Marc didn't know he had 19 super accounts and multiple life insurance policies. He's urging others to check their finances to avoid hefty fees eating away at the balance.

The tax office says there is $16 billion in lost and unclaimed super annuation in Australia, and 23 per cent of working Australians have more than one account.Australians can search for lost super and consolidate their accounts using the MyGov website.

It wasn't until the miner fell in love with his now wife Elle Roberts, and the couple began combining their finances, that he realised what had happened.Mr Ypinazar said he consolidated his accounts, but it affected his retirement savings because he was paying a lot of fees."It is probably double what I have."Ms Roberts said he should have at least $300,000 in super based on what he has earned over his working life, but he has about half of that.

"What would happen nowadays, if you went for a job, your super fund is stapled to your tax file number so we're not going to get into this state where we're collecting super funds," he said. Mr Ellrott said financial education needed to improve in Australia because parents did not always teach their children about financial literacy."If we introduce it into the curriculum, such as strategies that work and how to do your research properly, everyone can figure out their own financial journey after that."Mr James said those who have multiple super accounts could be at risk of having lost or unclaimed super.

Superannuation Money Security Education Unclaimed Super Lost Super Multiple Super Accounts Australian Tax Office Financial Literacy

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

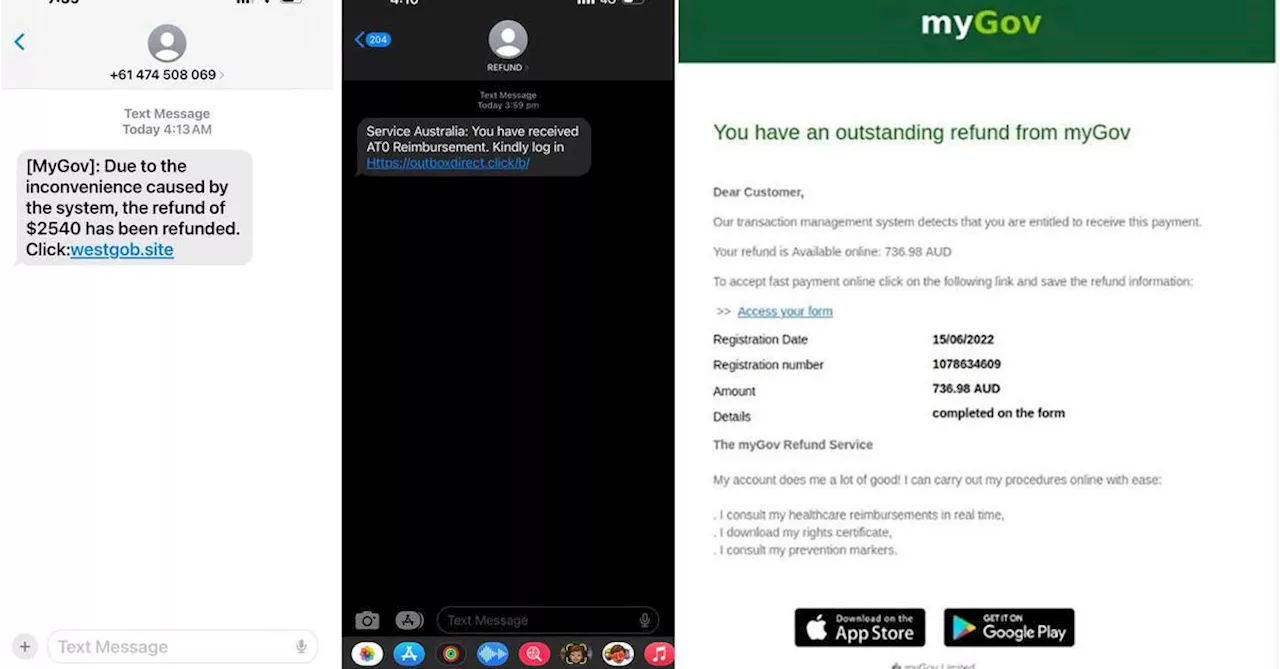

The scams targeting Australians at tax time — and the signs to look out forScammers are capitalising on tax time to lure people into handing over personal information. Here's what to look out for.

The scams targeting Australians at tax time — and the signs to look out forScammers are capitalising on tax time to lure people into handing over personal information. Here's what to look out for.

Read more »

'Organised crime at its worst': The new scam targeting Australians at tax timeA former bookkeeper and her son have joined a growing cohort of Australians who have fallen prey to sophisticated tax time scams.

'Organised crime at its worst': The new scam targeting Australians at tax timeA former bookkeeper and her son have joined a growing cohort of Australians who have fallen prey to sophisticated tax time scams.

Read more »

Almost one in three Australians fell for this tax scam, would you?Research participants were confident they could pick a scam, but 31 percent of those tested fell for one of these.

Almost one in three Australians fell for this tax scam, would you?Research participants were confident they could pick a scam, but 31 percent of those tested fell for one of these.

Read more »

Australian Taxation Office set to jack up penalty to $330 for Australians lodging tax returns late7NEWS brings you the latest local news from Australia and around the world. Stay up to date with all of the breaking sport, politics, entertainment, finance, weather and business headlines. Today's news, live updates & all the latest breaking stories from 7NEWS.

Australian Taxation Office set to jack up penalty to $330 for Australians lodging tax returns late7NEWS brings you the latest local news from Australia and around the world. Stay up to date with all of the breaking sport, politics, entertainment, finance, weather and business headlines. Today's news, live updates & all the latest breaking stories from 7NEWS.

Read more »

Pressure on Labour and Conservatives as tax gap hits £40bnShortfall between tax owed and tax paid puts issue of avoidance in election spotlight

Pressure on Labour and Conservatives as tax gap hits £40bnShortfall between tax owed and tax paid puts issue of avoidance in election spotlight

Read more »

Tax return: How can I maximise my tax return as a high-income earner?The changes to income tax rates from July one make this year’s deadline more important than ever.

Tax return: How can I maximise my tax return as a high-income earner?The changes to income tax rates from July one make this year’s deadline more important than ever.

Read more »