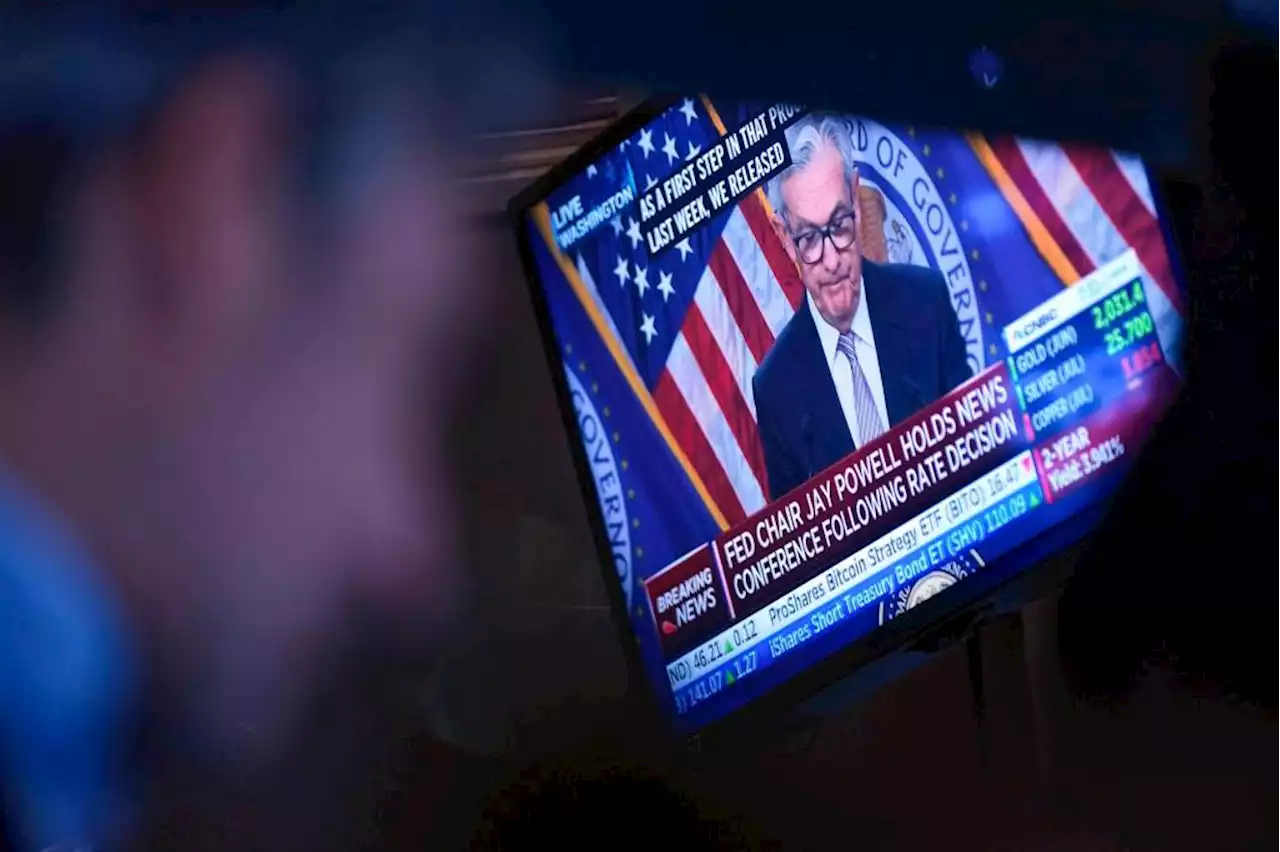

The Federal Reserve, having raised interest rates at the fastest pace in four decades, is poised Wednesday to leave rates alone for the first time in 15 months to allow time to gauge the impact of its aggressive drive to tame inflation

WASHINGTON — .

Some analysts have expressed concern that the collapse of three large banks last spring could cause nervous lenders to sharply tighten their loan qualifications and worsen the drop in lending. Economists at Goldman Sachs have estimated, though, that such damage will be modest. Yet much of that drop reflected sharply lower gas prices and slowdown in food inflation. Excluding volatile food and energy costs, uncomfortably high inflation persisted: So-called core prices rose 5.3% year over year, down from 5.5% in April but far above the Fed’s 2% annual target.

Tuesday’s inflation data showed that most of the rise in core prices reflected high rents and used car prices. Those costs are expected to ease later this year. “We think next month’s increase is probably the last of the cycle,” said Alan Detmeister, an economist at UBS.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Here's everything the Federal Reserve is expected to do WednesdayThe Federal Reserve on Wednesday is expected to take a break and let the U.S. economy catch its breath.

Here's everything the Federal Reserve is expected to do WednesdayThe Federal Reserve on Wednesday is expected to take a break and let the U.S. economy catch its breath.

Read more »

Federal Reserve Is Likely To Leave Rates Alone — For NowThe Federal Reserve is poised to allow time to gauge the impact of its aggressive drive to tame inflation.

Federal Reserve Is Likely To Leave Rates Alone — For NowThe Federal Reserve is poised to allow time to gauge the impact of its aggressive drive to tame inflation.

Read more »

The Federal Reserve will likely leave interest rates alone for the first time in 15 monthsThe Federal Reserve, having raised interest rates at the fastest pace in four decades, is poised Wednesday to leave rates alone for the first time in 15 months to allow time to gauge the impact of its aggressive drive to tame inflation

The Federal Reserve will likely leave interest rates alone for the first time in 15 monthsThe Federal Reserve, having raised interest rates at the fastest pace in four decades, is poised Wednesday to leave rates alone for the first time in 15 months to allow time to gauge the impact of its aggressive drive to tame inflation

Read more »

Inflation lowest since 2021 before pivotal Federal Reserve meetingOne-year inflation expectations are down 0.3%, dropping to a 4.1% rate — the lowest annual outlook since May 2021, according to the New York Fed’s Survey of Consumer Expectations in May.

Inflation lowest since 2021 before pivotal Federal Reserve meetingOne-year inflation expectations are down 0.3%, dropping to a 4.1% rate — the lowest annual outlook since May 2021, according to the New York Fed’s Survey of Consumer Expectations in May.

Read more »

How will US Consumer Price Index impact Federal Reserve monetary policy?The highly-anticipated Consumer Price Index (CPI) inflation data for May will be published by the US Bureau of Labor Statistics (BLS) on June 13 at 12

How will US Consumer Price Index impact Federal Reserve monetary policy?The highly-anticipated Consumer Price Index (CPI) inflation data for May will be published by the US Bureau of Labor Statistics (BLS) on June 13 at 12

Read more »

Why the Federal Reserve's dual mandate may seem impossibleThe Fed has to strike a delicate balance to ensure low, steady prices while setting a course for an economy that encourages everyone to get a job who wants one.

Why the Federal Reserve's dual mandate may seem impossibleThe Fed has to strike a delicate balance to ensure low, steady prices while setting a course for an economy that encourages everyone to get a job who wants one.

Read more »