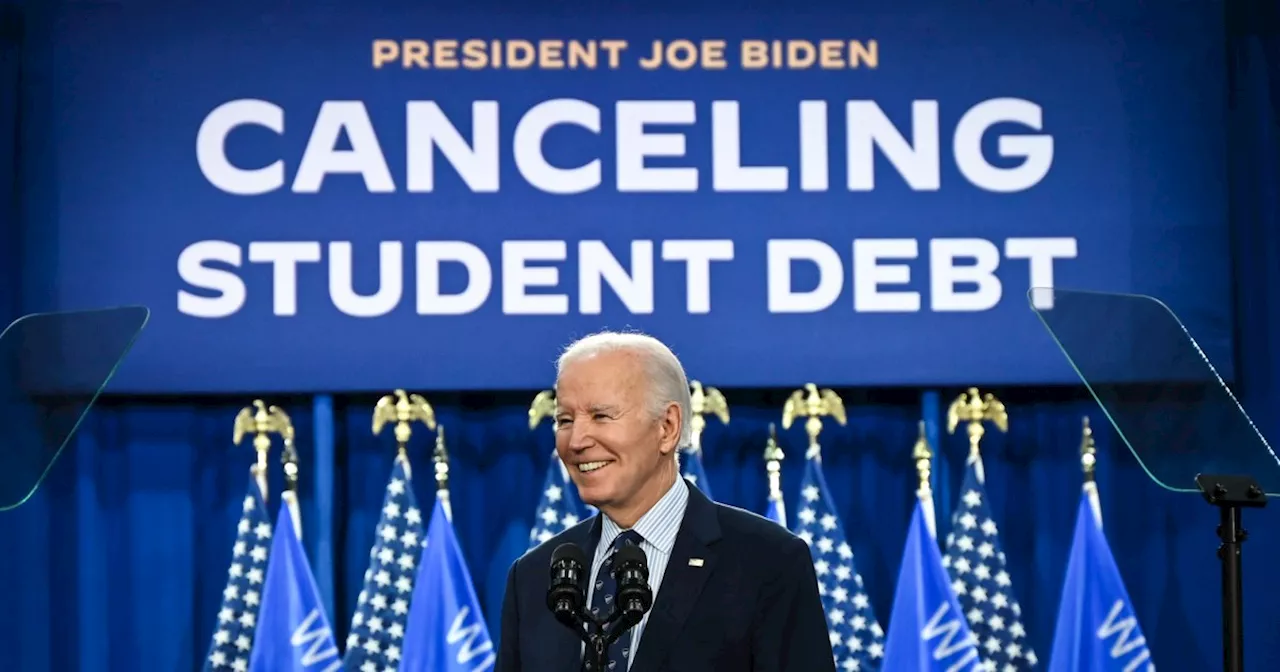

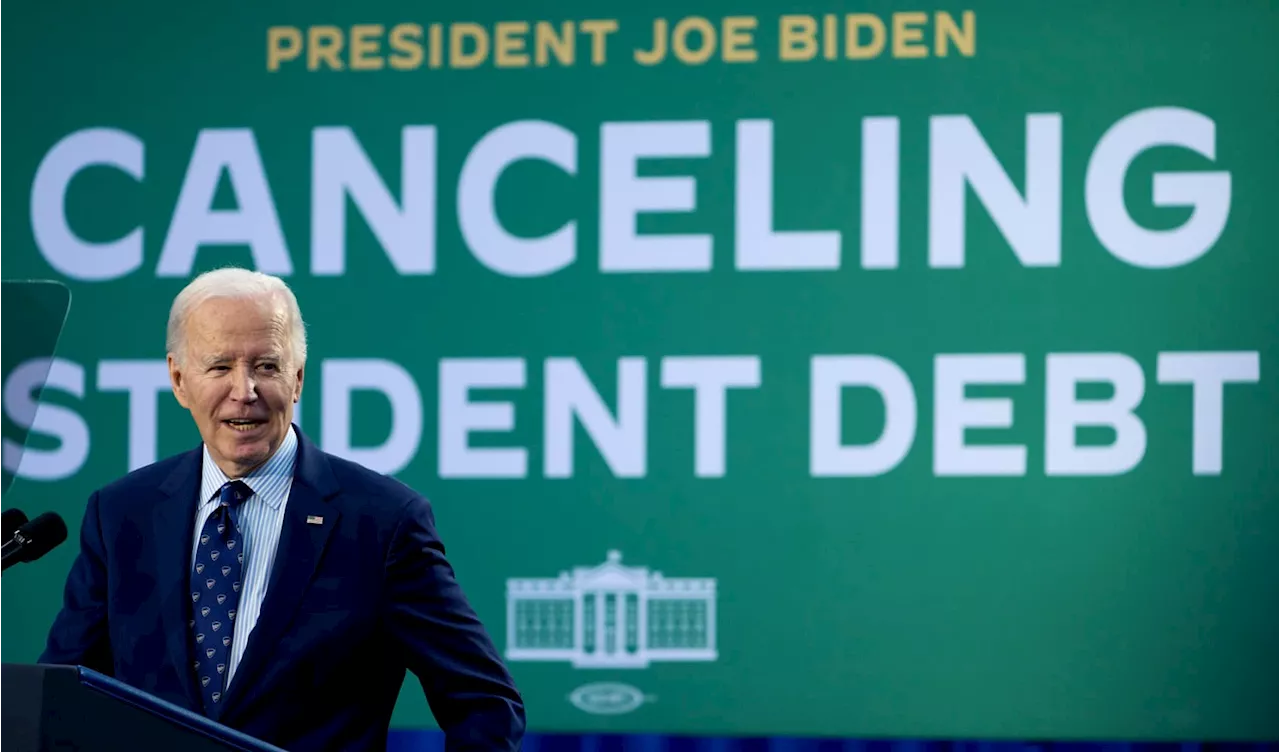

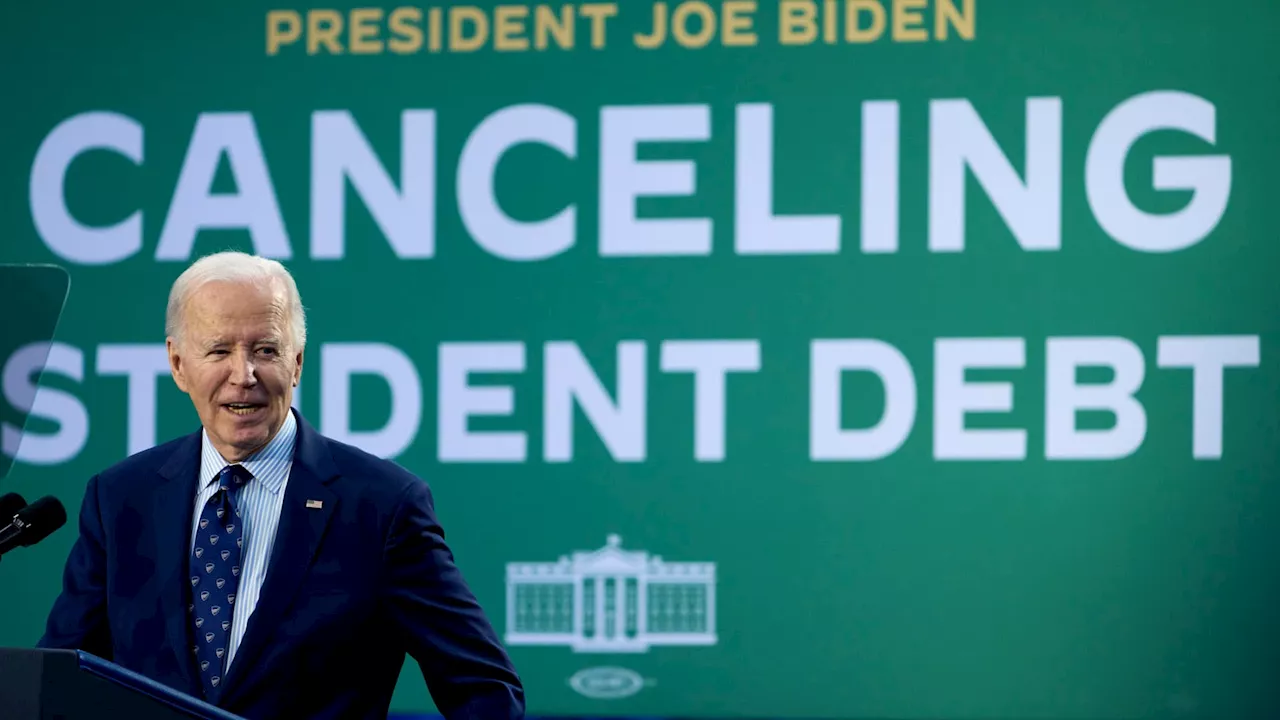

Biden Administration Announces Final Round of Student Loan ForgivenessThe Biden administration announced its final round of student loan forgiveness, discharging over $600 million in debt for thousands of borrowers. This relief includes 4,550 borrowers entitled to debt cancellation through the Income-Based Repayment plan and 4,100 former students of DeVry University. The U.S. Department of Education also completed its payment count adjustment for borrowers in income-driven repayment plans, aiming to ensure accurate tracking of their eligibility for loan forgiveness.

Biden Administration Announces Final Round of Student Loan ForgivenessThe Biden administration announced its final round of student loan forgiveness, discharging over $600 million in debt for thousands of borrowers. This relief includes 4,550 borrowers entitled to debt cancellation through the Income-Based Repayment plan and 4,100 former students of DeVry University. The U.S. Department of Education also completed its payment count adjustment for borrowers in income-driven repayment plans, aiming to ensure accurate tracking of their eligibility for loan forgiveness.

Read more »

Student-loan forgiveness: Biden made his final move on debt reliefBusiness Insider tells the global tech, finance, stock market, media, economy, lifestyle, real estate, AI and innovative stories you want to know.

Student-loan forgiveness: Biden made his final move on debt reliefBusiness Insider tells the global tech, finance, stock market, media, economy, lifestyle, real estate, AI and innovative stories you want to know.

Read more »

Biden announces final round of student loan forgiveness, bringing aid total to nearly $189 billionThe Biden administration announced on Thursday its final round of student loan forgiveness, clearing over $600 million in the debt for thousands of borrowers.

Biden announces final round of student loan forgiveness, bringing aid total to nearly $189 billionThe Biden administration announced on Thursday its final round of student loan forgiveness, clearing over $600 million in the debt for thousands of borrowers.

Read more »

How to get student loan relief after the L.A. wildfiresA natural disaster forbearance can pause your student loan payments for 90 days if you live in a FEMA disaster ZIP code.

How to get student loan relief after the L.A. wildfiresA natural disaster forbearance can pause your student loan payments for 90 days if you live in a FEMA disaster ZIP code.

Read more »