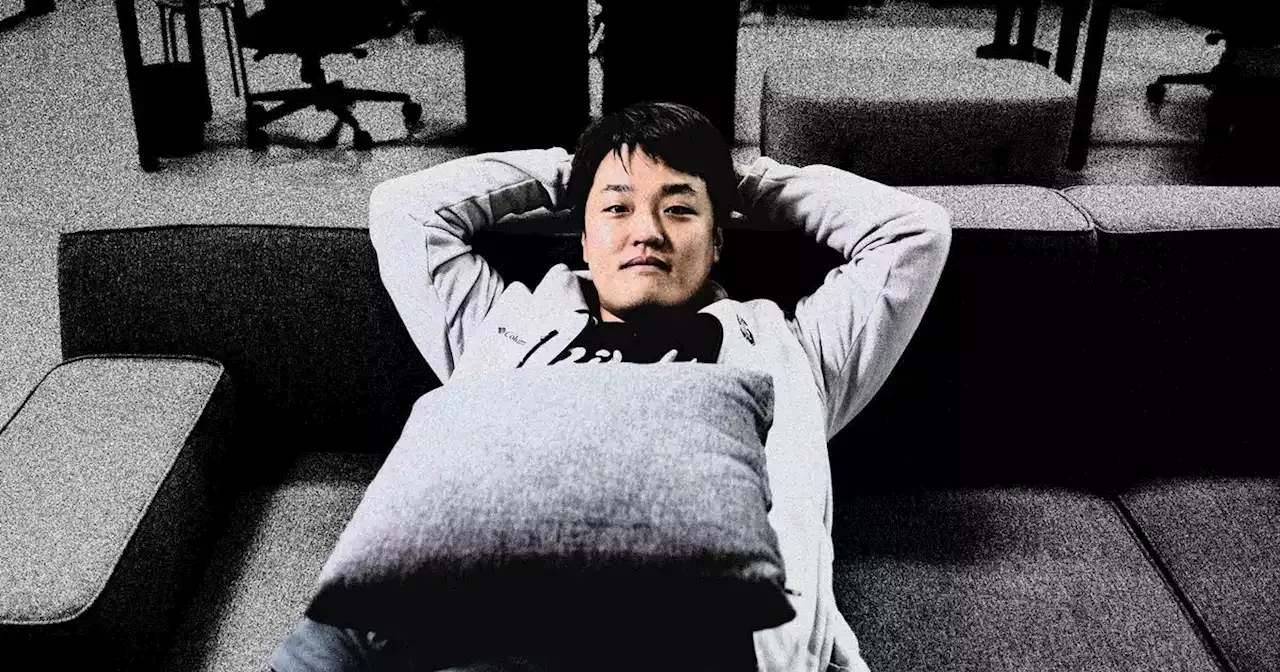

Do Kwon created a $60-billion empire with two of the fastest-growing projects in the digital-currency space. It all came crashing down in a couple days. KevinTDugan reports on the implosion of Terra and Luna and on their volatile, charismatic founder

Photo-Illustration: Intelligencer; Photo: Getty Images This article was featured in One Great Story, New York’s reading recommendation newsletter. Sign up here to get it nightly.

When he took the stage a half-hour or so later, though — before the 300-capacity crowd in front of a backdrop of the Manhattan skyline — any hint of caution was gone. “What we need to remember always is our true North Star of why we started this in the first place, and that is to make sure that our money is the most decentralized and the most useful on the face of this fucking planet!” Kwon shouted to huge applause.

Terraform Labs came into being in the wake of Basis’s failure. The idea behind this new venture was to create two interrelated digital currencies that had vastly different purposes but were designed to balance each other out. One was TerraUSD, called UST in shorthand. This was a so-called stablecoin, made to stay pegged at a value of $1. Stablecoins, which date back to 2014, are used by investors to buy into and cash out of cryptocurrency markets.

Internally, Kwon was a brash figure even in the world of massively wealthy crypto founders. Norman, the Terra developer, remembered how Kwon belittled an engineer over a Discord channel in December after a glitch had accidentally cashed out about 250 Terra holders. “He was extremely impatient and rude and seemed like he was annoyed at having to be there,” he said. “Kept telling the organizer he needs to speak in shorter sentences to not waste his time.

But on March 7, things started to fall apart. At the time, Terraform Labs was essentially upgrading its systems, switching from a program that had a reserve of tradable UST to a new one that didn’t appear to have any, according to research from Onramp Academy. In doing so, Kwon’s own company made $150 million in UST disappear — precipitating a $350 million drawdown soon after. If you were a crypto trader, all of a sudden you would see that half a billion UST tokens had just disappeared.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

A’s struggle at the plate again in series-opening loss to TwinsThe A’s are the first team since the 1910 White Sox to hit below .200 through at least 38 games.

A’s struggle at the plate again in series-opening loss to TwinsThe A’s are the first team since the 1910 White Sox to hit below .200 through at least 38 games.

Read more »

Is TerraUSD’s Collapse Crypto’s Lehman Brothers Moment?Was the recent crypto crash of TerraUSD and LUNA another repeat of the 2008 Lehman Brothers collapse or a Ponzi scheme similar to Bernie Madoff's?

Is TerraUSD’s Collapse Crypto’s Lehman Brothers Moment?Was the recent crypto crash of TerraUSD and LUNA another repeat of the 2008 Lehman Brothers collapse or a Ponzi scheme similar to Bernie Madoff's?

Read more »

NASA's Bill Nelson declares that China has become 'good at stealing'China and the U.S. are engaged in a new stage of the second space race, and NASA Chief Bill Nelson allegedly attributes our rival's success to 'stealing'.

NASA's Bill Nelson declares that China has become 'good at stealing'China and the U.S. are engaged in a new stage of the second space race, and NASA Chief Bill Nelson allegedly attributes our rival's success to 'stealing'.

Read more »

Dallas County judges push back at commissioners' accusations of not doing their jobsCommissioners John Wiley Price and J.J. Koch say there is a huge backlog and that the county could lose $50 million in criminal justice grants from the state because some judges have not been doing their jobs. The county judges finally responded. 'It's time to set the record straight.'

Dallas County judges push back at commissioners' accusations of not doing their jobsCommissioners John Wiley Price and J.J. Koch say there is a huge backlog and that the county could lose $50 million in criminal justice grants from the state because some judges have not been doing their jobs. The county judges finally responded. 'It's time to set the record straight.'

Read more »

I-Team: Texas father and son accountants convicted in $6M Ponzi schemeDozens of North Texas families found their retirement accounts empty after falling victim to a multi-million-dollar Ponzi scheme.

I-Team: Texas father and son accountants convicted in $6M Ponzi schemeDozens of North Texas families found their retirement accounts empty after falling victim to a multi-million-dollar Ponzi scheme.

Read more »

A possum in the press box is just the latest problem for the A'sIt isn't even the first time this has happened.

A possum in the press box is just the latest problem for the A'sIt isn't even the first time this has happened.

Read more »