“It appears that the state today, emphasis on today, is hitting on all cylinders when it comes to the state’s economy,” said Sen. Arthur Orr, chair of the Senate’s education budget committee.

and billions in federal dollars for pandemic relief, tax revenues that support public education and other government programs in Alabama are exceeding last year by a hefty margin.

Rep. Danny Garrett, R-Trussville, chair of the House education budget committee, has a similar outlook about the revenue growth. That growth includes a 22% increase in the taxes that support the Education Trust Fund through May, eight months into the state’s fiscal year, which started in October. Legislators have at some time to watch the trends before making any decisions. They will return for the regular session early next year to consider the next round of state budgets. In the meantime, revenues will be enough to cover planned expenditures for the rest of this fiscal year, which ends Sept. 30, said Kirk Fulford, deputy director of the Legislative Services Agency. Fulford said other states are also seeing unusually strong growth in tax revenues.

Through May, tax revenues for the Education Trust Fund totaled $6.9 billion, an increase of $1.2 billion over last fiscal year at this time, or 22 percent. Through May, the General Fund had received $1.8 billion, $144 million more than this time last year, an increase of almost 9 percent. “There’s a lot that could go on negatively between now and then so I really don’t want to speculate that we’ll have a bunch of extra money or we will or we won’t,” Orr said. “We may have some carry-forward money. That’s certainly possible. But we may have to be filling holes in the budget with that carry-forward money. So we just want to be very cautious and conservative.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Demand Grows for Windfall Profits Tax as Goldman Sachs Predicts More Gas Pump Pain'This tax would help rein in Big Oil's profiteering and put money directly in the pockets of consumers,' said Rep. Ro Khanna.

Demand Grows for Windfall Profits Tax as Goldman Sachs Predicts More Gas Pump Pain'This tax would help rein in Big Oil's profiteering and put money directly in the pockets of consumers,' said Rep. Ro Khanna.

Read more »

Rep. Elise Stefanik Pushes Bill to Create Tax Break for Gun Safety CostsWhat about a tax BREAK for gun safety costs? Rep. Elise Stefanik is pushing the Firearm Proficiency and Training Act to create a tax break for Americans seeking gun safety courses.

Rep. Elise Stefanik Pushes Bill to Create Tax Break for Gun Safety CostsWhat about a tax BREAK for gun safety costs? Rep. Elise Stefanik is pushing the Firearm Proficiency and Training Act to create a tax break for Americans seeking gun safety courses.

Read more »

Nassau County voters could decide on property tax hike to fund teacher pay raisesThe resolution on the agenda for Thursday’s school board meeting in Nassau County would ask voters in the Nov. 8 election to increase the county’s millage rate to help boost teacher pay, enhance athletics and fine arts programs and make schools safer.

Nassau County voters could decide on property tax hike to fund teacher pay raisesThe resolution on the agenda for Thursday’s school board meeting in Nassau County would ask voters in the Nov. 8 election to increase the county’s millage rate to help boost teacher pay, enhance athletics and fine arts programs and make schools safer.

Read more »

Crypto Billionaire’s Possible Senate Run May Blow Up His Tax ShelterCrypto billionaire Brock Pierce is exploring a run for Senate in Vermont this November. Opting in could mean giving up a lot of money in back taxes to say that Puerto Rico is not his home. KevinTDugan reports

Crypto Billionaire’s Possible Senate Run May Blow Up His Tax ShelterCrypto billionaire Brock Pierce is exploring a run for Senate in Vermont this November. Opting in could mean giving up a lot of money in back taxes to say that Puerto Rico is not his home. KevinTDugan reports

Read more »

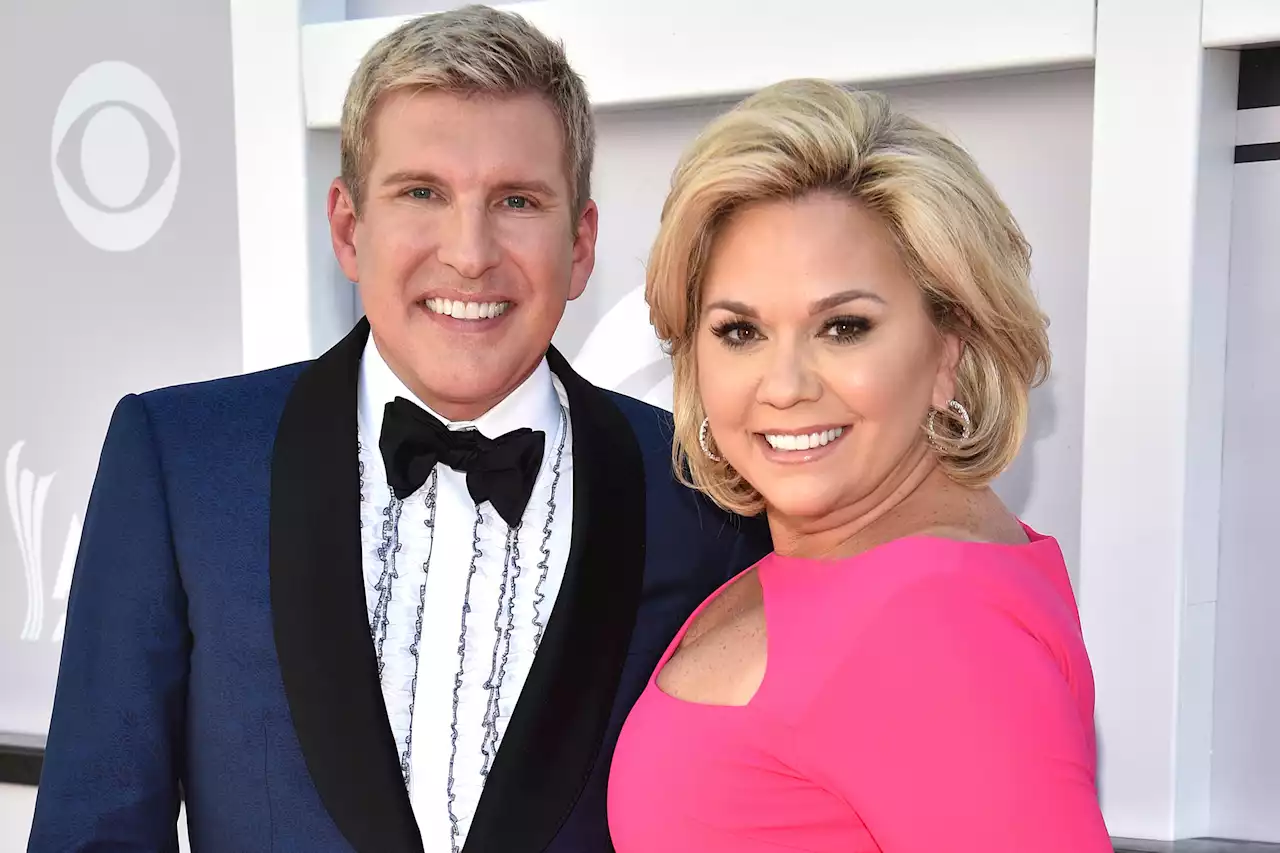

Todd and Julie Chrisley found guilty of bank fraud, tax evasionTodd’s attorney Bruce Morris told TMZ that they plan to appeal the jury’s decision. “We are disappointed in the verdict,” Morris said.

Todd and Julie Chrisley found guilty of bank fraud, tax evasionTodd’s attorney Bruce Morris told TMZ that they plan to appeal the jury’s decision. “We are disappointed in the verdict,” Morris said.

Read more »