Residents of Washington state can partake in a new tax credit that will award them up to $1,200 if they apply for it.

The tax credit, called the Working Families Tax Credit, is a new annual tax credit for low/moderate income residents of the Evergreen State. Undocumented people and mixed-status families are also allowed to apply.The amount one can receive from this credit will vary depending on an applicant's income and the number of children they have, according to the Working Families Tax Credit Coalition.

To be eligible for this credit, an applicant must have earned at least $1 in income for the tax year they are applying for, be a resident of Washington for at least six months, and either be between the ages of 25 and 65 or have at least one qualifying child. Residents without children can still apply and be eligible, though they must be within the age range.

Washington residents interested in applying can do so through a variety of options, including applying when doing their taxes for free at a Volunteer Income Tax Assistance site or when applying through a third-party tax preparation service. If a taxpayer has already filed their taxes, they can still apply for this credit either online or by filling out a paper application available at the Department of Revenue Working Families Tax Credit website.

The income limits for this credit will be the same as the income limits set for the federal Earned Income Tax Credit. A single filer with no children must make no more than $16,480 to receive a maximum credit of $300, and married couples with no children filing jointly can make no more than $22,610.

Further information regarding this credit is available on Washington's Department of Revenue website.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Breaking down the Mass. House's tax reform proposal, from rebates to child tax creditsGov. Healey and the House agree on a few items within their respective tax proposals. However, these current discussions are hardly the end, as the Senate is also working on its own tax reform package. Plus: Somerville appoints a new school superintendent.

Breaking down the Mass. House's tax reform proposal, from rebates to child tax creditsGov. Healey and the House agree on a few items within their respective tax proposals. However, these current discussions are hardly the end, as the Senate is also working on its own tax reform package. Plus: Somerville appoints a new school superintendent.

Read more »

Alaska Senate passes bill to allow municipal blight tax, property tax exemptionsThe Alaska Senate voted 13-6 on Tuesday to pass a bill that would allow municipalities to exempt owners of newly developed properties from property taxes — or raise taxes up to 50% on owners of blighted properties. (via AlaskaBeacon)

Alaska Senate passes bill to allow municipal blight tax, property tax exemptionsThe Alaska Senate voted 13-6 on Tuesday to pass a bill that would allow municipalities to exempt owners of newly developed properties from property taxes — or raise taxes up to 50% on owners of blighted properties. (via AlaskaBeacon)

Read more »

USD/CAD to dip toward 200-DMA around 1.34 on underwhelming US CPI print – SocGenToday, the US Bureau of Labor Statistics will publish March Consumer Price Index (CPI) data while the Bank of Canada (BoC) will announce its interest

USD/CAD to dip toward 200-DMA around 1.34 on underwhelming US CPI print – SocGenToday, the US Bureau of Labor Statistics will publish March Consumer Price Index (CPI) data while the Bank of Canada (BoC) will announce its interest

Read more »

Houston looking to hire nearly 200 lifeguards for its pools this summerThe City of Houston is in the middle of recruitment to hire over 200 lifeguards for...

Read more »

Watt Wagons' New Hound Is A Rugged, 200-Mile, Off-Road E-BikeU.S.-based e-bike specialist Watt Wagons has launched the Hound, a rugged, go-anywhere e-bike with up to 200 miles of range.

Watt Wagons' New Hound Is A Rugged, 200-Mile, Off-Road E-BikeU.S.-based e-bike specialist Watt Wagons has launched the Hound, a rugged, go-anywhere e-bike with up to 200 miles of range.

Read more »

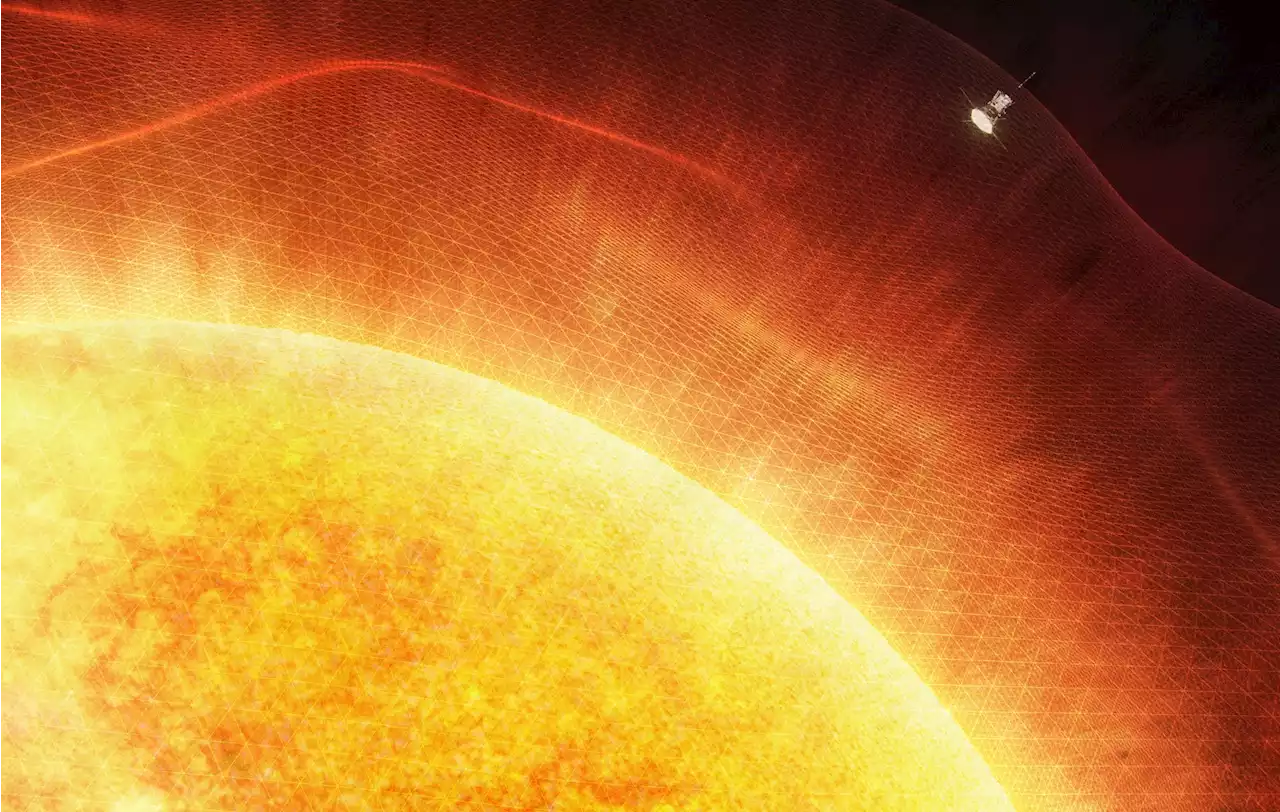

Why is the sun's corona 200 times hotter than its surface?The sun's corona is 200 times hotter than its surface, leaving astronomers hunting for the source of immense heat and energy.

Why is the sun's corona 200 times hotter than its surface?The sun's corona is 200 times hotter than its surface, leaving astronomers hunting for the source of immense heat and energy.

Read more »