Even in a robust market like 2024, investors can potentially capitalize on tax-loss selling strategies by identifying securities in their taxable portfolios trading below their cost basis. This allows offsetting gains elsewhere, potentially reducing tax liability. The article delves into the mechanics of tax-loss selling, cost basis calculations, and the importance of choosing specific share identification methods for maximizing these opportunities.

A specialist studies monitors on the New York Stock Exchange trading floor in New York on November 21, 2024. (AP Photo/Ted Shaffrey, File)The U.S. market gained more than 25% for the year to date through mid-December 2024. That’s a healthy showing by any measure. It doesn’t seem like it would be a market environment that’s conducive to tax-loss selling . But unless your strategy is to buy only U.S.

stocks, you may indeed have opportunities to realize tax losses in your portfolio, which you can use to offset gains elsewhere. That’s because other market segments haven’t performed nearly as well.It’s important to note that tax-loss selling is only a worthwhile strategy if you have taxable accounts. To benefit from a tax loss that in turn can help you save on taxes, you need to find holdings in your taxable portfolio that are trading below your cost basis — your purchase price adjusted upward to account for any commissions that you paid along with reinvested dividend and capital gains distributions. There are different methods for determining cost basis. The specific share identification method for cost-basis elections provides the most opportunities for tax-loss selling or gain harvesting because it allows you to cherry-pick specific lots of a security to sell. But it’s important to note that the average cost basis is usually the cost-basis election default for mutual funds, while the default cost basis election for individual stocks is often first in, first out. In other words, unless you select a different cost-basis election before selling, your investment firm will report your loss or gain using the default. If you sell securities and your sale price is lower than your cost basis, you have a capital loss. That loss, in turn, can help offset taxable gains elsewhere in your portfolio. (With many mutual funds again poised to make big capital gains distributions in 2024, those losses could come in hand

Tax-Loss Selling Investment Strategies Capital Gains Cost Basis Portfolio Management

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Tax-Loss Selling Opportunities in a Bull MarketDespite a strong U.S. market performance, tax-loss selling opportunities may exist in other market segments.

Tax-Loss Selling Opportunities in a Bull MarketDespite a strong U.S. market performance, tax-loss selling opportunities may exist in other market segments.

Read more »

Missed opportunities doom Auburn in loss to TideOn College GameDay, Andrew Luck joins Nick Saban, Pat McAfee, Desmond Howard, Rece Davis and Stanford Steve to discuss his new position as general manager for the Stanford Cardinal football program. ✔️ Subscribe to ESPN+ http://espnplus.com/youtube ✔️ Get the ESPN App: http://www.espn.com/espn/apps/espn ✔️ Subscribe to ESPN on YouTube: http://es.

Missed opportunities doom Auburn in loss to TideOn College GameDay, Andrew Luck joins Nick Saban, Pat McAfee, Desmond Howard, Rece Davis and Stanford Steve to discuss his new position as general manager for the Stanford Cardinal football program. ✔️ Subscribe to ESPN+ http://espnplus.com/youtube ✔️ Get the ESPN App: http://www.espn.com/espn/apps/espn ✔️ Subscribe to ESPN on YouTube: http://es.

Read more »

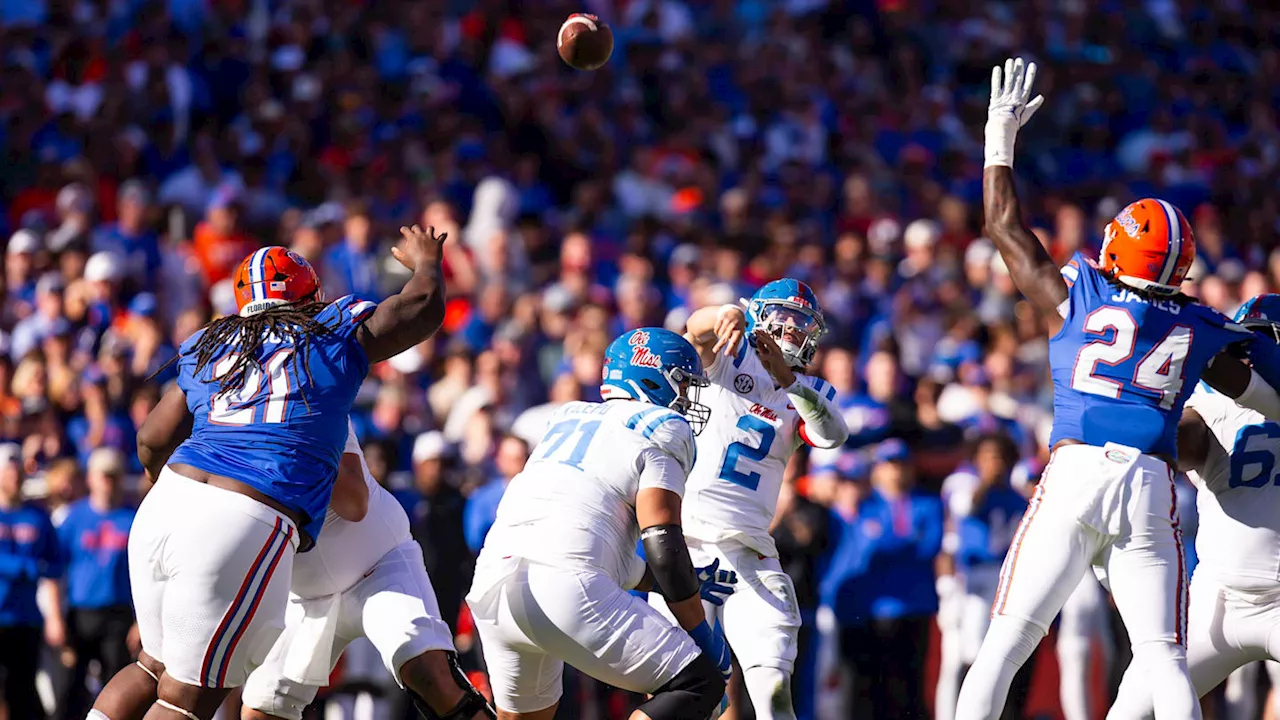

'A Game of Missed Opportunities': Ole Miss Rebels Offense Stalls in Upset LossThe Ole Miss Rebels left a good deal of points on the field on Saturday in their upset loss to the Florida Gators.

'A Game of Missed Opportunities': Ole Miss Rebels Offense Stalls in Upset LossThe Ole Miss Rebels left a good deal of points on the field on Saturday in their upset loss to the Florida Gators.

Read more »

Wait, Why Is Novo Selling Weight Loss Drugs for So Cheap in China?Science and Technology News and Videos

Wait, Why Is Novo Selling Weight Loss Drugs for So Cheap in China?Science and Technology News and Videos

Read more »

Tennessee Woman Accused of Selling Counterfeit Weight Loss DrugsA Tennessee woman has been arrested for selling counterfeit versions of popular weight loss drugs, like Ozempic and Wegovy, at significantly lower prices than the brand-name versions. Authorities seized over 300 vials of counterfeit semaglutide during a raid on her home.

Tennessee Woman Accused of Selling Counterfeit Weight Loss DrugsA Tennessee woman has been arrested for selling counterfeit versions of popular weight loss drugs, like Ozempic and Wegovy, at significantly lower prices than the brand-name versions. Authorities seized over 300 vials of counterfeit semaglutide during a raid on her home.

Read more »

Tennessee Woman Accused of Selling Fake Weight Loss DrugsA woman in Tennessee is facing charges for allegedly selling counterfeit versions of popular weight loss medications like Ozempic and Wegovy. The investigation began after authorities received a tip about suspiciously low prices for the drugs. During a raid on her home, over 300 vials of counterfeit semaglutide were seized, along with other weight loss medications and supplies.

Tennessee Woman Accused of Selling Fake Weight Loss DrugsA woman in Tennessee is facing charges for allegedly selling counterfeit versions of popular weight loss medications like Ozempic and Wegovy. The investigation began after authorities received a tip about suspiciously low prices for the drugs. During a raid on her home, over 300 vials of counterfeit semaglutide were seized, along with other weight loss medications and supplies.

Read more »