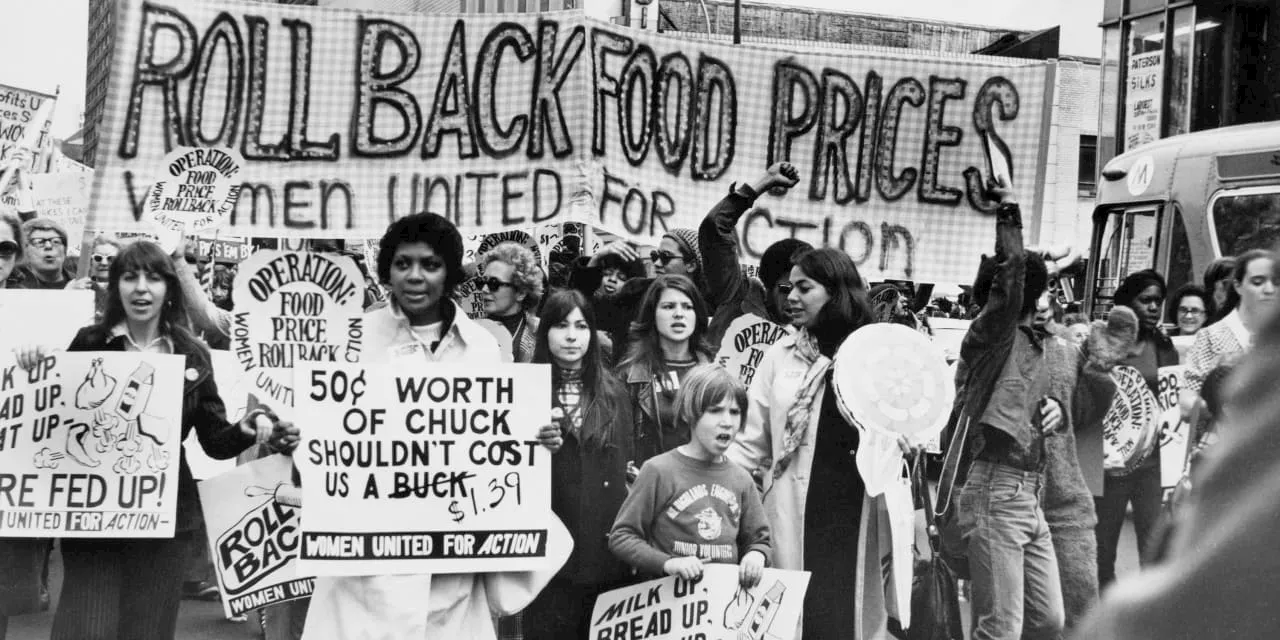

The central bank loosened up the money supply too early in 1973, igniting nearly a decade of soaring prices dubbed 'the Great Inflation.'

Arthur F. Burns is known as the Federal Reserve chairman who failed to stop surging inflation in the 1970s, resulting in America’s worst economic downturn since the Great Depression.

Repeating a line he had used for weeks, Burns told the committee on Sept. 12 that the Fed “intends to pursue a restrictive monetary policy until the growth of the monetary and credit aggregates has been subdued.” “I don’t want to go out of town fast,” Nixon tells Burns in an Oct. 10, 1971, conversation recorded on his secret White House tapes. The president was fixated on increasing the money supply.

“Good, good, good,” replies Nixon. When Burns says the Federal Open Market Committee resisted, the president tells him, “just kick ‘em in the rump.”Burns acted “more like a member of the administration—plotting political strategy in White House meetings and discussing policy initiatives unrelated to Fed responsibilities—than the head of an independent central bank,” Bernanke writes in his Fed history, “21st Century Monetary Policy.

At the same time, the stock market was in the midst of its steepest decline since the Depression, unemployment was at 4.8% , and Middle East geopolitics were being felt at the gas pump.“Fed Voted Easing in Money Policy,” was the headline Dec. 18, 1973, when the New York Times first reported on the FOMC decision—made two months earlier—to increase monetary aggregates.

How bad did it get? On Dec. 30, 1974, Barron’s ran the headline: “No Depression: Our Year-End Panel Sees Business Hitting Bottom by June.”To be sure, Burns was in an impossible position. Nixon’s bullying could be “startling and even frightening,” he wrote in his personal diary. At times, he writes, “I felt that the President was going mad.”

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

U.S. stocks staged a surprising rally on Friday. But can the party last?Inflation data, Fed minutes of September meeting will be a big focus for investors this week

U.S. stocks staged a surprising rally on Friday. But can the party last?Inflation data, Fed minutes of September meeting will be a big focus for investors this week

Read more »

Tighter financial conditions could leave less for Fed to do, Logan saysTighter financial conditions could leave less for Fed to do, Logan says

Tighter financial conditions could leave less for Fed to do, Logan saysTighter financial conditions could leave less for Fed to do, Logan says

Read more »

US Fed's top bank cop defends effort to hike bank capitalUS Fed's top bank cop defends effort to hike bank capital

US Fed's top bank cop defends effort to hike bank capitalUS Fed's top bank cop defends effort to hike bank capital

Read more »

Savings simulator: Is your money beating inflation?JoElla Carman is the Data Graphics Interactive Visual Designer

Savings simulator: Is your money beating inflation?JoElla Carman is the Data Graphics Interactive Visual Designer

Read more »

Nodding to rising bond yields, Fed's Jefferson says can 'proceed carefully'Nodding to rising bond yields, Fed's Jefferson says can 'proceed carefully'

Nodding to rising bond yields, Fed's Jefferson says can 'proceed carefully'Nodding to rising bond yields, Fed's Jefferson says can 'proceed carefully'

Read more »

Stock Market Today: Dow up despite Israel-Hamas war as Fed members signal cautionStock Market Today: Dow up despite Israel-Hamas war as Fed members signal caution

Stock Market Today: Dow up despite Israel-Hamas war as Fed members signal cautionStock Market Today: Dow up despite Israel-Hamas war as Fed members signal caution

Read more »